As a seasoned researcher with a decade of experience in the cryptocurrency market, I have witnessed the ebb and flow of various digital assets. The surge of Ethereum to its highest price in nearly three years is indeed an exciting development that warrants close attention.

On Thursday, December 6, the price of Ethereum (ETH) peaked at a nearly three-year high, hitting $4,089.

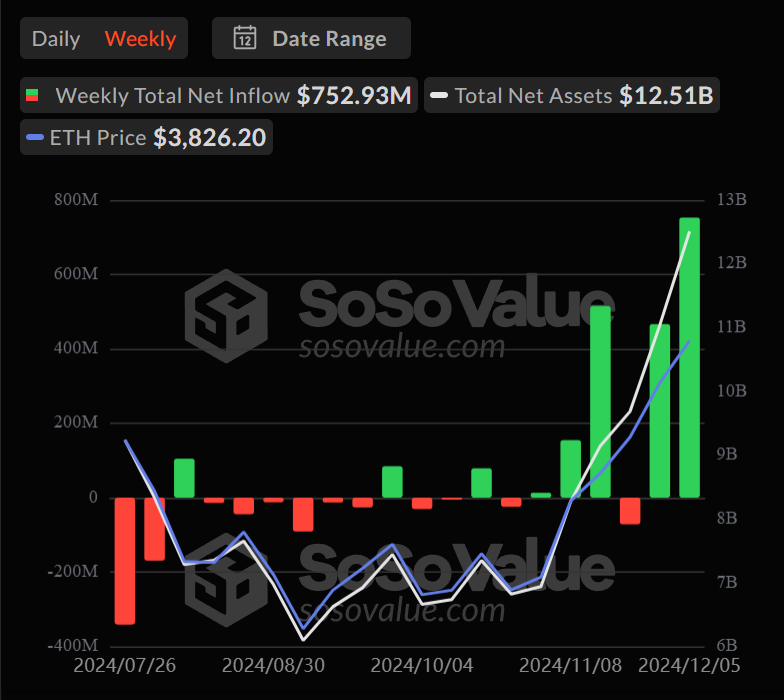

On December 5th, there was a considerable surge in investments, particularly in U.S.-based Ethereum Exchange Traded Funds (ETFs), marking their highest one-day net influx of approximately $428.4 million.

A Revival of Institutional Investments in Ethereum ETFs

At the forefront of the influx were deposits into BlackRock’s ETHA fund, with Fidelity’s FETH closely behind. These investments significantly boosted the weekly net inflow of Ethereum ETFs to a record high since their debut in July.

In the opening week of December, the accumulated weekly influx amounts to an impressive $752.9 million, setting a new record for weekly gains in the fund. Notably, this figure doesn’t include the data from Friday yet. This substantial institutional investment surge has significantly contributed to Ethereum’s price increase and pushed the fear and greed index up to 65, indicating a high level of investor optimism.

In contrast to Bitcoin ETFs, Ethereum ETFs have had a more gradual beginning in the U.S., with just one week of positive investment during their first month on the market. As of now, the combined assets across nine ETFs amount to $12.5 billion, which equates to approximately 2.7% of Ethereum’s total circulating supply.

On the other hand, November emerged as a significant milestone, as the incoming funds surpassed $1 billion each month, indicating an increasing institutional appetite, even after previous withdrawals.

As an analyst, I’m excited to share a significant stride: The Michigan State Retirement System (SMRS) made history by being the first U.S. state pension fund to invest in an Ethereum Exchange-Traded Fund (ETF). This move expanded their crypto holdings, now comprising 460,000 shares of Grayscale Ethereum and 110,000 shares of the ARK Bitcoin ETF, as part of a strategically diversified digital asset portfolio.

Additionally, other digital currencies are joining the competition to be part of an ETF. Companies such as VanEck, 21Shares, and Grayscale have submitted applications for Solana ETFs. Moreover, WisdomTree and Bitwise are among four entities hoping to receive approval for XRP ETFs.

With the U.S. regulatory environment becoming increasingly favorable towards cryptocurrencies, it’s expected that the market for Exchange Traded Funds (ETFs) focused on digital assets will likely grow.

Read More

2024-12-07 01:48