As a seasoned crypto investor with a decade of experience under my belt, I’ve seen the market’s twists and turns more times than I can count. The recent surge of Ethereum (ETH) beyond $4,000 is indeed exciting, but as always, it’s essential to look beneath the surface for a more nuanced understanding.

Ethereum (ETH) price recently surpassed $4,000 for the first time since March 2024, marking a 25% gain over the past 30 days. However, the 7D MVRV ratio, now at -1.35%, suggests short-term holders are experiencing unrealized losses, hinting at potential further downside before a recovery.

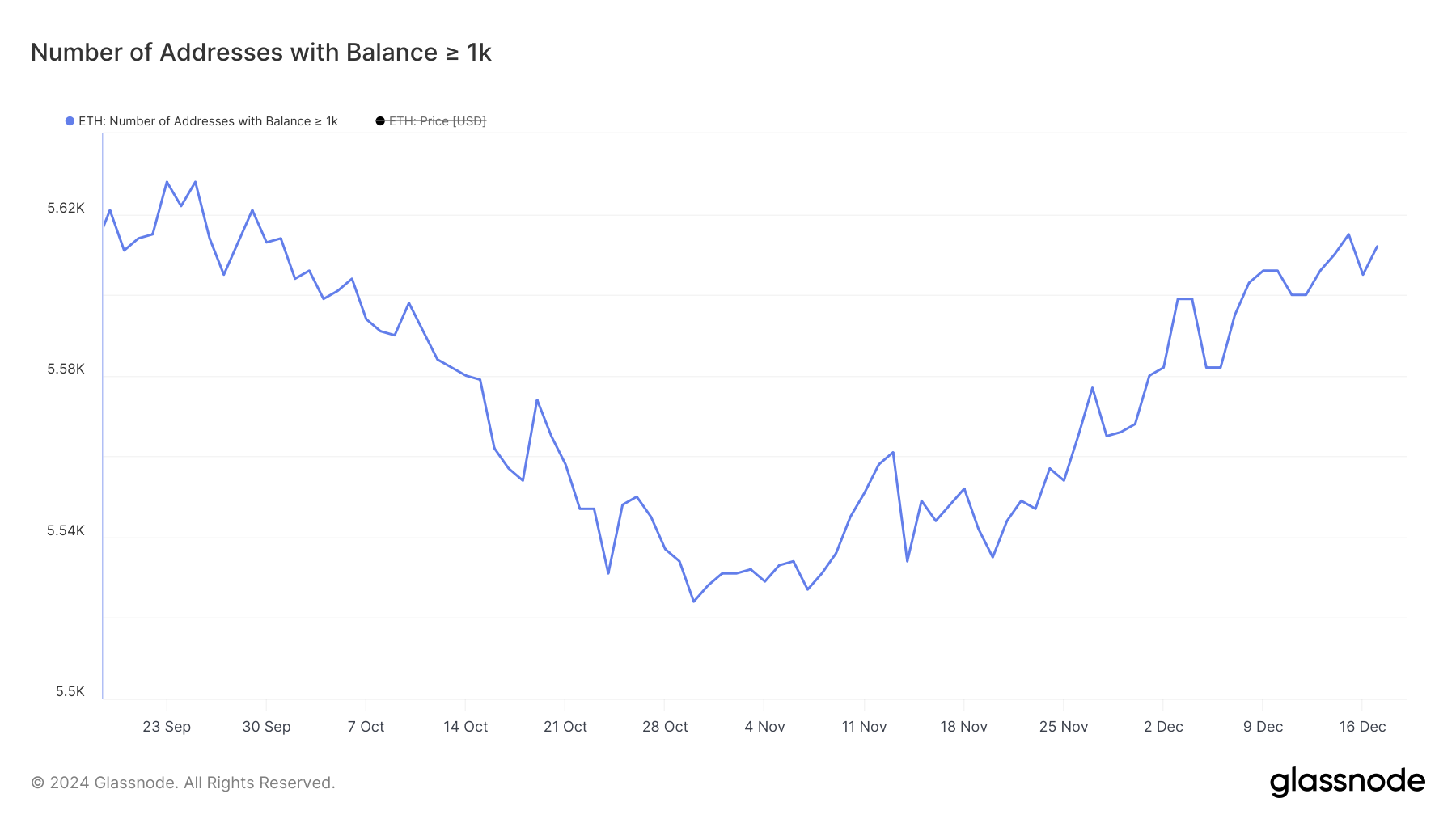

As an analyst, I’ve observed historically that Ethereum (ETH) tends to recover when the MVRV metric dips below -4%. This dip often coincides with a surge in whale accumulation, as the number of addresses holding 1,000 ETH or more has consistently increased in December.

7D MVRV Shows ETH Could Go Down Before a Surge

7-day Ethereum MVRV (Maker’s Value Realized to Value) has dipped to -1.35%, having been at 3.32% on December 16. This suggests that the average short-term holder is now in a loss position. When the MVRV value goes negative, it usually indicates increased market pessimism, which can sometimes signal oversold conditions.

In this scenario, it fosters a setting where the probability of losses lessens and the opportunity for rebound becomes stronger, since being underestimated encourages renewed investment.

The MVRV 7-day Ratio calculates the average profit or loss of Ethereum tokens transferred over the last week compared to their current value. Typically, a drop in Ethereum’s 7-day MVRV ratio down to approximately -4% or lower than -5% has preceded significant price increases in the past.

Based on this pattern, it seems there might be more potential for decreases, but Ethereum might shortly reach historical levels that typically lead to buying, possibly paving the way for an upturn in its price.

Ethereum Whales Are Accumulating Again

Over the course of December, the count of wallets holding more than 1,000 Ether has consistently grown. As of December 1st, there were approximately 5,580 such wallets, which represents an increase from a three-month low of 5,524 on October 30th.

Over the past month, there’s been a steady increase in this number, currently standing at 5,612, as large investors, often referred to as “whales,” have been acquiring more of these assets.

