As a seasoned researcher with years of experience analyzing the cryptocurrency market, I find myself intrigued by Ethereum’s latest price action and the predictions surrounding its future rally. The cup and handle pattern is a technical formation that has historically indicated significant price gains, but as VentureFounder suggests, it remains to be seen whether ETH can break above the $3,800 resistance level to confirm this bullish pattern.

Ethereum (ETH) has experienced a significant upward trend in the past few weeks, moving from a price of $2,400 to $3,700. This surge has drawn interest from traders and investors alike, sparking optimism regarding ETH’s future prospects. However, based on the insights of an anonymous analyst known as VentureFounder, Ethereum could be set for an even more substantial rally, potentially reaching a peak of $7,346.

As a researcher, I’m observing an optimistic perspective surrounding Ethereum, but I can’t ignore the slight instability within its foundation. There are uncertainties about long-term holder behavior and market volatility that need to be addressed. Although a significant surge is predicted, I urge caution as we navigate these crucial phases in Ethereum’s journey.

Ethereum Has a Strategic Rise Ahead

An analyst who also founded a venture predicts that Ethereum may be forming a “cup and handle” triangle consolidation pattern, which historically indicates potential price growth. If Ethereum manages to surpass the $3,800 resistance point, it might aim for $7,346—representing an approximately 97% increase from its current value. This technical configuration suggests that a prolonged uptrend could occur, but only if Etherum confirms the breakout and maintains its upward momentum.

Yet, the trend hasn’t been completely established yet, and whether Ethereum can move beyond the $3,800 barrier is crucial for its future progression. Until it does, Ethereum is in a holding pattern, and a breakthrough could be the trigger for more price growth. Therefore, traders will closely monitor any indications of an uptrend to verify the anticipated surge.

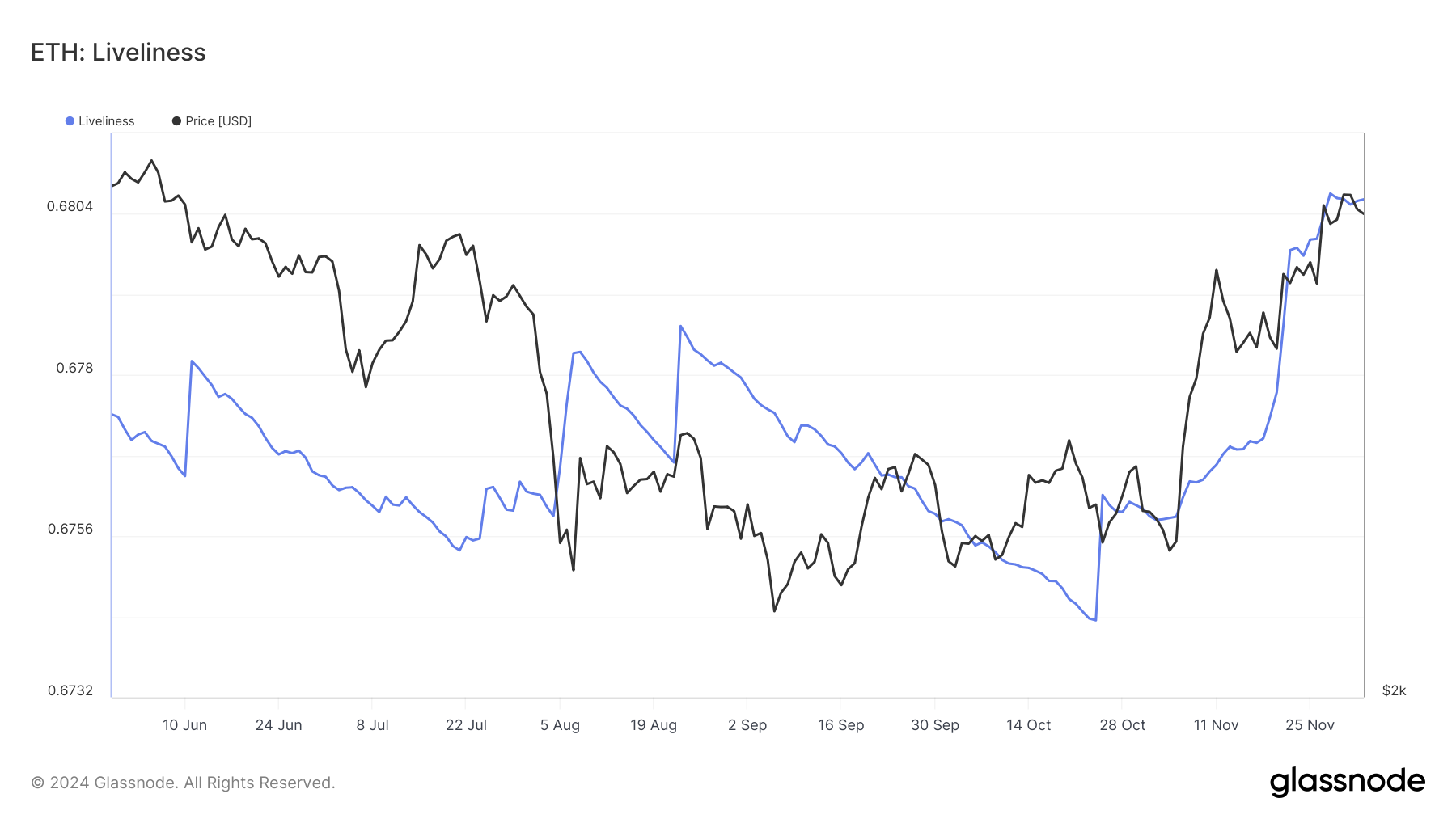

The overall trend for Ethereum on a larger scale appears optimistic, but there’s some worry about the rate at which long-term investors are offloading or acquiring Ethereum, as indicated by the Liveliness indicator. This tool measures whether long-term investors are choosing to sell or hoard Ethereum.

An increase in activity among Long-Term Holders (LTHs) may indicate they’re selling off their positions, potentially suggesting a bearish trend or a change in market sentiment. On the other hand, a decrease in activity could mean that LTHs are buying or holding onto their Ethereum, supporting a bullish perspective.

Currently, the uncertainty surrounding long-term holders (LTH) is significant. Should Ethereum’s vitality persistently increase, it might suggest that long-term investors are offloading their assets, which could exert downward pressure on the price. This selling action could potentially disrupt the rally and postpone any impending price spike. As a result, the actions of long-term holders continue to be an essential aspect to keep an eye on.

ETH Price Prediction: Aiming at All-Time High

At present, Ethereum is hovering around $3,700, slightly under the important barrier at $3,800. If Ethereum manages to surpass this level, it might spark an upward trend that could take it to approximately $7,346. This bullish prediction is based on the ‘cup and handle’ pattern in its price movement, which indicates a potential increase of 97%. This suggests strong optimism for Ethereum investors.

To see significant price increases, it’s crucial that Ethereum maintains strong resistance at around $3,800 first.

Reaching a bounceback point at around $3,800 could potentially help Ethereum surpass its current yearly peak of $4,000. This significant milestone might encourage individual investors to hold firm and attract the attention of institutional investors as well.

If Ethereum’s vitality persists in increasing and long-term investors consistently sell their holdings, the optimistic outlook might be jeopardized. Prolonged selling could lead to a price adjustment, possibly driving Ethereum down towards the $3,327 lower range. This potential market downturn could contradict the current positive theory and potentially postpone the expected surge.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2024-12-04 17:28