As a seasoned researcher with a deep understanding of the cryptocurrency market, I have closely followed the developments in the space for years. Matt Hougan, the Chief Investment Officer at Bitwise Asset Management, is someone whose insights and predictions I hold in high regard due to his extensive experience and expertise. In his latest blog post, Hougan expresses a bullish outlook on Ethereum’s future price performance, predicting it will surpass its all-time high by the end of this year.

Matt Hougan, the Chief Investment Officer at Bitwise Asset Management, is optimistic about Ethereum‘s future. He believes that the cryptocurrency will surpass its record high and reach above $5,000 by the end of this year. This positive outlook is partly due to the upcoming launch of spot Ethereum Exchange-Traded Products (ETPs), which will facilitate easier trading of Ethereum.

As a financial analyst, I’d interpret Bitwise’s latest blog post as follows: In my perspective, the introduction of Ethereum Exchange-Traded Products (ETPs) might lead to turbulent market conditions. The reason being, there is a likelihood that investors may withdraw funds from the $11 billion Grayscale Ethereum Trust (ETHE) once it transforms into an ETP.

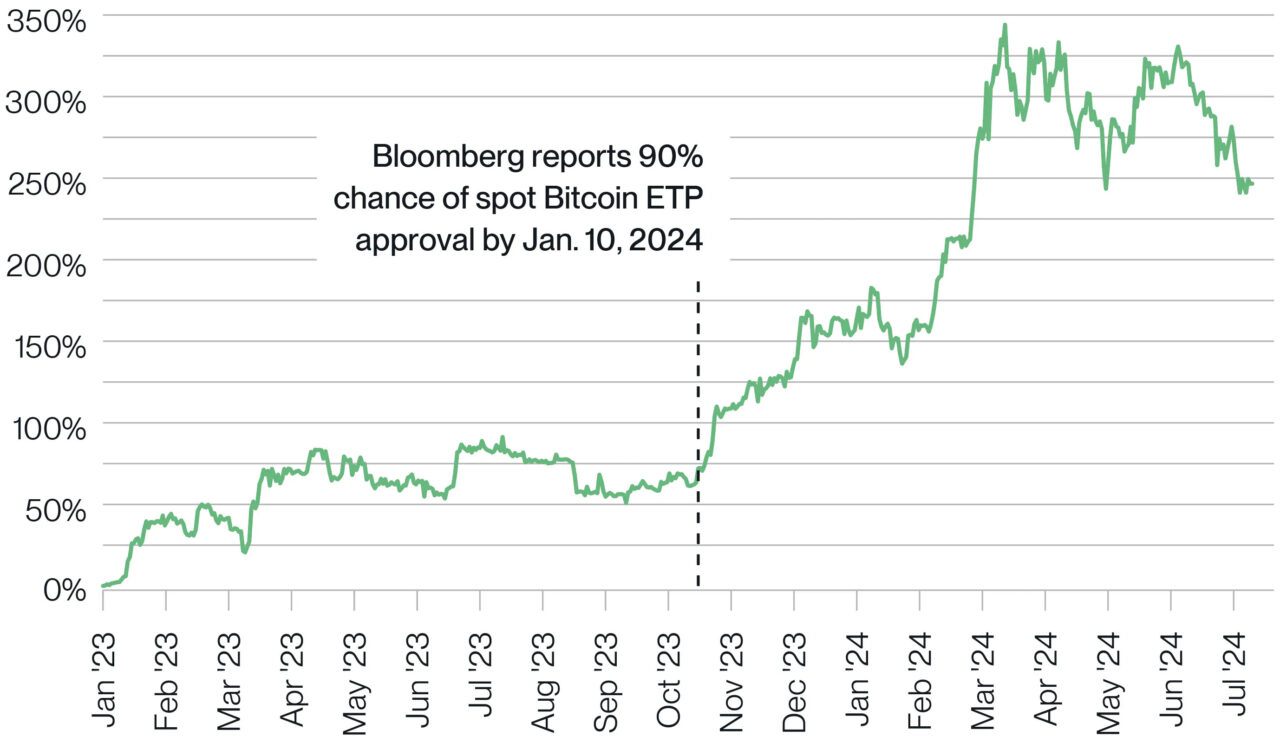

According to Per Hougan, the introduction of spot Bitcoin Exchange-Traded Products (ETPs) has led to the purchase of over twice as much Bitcoin as miners have been able to produce since their inception. Specifically, these ETPs have acquired a total of 263,965 coins, whereas miners have only managed to mine 129,181 BTC during this period. Consequently, Bitcoin’s price has experienced an upward trend as a result.

As a crypto investor, I believe in Hougan’s bullish perspective towards Ethereum for several reasons. One of the significant factors setting Ethereum apart from Bitcoin is its lower short-term inflation rate. When Ethereum’s Exchange Traded Products (ETPs) were introduced, Ethereum had a noticeably reduced inflation rate compared to Bitcoin.

Bitcoin experienced an inflation rate of approximately 1.7%, whereas Ethereum currently has minimal inflation due to the Ether tokens being burned on its network. The equilibrium between new coin generation and network activity results in a more advantageous supply-demand situation for Ethereum, potentially leading to price increases.

In contrast to Bitcoin mining where miners are compelled to sell freshly minted coins to meet expenses, Ethereum’s Proof-of-Stake mechanism imposes no such obligation on validators. As a result, there’s less compulsory selling of ETH in the market, which can help maintain or even boost its value.

In summary, approximately 40% of Ethereum’s total supply is currently unreachable for trading: around 28% is being staked, and another 13% is secured in decentralized finance contracts. Consequently, the reduced availability might lead to increased scarcity and potentially push prices upwards.

Hougan expects these elements, along with approximately $15 billion projected to enter new Ethereum Exchange-Traded Products (ETPs) within the next 18 months, to fuel a significant price increase for Ethereum.

Currently priced at roughly $3,400 following an 11% surge, Ethereum, according to Hougan’s perspective, has a strong chance of not just reaching but even exceeding its historical price maximum.

Read More

2024-07-19 05:52