As a seasoned researcher with over two decades of market analysis under my belt, I find myself constantly intrigued by the ever-evolving landscape of cryptocurrencies. The latest surge in Ethereum’s price has piqued my interest, and as I delve deeper into the data, I can’t help but feel a sense of déjà vu.

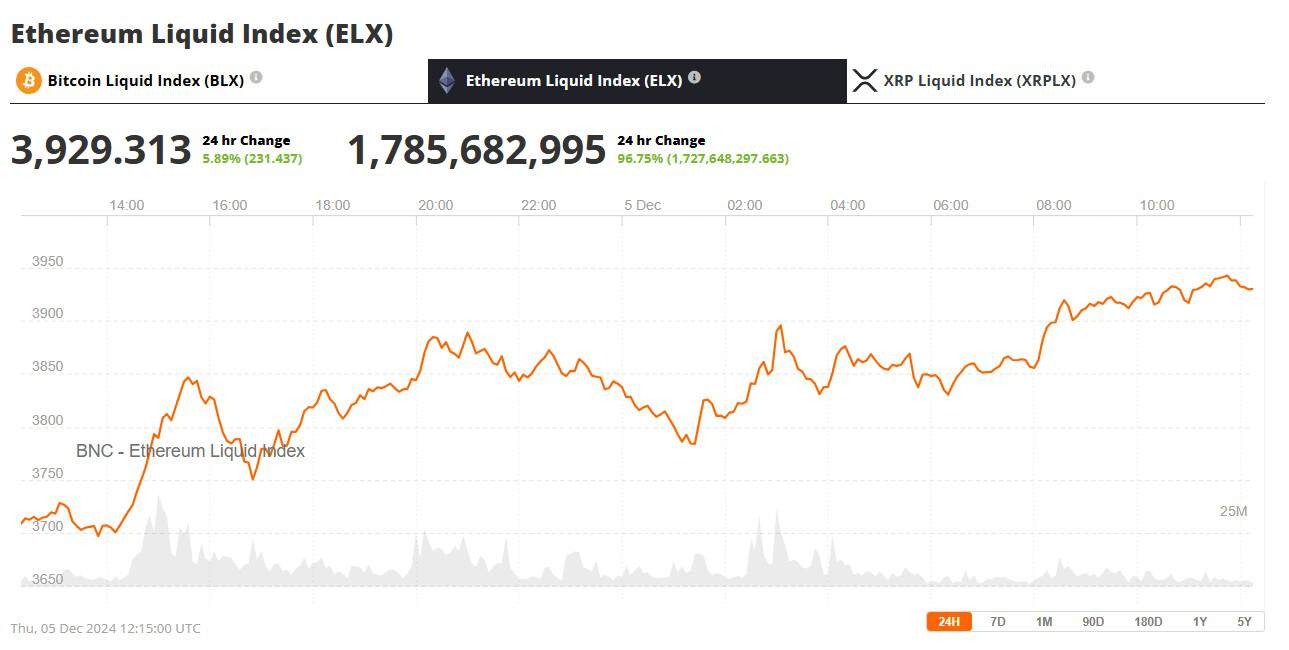

The Ethereum price is $3,929, up 5.89% in the last 24 hours and 6.73% over the past week. The daily trading volume has increased by 4% to over $42 billion, indicating heightened investor activity and a bullish momentum in the market.

Analysts Anticipate a Breakout

Cryptocurrency experts are positive about Ethereum’s future trend. IncomeSharks, a reputable crypto analyst, has pointed out that Ethereum’s daily support levels remain strong, implying a stable base for its current position. The analyst commented, “I wouldn’t buy ETH at this price point, but it’s holding up for now,” suggesting a possible decrease to $3,200 in the short term, while still predicting a near-term price of $4,000 or more.

Analyst Ali Martinez emphasized that the $3,300 level could serve as a good opportunity to enter if Ethereum undergoes a downturn. He expressed positive sentiment, predicting mid-term and long-term prices to reach $6,000 and $10,000 respectively.

Technical Indicators Signal Bullish Trends

In recent times, Ethereum’s graphical trend suggests the development of bullish structures, like the cup-and-handle chart pattern that originated in November 2021. According to analyst Venturefounder, breaching the $3,800 mark could verify this pattern, possibly triggering rapid expansion. Given past tendencies, the projected price objective for this breakout might soar as high as $7,346, emphasizing the enduring optimism towards Ethereum’s future prospects.

The growing enthusiasm for Ethereum is reinforced by the increasing investment into Ethereum-based Exchange-Traded Funds (ETFs). As Farside’s data reveals, Ethereum ETFs recorded a net inflow of $132.6 million on December 3, marking the third straight day of positive investments. This trend indicates a revived interest from institutional investors in the cryptocurrency.

BlackRock’s ETHA Exchange-Traded Fund attracted investments worth $65.3 million, while Fidelity’s FETH saw inflows of $73.7 million. These significant investments suggest that major financial institutions are becoming increasingly optimistic about Ethereum’s future. Conversely, Grayscale’s ETHE experienced withdrawals of $6.4 million, indicating a difference in investor sentiment among various funds.

Market Context and Future Outlook

Ethereum’s rise occurs during broader fluctuations in the crypto market and Bitcoin reaching an all-time high of $100,000. With Bitcoin grabbing worldwide interest, Ethereum seems ready to mirror this trend, gaining from the overall positive outlook in the cryptocurrency sector.

Experts predict that as long as Ethereum holds above crucial milestones and shows improving technical signs, it could see significant expansion in the upcoming period. If Ethereum manages to break through $4,000, it could pave the way for the lofty price predictions made by industry professionals.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

2024-12-05 21:22