As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles, and the current state of Ethereum is reminiscent of some of the most challenging periods I’ve encountered. The worsening market conditions and the altcoin’s struggles to reclaim $3,500 are a stark reminder of the unpredictable nature of the crypto market.

Having navigated through numerous bear markets in traditional finance, I can attest that patience is often rewarded when it comes to investing. However, the behavior of investors panic-selling their holdings and the high level of activity among long-term holders liquidating their positions are worrying signs that could potentially prolong the downturn.

The continued rise in Ethereum’s Liveliness indicator, despite declining prices, is a red flag for me as it signals that long-term holders prioritize profit-taking over supporting recovery. This behavior undermines market confidence and puts additional pressure on Ethereum’s price, potentially leading to further declines.

In my experience, such situations often present opportunities for those who are patient and disciplined enough to ride out the storm. The current consolidation of Ethereum around $3,402 could be a chance for investors to accumulate at lower prices in anticipation of a potential breakout above the crucial resistance level of $3,524.

However, it’s essential to keep in mind that the crypto market is inherently unpredictable, and even the most seasoned analysts can’t always predict its twists and turns. As the great Mark Twain once said, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” So, while I remain cautiously optimistic about Ethereum’s potential recovery, it’s crucial to approach investing with a healthy dose of skepticism and a willingness to adapt as the market evolves.

Oh, and remember: Never invest more than you can afford to lose—even in promising projects like Ethereum!

Ethereum is still encountering difficulties as it attempts to regain the significant mark of $3,500, which serves as a crucial stepping stone towards $4,000.

Poor market trends are making it harder for the altcoin, increasing doubts about an immediate comeback and leaving investors in the dark about its future price direction.

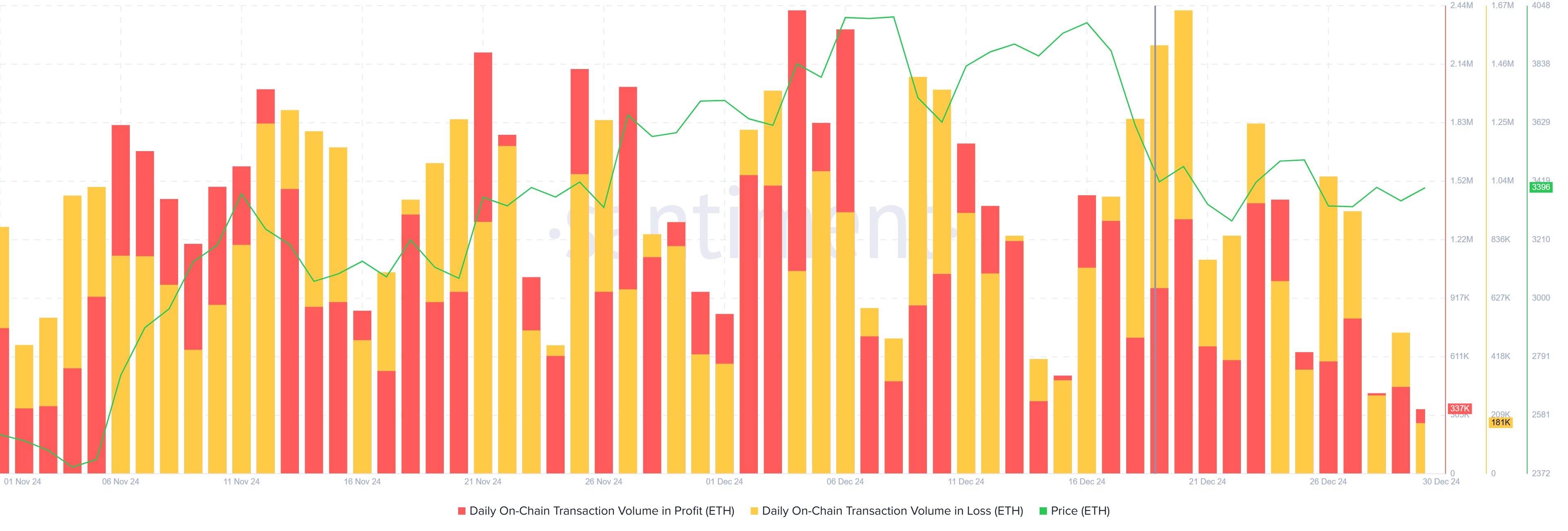

Ethereum Losses Mount

Lately, it seems that more Ethereum network transactions involve losses over profits. Many investors are rushing to sell their investments, especially those who have held for a short period, hoping to cash out or invest during market lows. Unfortunately, these actions can lead to missed opportunities and further contribute to the market’s decline.

This action underscores a wider hesitancy in investor confidence. Early exits from positions are fueling market turbulence, making it difficult for Ethereum to rebound and maintain a steady position above vital support thresholds.

The vitality measure of Ethereum has reached its highest point in the past two years, indicating increased action among long-term investors. This statistic rises when these long-term investors sell their assets, usually suggesting potential instability in the market price.

