As a seasoned crypto investor with a knack for spotting trends and navigating market volatility, I find myself quite optimistic about Ethereum’s current trajectory. The surge in institutional interest, as evidenced by the influx into Ethereum ETFs, is a clear testament to the growing confidence in Ethereum as a viable long-term investment.

At the start of November, Ethereum experienced an impressive surge of about 40%, but maintaining this growth pace has turned out to be difficult for the reigning cryptocurrency.

From my perspective as an analyst, with Ethereum’s price holding steadily above $3,000, a substantial surge from institutional investment could potentially rekindle its upward momentum. The spotlight is on Ethereum ETFs, as they are experiencing unprecedented inflows, a clear sign of this resurgence.

Ethereum Has the Institutions’ Support

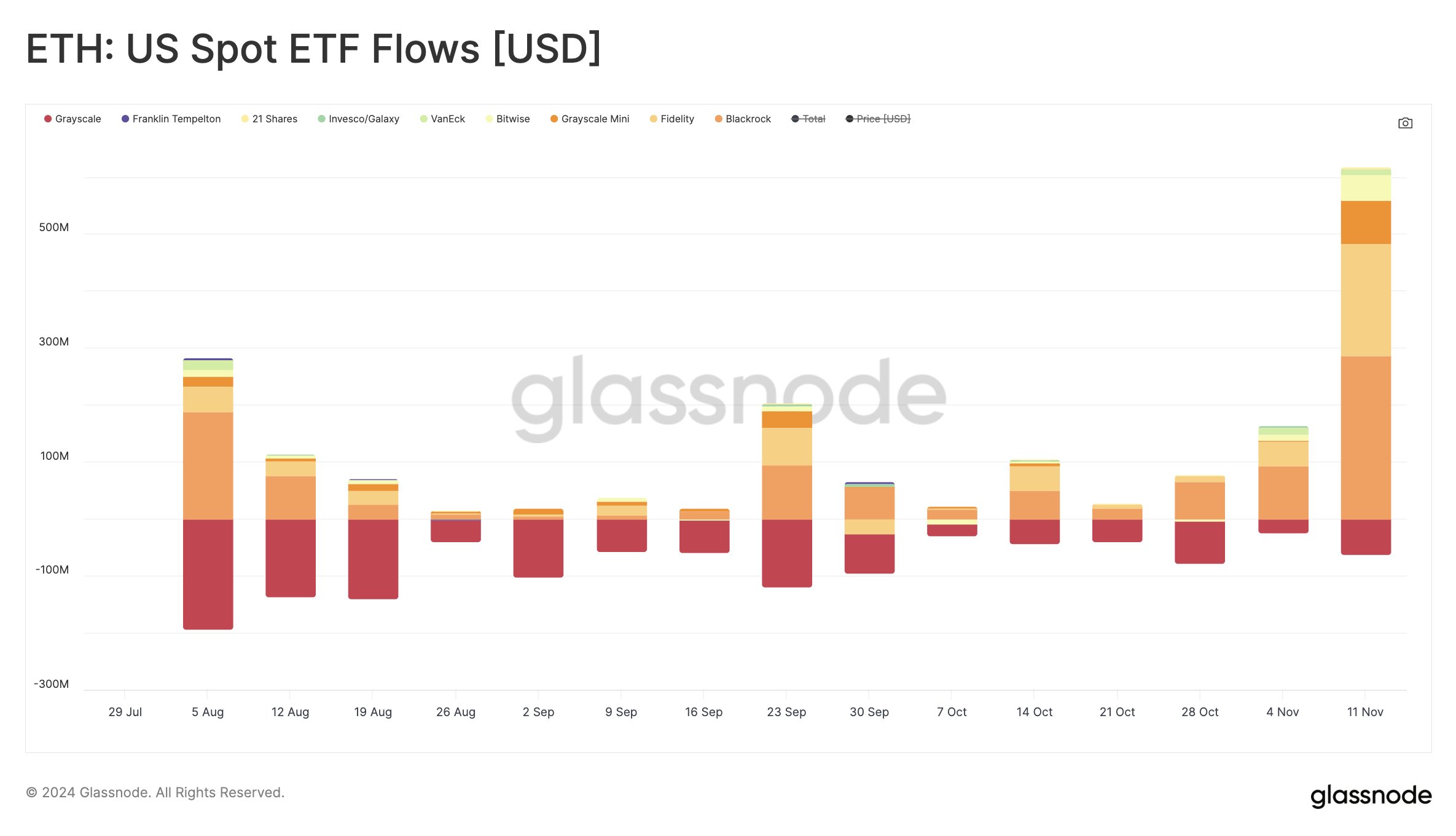

Over the past week, Ethereum ETFs experienced their largest weekly inflows since launch. BlackRock led the surge with a staggering $286 million, while the combined inflows across all ETFs reached $550 million. This influx reflects growing institutional confidence, driven by Ethereum’s price recovery and Bitcoin’s recent all-time highs.

