The price of Ethereum (ETH) has declined by more than 15% in the past week, raising concerns that it might dip below the significant $3,000 threshold for the first time since late 2024. Technically speaking, charts like DMI and EMA suggest a bearish trend, with growing downward pressure and diminishing bullish energy.

As a crypto investor, I’m observing a trend where whales are accumulating Ethereum (ETH), indicating their long-term faith in the coin. However, as we near significant support levels and the market is downward trending, the immediate future appears uncertain for ETH. If this downtrend continues, ETH might experience a more substantial correction. But if the trend reverses, it could open up opportunities for a recovery that could potentially push the price towards $3,300 or even higher.

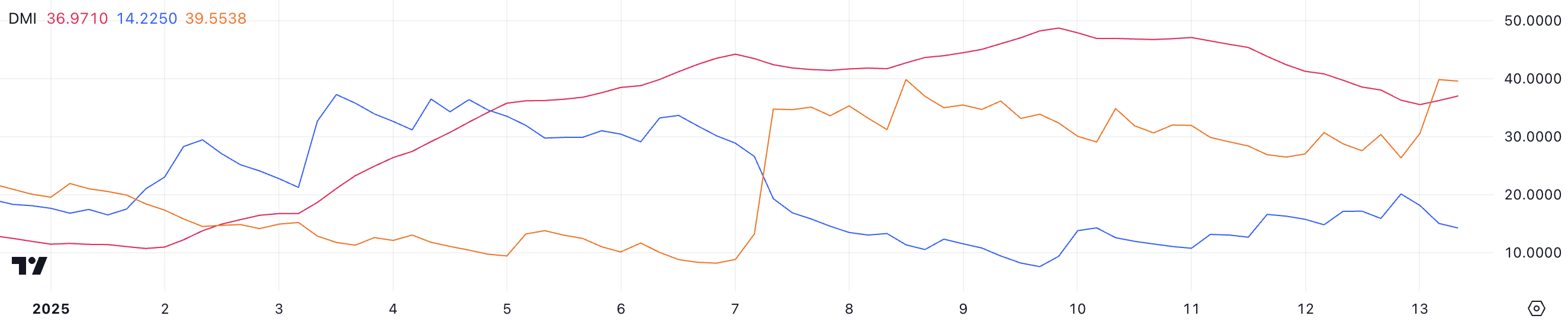

ETH DMI Shows a Bearish Setup

The Ethereum Directional Movement Index (DMI) is now reporting an ADX level of 36.9, which is a decrease from 48 four days prior, suggesting a lessening in trend strength. However, even with this decline, the price of ETH has still dropped approximately 6% over the same period.

The ADX (a measure of trend strength regardless of its direction) usually indicates a powerful trend when it’s above 25, and an extremely potent trend when it exceeds 40.

The DMI indicates a more pessimistic outlook, as the negative directional index (D-) rose significantly from 26.3 to 39.5, suggesting a stronger bearish influence. Simultaneously, the positive directional index (D+) has noticeably decreased from 20 to 14.2, indicating a decline in bullish energy.

The increasing disparity between D- and D+ suggests that Ethereum (ETH) is currently experiencing a temporary downtrend. If the Average Directional Index (ADX) continues to decrease, it could indicate a possible weakening of the trend, potentially offering some respite for ETH’s price. However, until there are signs of recovery in D+ or a decline in D-, Ethereum may continue to face bearish pressure in the immediate future.