As a seasoned trader with years of experience under my belt, I’ve learned that market trends can sometimes be puzzling and unpredictable. However, when I see prices falling but liveliness persisting in the market, it sets off a few alarm bells for me. It seems to me that LTHs (Large Token Holders) might be prioritizing profit-taking over supporting recovery. This behavior, in my opinion, undermines market confidence and creates an atmosphere of uncertainty.

I’ve seen similar situations before, and the result is usually a further decline in the asset’s price. It’s like standing on the edge of a cliff, watching as the ground beneath you gives way bit by bit. The fear of falling can be paralyzing, and it’s essential to act swiftly when such behavior is observed.

In this case, I believe that Ethereum might face additional pressure due to these actions, potentially leading to further declines in its price. It’s a tough lesson for those who are new to trading, but experience teaches us that market confidence is crucial, and actions like these can quickly erode it.

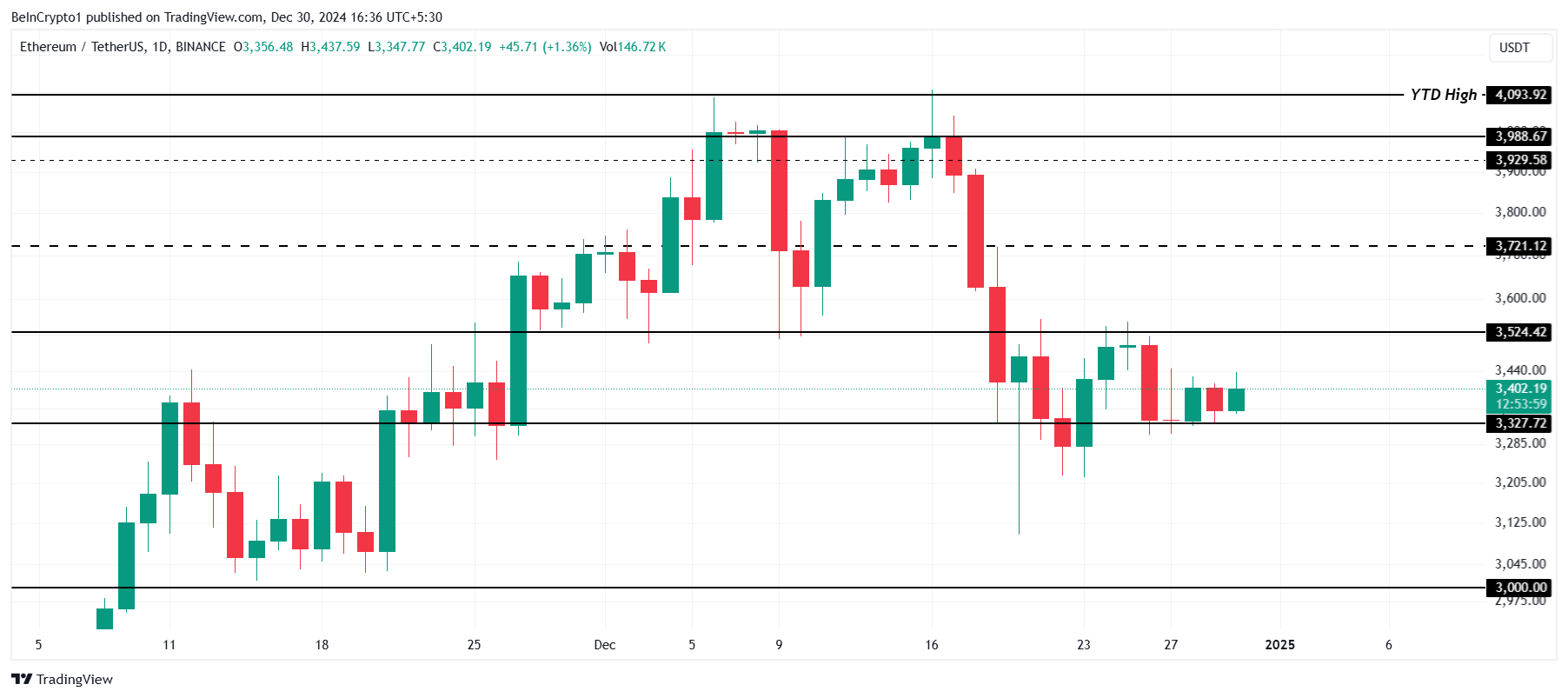

ETH Price Prediction: Breaking Resistance

At present, Ethereum is valued at around $3,402. It’s holding steadily above a potential support level of $3,327, yet it hasn’t been able to surpass the resistance at $3,524. This price range has remained relatively stable for close to two weeks, indicating some market unpredictability and a lack of robust bullish indicators.

Under the current circumstances, it’s predicted that Ethereum might carry on accumulating or even fall. Such a descent may lead it to challenge the $3,000 mark, potentially causing more losses for investors and postponing any substantial rebound.

Instead, if $3,524 is turned into resistance, it could challenge the bearish perspective. Reaching this level would set a path for Ethereum to advance towards $3,721, enabling the crypto to recoup losses and boost the faith of its investors once more.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-30 15:18