As a seasoned crypto investor with over a decade of experience, I’ve seen my fair share of market fluctuations, and the recent surge in Ethereum (ETH) has certainly caught my attention. The 10% increase in the last 24 hours, coupled with the significant large transactions, is reminiscent of the early days of Bitcoin‘s meteoric rise.

As a crypto investor, I’ve been closely watching the price movements of Ethereum (ETH). Over the past period, it surged beyond the $4,000 mark, only to dip down below $3,200 at one point. This rollercoaster ride has kept me and many others on our toes.

Over the past day, Ethereum’s price has surged by 10%. Furthermore, the volume of significant transactions has reached levels not witnessed in nearly a week.

Ethereum Sees Notable Institutional Interest

Ethereum’s 10% surge has pushed the altcoin to $3,422. On-chain data reveals that increasing institutional interest is a key factor influencing Ethereum’s price outlook.

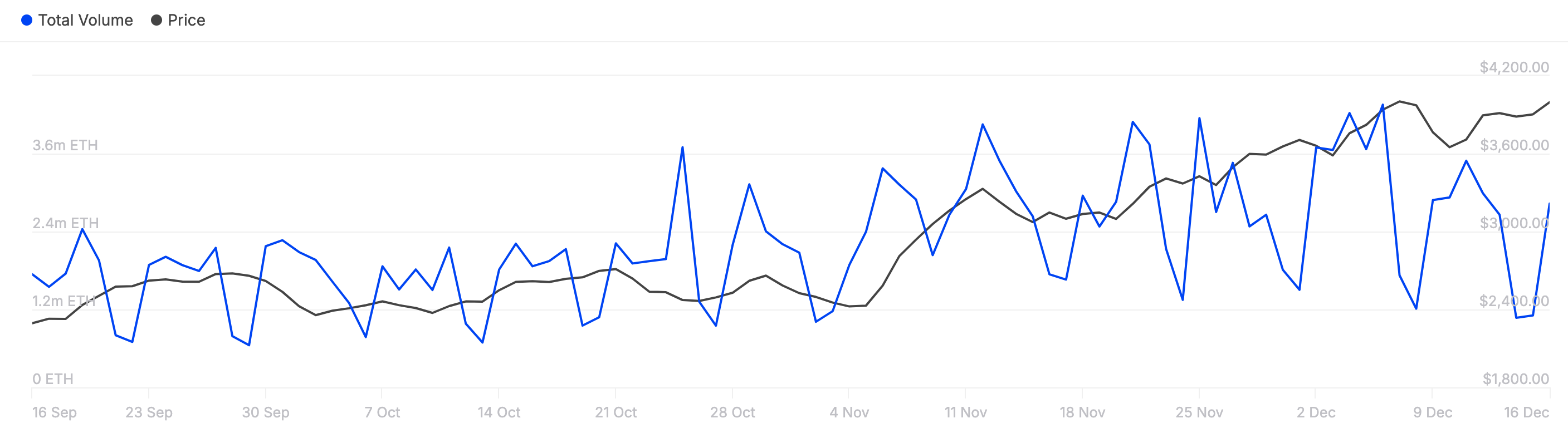

According to IntoTheBlock, the value of large Ethereum transactions has risen to approximately 2.83 million Ether. This surge indicates that there’s been a significant uptick in trading by major players (whales) and influential stakeholders.

Conversely, a decrease in this measure suggests waning enthusiasm. Currently, these transactions are valued at around $11 billion. Generally speaking, when this metric increases with the price, it’s a positive sign known as bullishness. Therefore, the ETH price may surpass $4,500 in the near future.

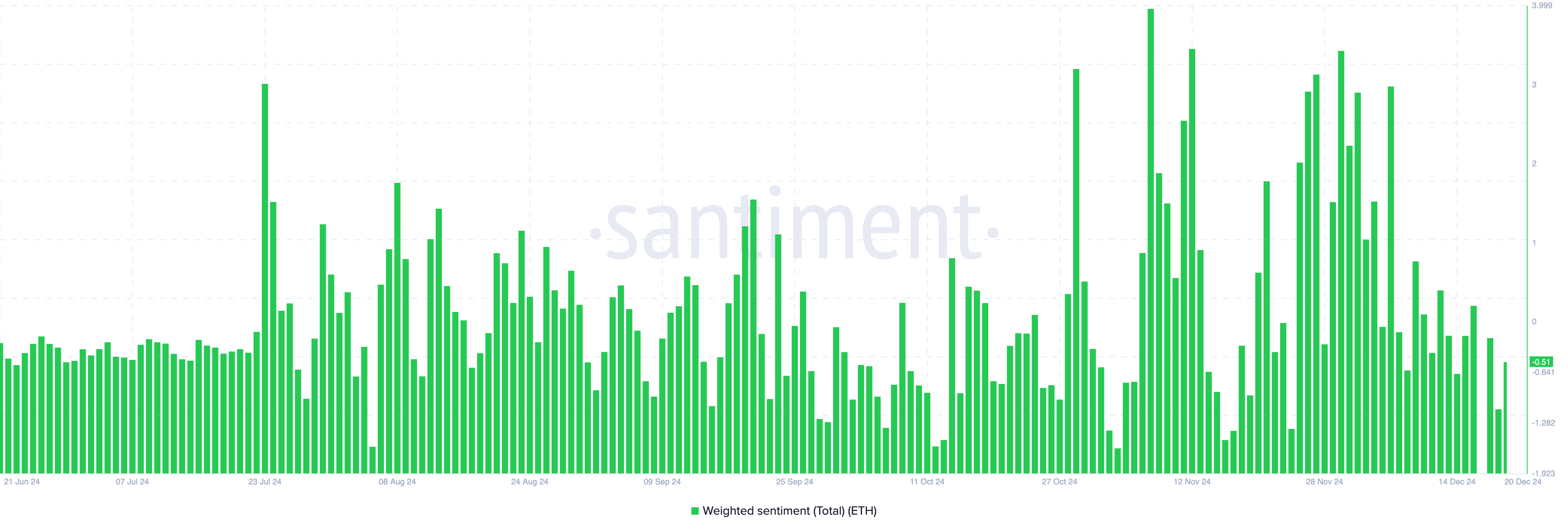

According to the Weighted Sentiment analysis, it appears that Ethereum’s price might continue increasing. This tool gauges the general feeling about a cryptocurrency within the market, where positive values suggest optimistic attitudes (bullish sentiment), while negative values indicate pessimistic views (bearish sentiment).

According to Santiment’s data, Ethereum’s Weighted Sentiment is approaching a favorable region. If it persists here, Ethereum’s worth might keep climbing up.

ETH Price Prediction: Breakout Beyond $4,000 Still On the Cards

Based on the 3-day chart of ETH/USD, the Accumulation/Distribution (A/D) line has consistently increased. An increasing A/D line suggests that investors are purchasing, potentially causing the price to rise further. Conversely, when the indicator shows a decrease, it implies that investors are offloading, which is a negative signal.

For Ethereum (ETH), surpassing the current resistance at $3,982 could be a possibility. If this level is breached, the price might climb to $4,110. However, should the overall market experience an exceptionally bullish trend, ETH’s value could potentially surge beyond $4,500.

If the cryptocurrency doesn’t manage to surpass its resistance level, it’s possible that the value won’t see such a significant increase. Conversely, the price could potentially drop down to around $3,178.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-21 19:23