As a seasoned analyst with over two decades of experience in financial markets and blockchain technology, I find myself increasingly intrigued by the dynamics unfolding within the Ethereum ecosystem. The recent rally, propelling ETH to touch the $4,000 mark, while impressive, has raised some red flags that suggest a potential short-term correction could be on the horizon.

Based on various Ethereum (ETH) market indicators, there could be a temporary price drop following its impressive 35% increase in the last month. The digital currency has just surpassed the $4,000 threshold, leading to speculation that it might have become overvalued.

When the cost hits this important resistance point, the data indicates that selling activity might increase, possibly triggering a temporary retreat before any additional advance.

Ethereum Flashes Bearish Signs

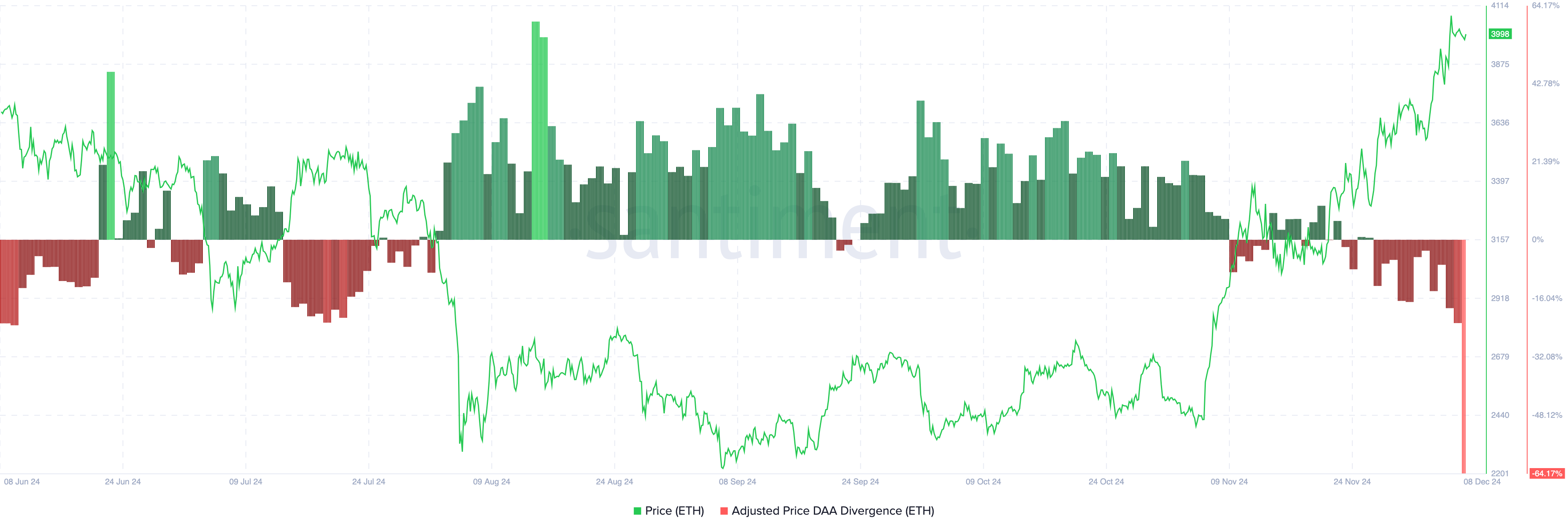

One significant Ethereum on-chain indicator hinting at this drop is the disparity between the price and Daily Active Addresses (DAA). In simpler terms, the price-DAA disparity indicates whether a cryptocurrency’s worth is growing in tandem with user activity or not.

As a researcher, I find it intriguing when the metric shows a positive reading. This suggests that user engagement has escalated, opening up a potential for the value to climb higher. Conversely, if the DAA price reads negatively, it’s an indication of reduced network activity. In such a case, the upward trend might falter or level off.

Based on Santiment’s analysis, the disparity between Ethereum’s price and its DAA (Daily Active Addresses) has fallen to -64.17%. This significant drop suggests a decrease in the number of addresses using Ethereum. Under these circumstances, it’s possible that the price of Ethereum might also decrease.