As an analyst, I find it essential to monitor whale activity due to their substantial impact on market movements. A rise in the number of whales typically indicates increased trust from prominent investors, often interpreted as a positive or bullish indication.

Based on my years of observing and analyzing market trends, I have noticed that whale activities can sometimes be a reliable indicator of future price movements in the cryptocurrency world. From my personal experience, I’ve seen situations where whales’ transactions often seem to predict or fuel an upward price trend. This leads me to suspect that their recent accumulation of Ether (ETH) might signal a positive price movement for this digital asset in the near future. It’s important to remember that while whale activity can be insightful, it should not be used as the sole basis for investment decisions, as market movements can be influenced by numerous factors.

ETH Price Prediction: Can It Test $4,000 Again In December?

At present, the value of Ethereum is fluctuating between a potential barrier at around $3,987 (where it may struggle to rise) and a floor at roughly $3,763 (which could act as a safety net if it falls). Should the resistance be surpassed, the price of ETH might ascend to check $4,100, and with continued momentum, it could strive for new peak levels around $4,800 or $4,900.

These levels represent key targets for bullish continuation if buyers regain control.

Meanwhile, as the EMA lines draw together, suggesting a weakening trend, it’s worth noting that the 7-day MVRV points to potential additional corrections. This might imply that the Ethereum price may encounter downward pressure in the near future.

If the quickly moving Exponential Moving Average (EMA) drops beneath the slowly moving EMA, indicating a bearish signal, the value of Ethereum (ETH) might challenge the $3,500 support level. Should it fail to hold this level, the price could slide further downwards, potentially dipping as low as $3,256.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- ANDOR Recasts a Major STAR WARS Character for Season 2

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Is a Season 2 of ‘Agatha All Along’ on the Horizon? Everything We Know So Far

- Apocalypse Hotel Original Anime Confirmed for 2025 with Teaser and Visual

2024-12-18 19:54