Well now, if you ever thought the world of finances was too dull for a good story, it seems the latest circus in Ethereum’s parlor might just change your mind. Last Friday, money practically fell out of the sky – over $460 million flowed into those Ethereum ETFs like a hot cake at a Sunday picnic. And wouldn’t you know it, ETH itself punched its way back above the $4,000 mark, something it hasn’t done since December 2024. Folks, it’s enough to make a man say, “Well, I’ll be! The old girl’s back in the race.”

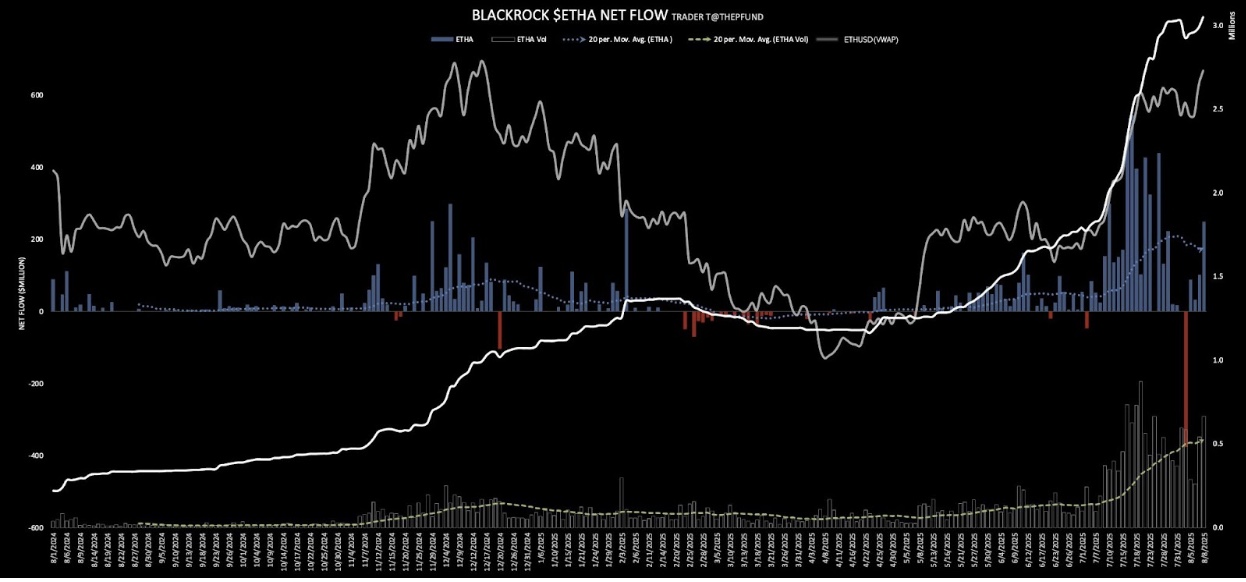

Leading the charge was BlackRock’s Ethereum Trust, or as I like to call it, the big cheese of the ETF barnyard. They scooped up a hefty $254.7 million worth of ETH-enough to make even a fox look fat. During the day, they bought over 62,936 ETH tokens, and the trading volume? Oh, just a humble $1.7 billion. No big deal, just a little number to set hearts aflutter.

According to the fine folks at Farside Investors, since that ETF first strutted onto the scene, they’ve pulled in nearly $10 billion worth of investment, making it the talk of Wall Street and the stockyards alike. The share price of the ETF jumped five percent in a single day, closing at $30.79-sounds like a wild ride, doesn’t it? That’s a 47% gain in just a month, all thanks to those big dollars pouring in like water from a busted bucket. Fidelity’s FETH also contributed a modest $132 million, like a quiet neighbor bringing cookies to the barn dance.

Crypto’s Jungle Gym: ETH Price Surge Sends Shorts Running for Cover

And if you liked a good fight, you’d love this: ETH shooting past $4,000 sent a wave of short sellers tumbling like dominoes. “Seeing ETH shorts get smoked today,” said Eric Trump (yes, that one), “it’s like watching a cat chase a mouse and catching it-sweet victory.” About $105 million worth of these short bets on ETH got liquidated – just about half of the total short liquidations in the whole market. All that fuss just because ETH crossed the magical $4,000 threshold for the first time since the days of December last year.

Blackrock Ethereum ETF inflows | Source: Trader T

Michael van de Poppe, that sharp-eyed analyst, chimed in: “Ethereum’s got a wild streak right now. It’s high and mighty, but probably best to play it safe and spread your eggs within the Ethereum basket if you don’t want to get banged up.” Seems like the smart money is eyeing the horizon for a big breakout, but caution’s the watchword in this rollercoaster.

Now, if history’s any teacher, this upward swing might just signal a grand new season for altcoins-they’ve been whispering sweet nothings and taking a few hefty steps forward, XRP, ADA, SOL, and DOGE included. As they say in the city, “The main event’s just getting started.”

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- USD PHP PREDICTION

2025-08-09 20:31