The rise in ETF usage among institutional investors underscores their growing dependence on Ethereum as a varied investment option. This pattern is fortifying Ethereum’s clout within the crypto market, potentially generating the push required to surpass its current price plateau. The overall market mood seems to be leaning towards optimism.

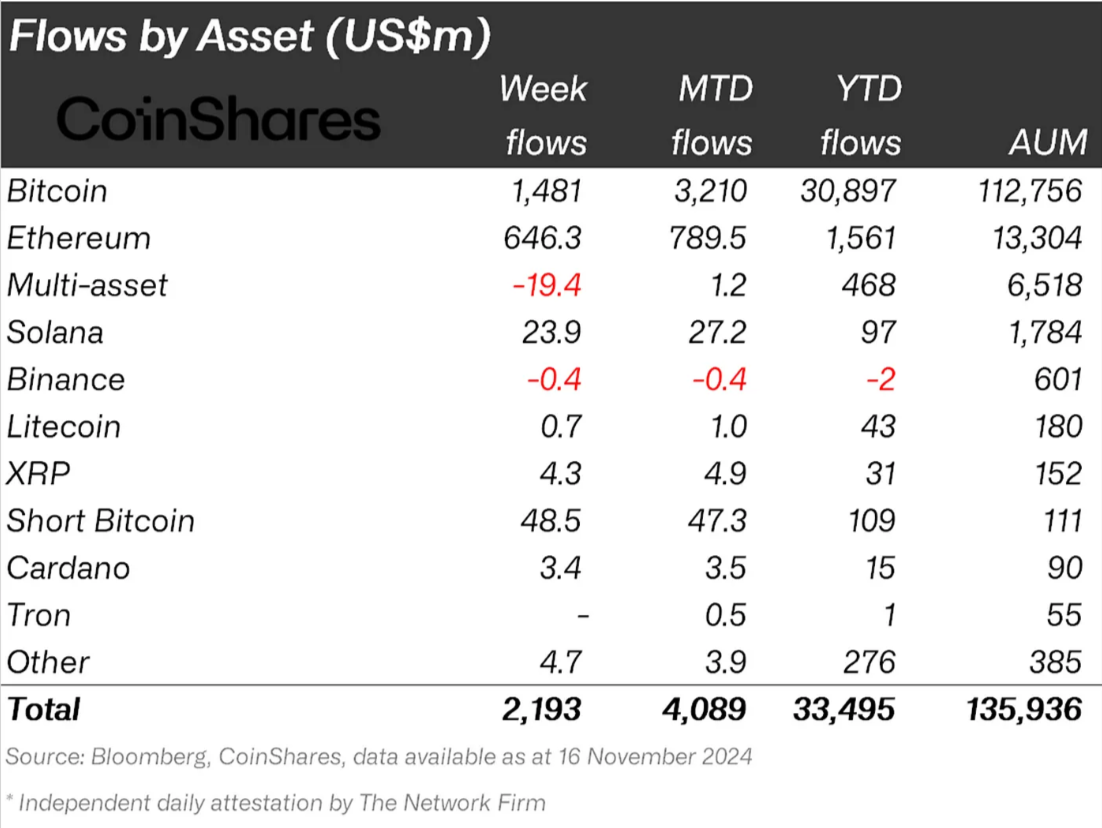

Institutional interest in Ethereum surpasses just Exchange Traded Funds (ETFs). As per the most recent CoinShares ETP netflow report, November has already witnessed inflows of $789 million from institutions towards Ethereum. This substantial investment indicates a growing focus on Ethereum as a long-term asset.

Moreover, it appears that significant investors are becoming more active, which strengthens Ethereum’s overall market trend. These investments could play a crucial part in boosting ETH‘s value, particularly since institutions are increasing their involvement with the cryptocurrency. This surge of interest underscores Ethereum’s growing importance within institutional investment portfolios.

ETH Price Prediction: Looking Forward

As a researcher observing the cryptocurrency market, I’m noting that Ethereum is currently holding strong at around $3,108. This price point is significantly above its crucial support level of $3,001, which interestingly coincides with the 61.8% Fibonacci Retracement line – a significant bull market support floor. This solid foundation could potentially foster further growth.

If the ongoing institutional activities and favorable market conditions continue, it’s possible that Ethereum could break through the $3,248 barrier, paving the way for further upward momentum. Such a move would strengthen Ethereum’s position as the leading altcoin, reinforcing its bullish trend.

If Ethereum fails to hold onto its current position, it could challenge the optimistic viewpoint, possibly affecting investors’ trust. Sustaining crucial support points and leveraging its institutional endorsement are essential for Ethereum to continue its progress.

Read More

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-11-19 19:07