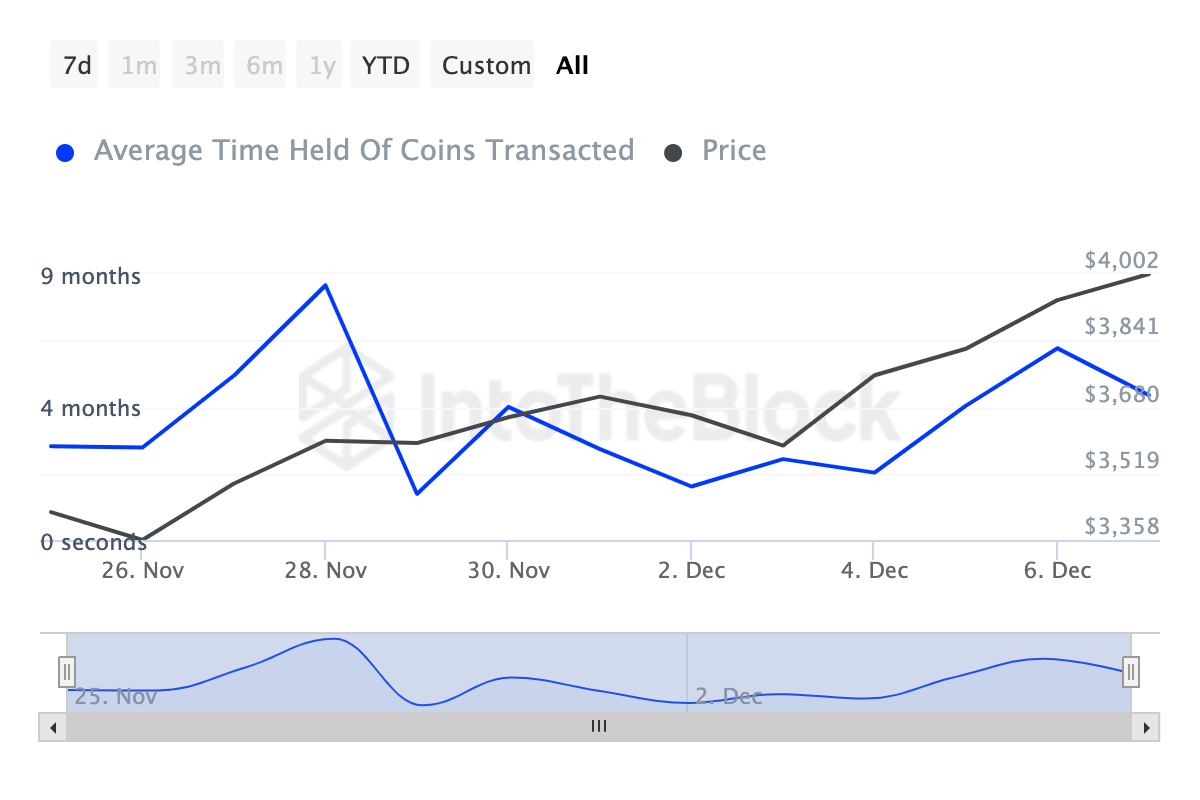

Additionally, BeInCrypto’s assessment of the duration coins are held lines up with this preference. The Coin Holding Time quantifies the length of time a cryptocurrency remains unsold or untouched in transactions.

When it rises, it generally suggests that most owners are choosing to keep their assets. Conversely, a drop might indicate that they’re selling instead.

Based on data from IntoTheBlock, the duration of Ethereum holdings appears to have shortened significantly since December 6. This indicates that there might be increased selling activity for the cryptocurrency. If this trend persists in the upcoming days, it’s possible that the price of Ethereum could dip below its current $3,900 level.

ETH Price Prediction: Back Below $3,800?

On a timeframe of four hours, the cost of Ethereum encountered resistance at approximately $4,073, causing it to retreat slightly to around $3,985. Furthermore, the Cumulative Volume Delta (CVD) now shows a decline into the negative zone.

The CVD (Cumulative Volume Difference) serves as a valuable analytical resource for traders, offering an intricate perspective on the balance of demand and supply within the market. By employing this tool, traders are able to discern the net variation between buying and selling activities during a particular time frame.

When the CVD (Capital Velocity Differential) shows a positive value, it signifies that buying pressure is stronger than selling pressure. Conversely, if the CVD is negative, it suggests that selling pressure is growing, as observed in the case of ETH.

If things continue as they are, Ethereum’s value could potentially fall to around $3,788. In a very pessimistic outlook, it could even drop to $3,572. But if the trend shifts, it might not go that low. Instead, there’s a possibility that Ethereum could increase and move towards $4,500.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-12-09 00:49