In a plot twist that would make Hollywood jealous, Ether (ETH), the second fiddle turned headliner in the crypto concert, has once again stolen the spotlight from Bitcoin. While Wall Street was busy pretending they understood finance, all US-based spot Ethereum ETFs rubbed their hands together and scooped up over $281.07 million—because nothing says “investment opportunity” like a digital dragon breathing fire, right? Meanwhile, Bitcoin’s ETF inflows decided to take a little vacation, with $128.81 million doing an impressive disappearing act.

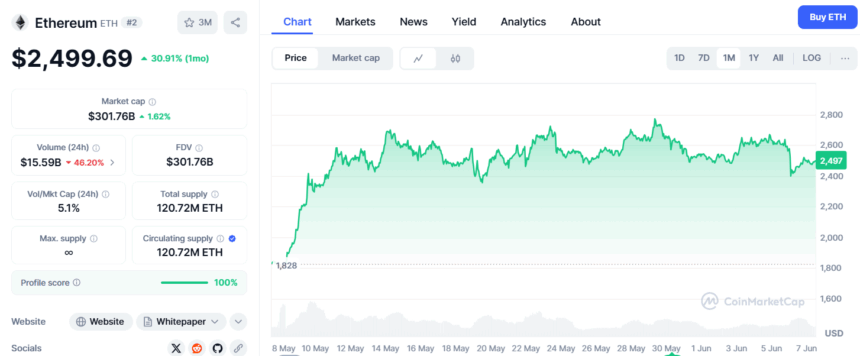

The reasons? Well, ETH’s price decided to channel its inner rocket and soared from a modest $1,790 to smashing past $2,700 in just a month—an impressive 54% hike, which basically makes it look like a teenager with a sugar rush. This furious rally has market maniacs craving more ETH, turning the Ethereum ETF crowd into the crypto equivalent of kids in a candy store with pockets full of monopoly money.

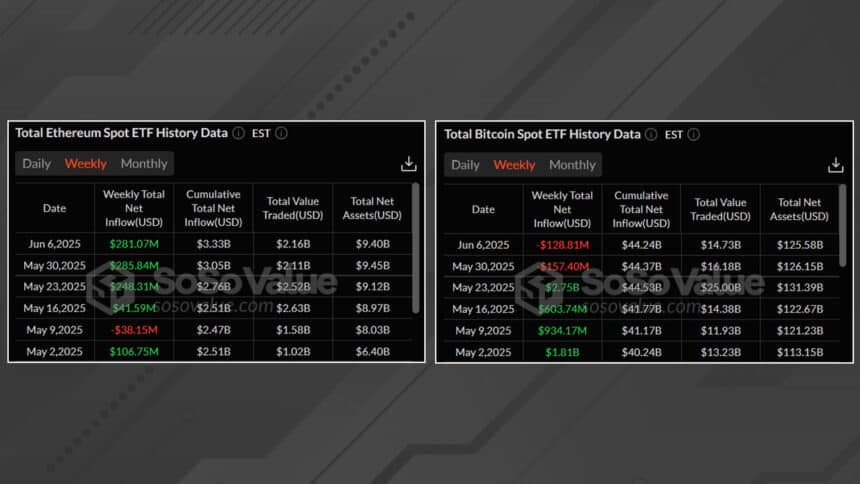

The data nerds at Sosovalue confirmed that Ethereum ETFs have been on a winning streak, netting a cool $856.81 million over four weeks—making the total stash in ETH ETFs a tidy $9.40 billion. That’s enough to buy a small island, if small islands were bought with digital tokens and a willingness to ignore the ocean.

Meanwhile, Bitcoin ETFs are out there having a little tantrum, with outflows of $157.40 million and $128.81 million over the past couple of weeks. Looks like the market’s giving Bitcoin a gentle nudge—perhaps towards the door of the exit, or maybe just reminding it to pack its bags for the crypto equivalent of a picnic.

Ethereum Keeps the Bull Run Going—While Bitcoin Takes a Nap

Institutional deals are pouring into ETH, making it look like the cool kid on the blockchain block. Its price has been doing the cha-cha, bouncing around near $2,500—up a healthy 30% over the last month. Even when Trump and Musk played their little game of “Who Can Confuse the Markets Most?”, ETH dipped to a sleepy $2,400 but quickly recovered because, let’s face it, it’s got resilience in its digital DNA.

Market wizards (and some computer programmers with too much free time) now predict Ethereum might leap past its previous peaks—maybe even sprint towards $3,000 before the year’s out. With the Ethereum Foundation busy doing whatever non-profits do (probably non-stop coding and avoiding taxes), the broader view is one of bullish optimism—likely the only thing holding the crypto markets together at this point.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-06-07 10:48