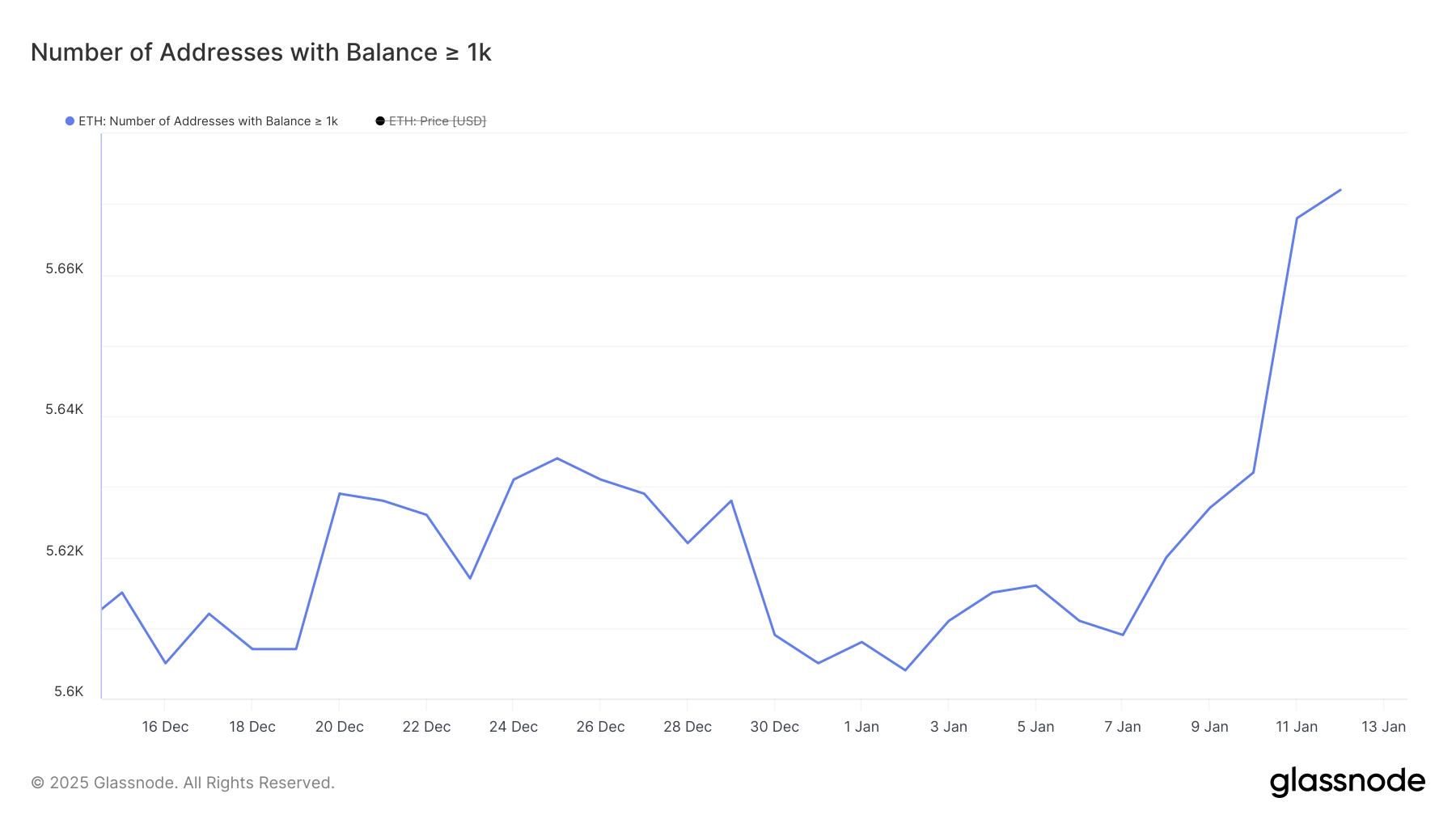

Ethereum Whales Hit the Biggest Level In 11 Months

Ethereum whales seem to be taking advantage of the recent correction to accumulate more ETH.

From January 7th through January 12th, there was a significant uptick in the number of Ethereum addresses containing at least 1,000 ETH. This figure rose from 5,609 to 5,672, indicating an increase in large Ethereum holders during a period of price downturn.

Monitoring whale behavior is essential because it frequently offers clues about investor sentiment and possible future price fluctuations. These ‘whales’ have significant influence over market trends thanks to the massive amounts of assets they control. When they start amassing more of an asset, it usually suggests they are optimistic about its future growth prospects.

Right now, the number of Ethereum (ETH) holders with significant amounts (often referred to as ‘whales’) is at its peak since February 2024. This rise in large investors indicates growing curiosity from influential parties. If this pattern of accumulation persists, it might be a sign of potential price increases ahead.

ETH Price Prediction: A Potential 23% Correction

At present, Ethereum’s Exponential Moving Averages (EMA) indicate a bearish structure as all short-term EMAs are situated beneath their long-term counterparts. This arrangement, coupled with Ethereum’s substantial drop of more than 15% in the past week, suggests a robust downward trend, leaving its price in a potentially vulnerable state.

If the negative trend persists in Ethereum’s market, it may challenge the significant support point of $3,014. Dropping below this level could potentially cause Ethereum to dip beneath $3,000 for the first time since November 2024. The following supports are located at $2,723 and $2,359, with the latter indicating a potential correction of about 23%.

Instead, if the current decline changes direction, Ethereum’s price might challenge $3,300 again. If it manages to breach this level, there’s potential for further increases toward $3,545 or even $3,745, suggesting a possible route for recovery.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Oblivion Remastered: How to get and cure Vampirism

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Does Oblivion Remastered have mod support?

- DODO PREDICTION. DODO cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- Franklin Templeton’s 2025 Crypto Predictions: BTC Reserves, Crypto ETFs, and More

2025-01-13 22:30