As a seasoned researcher with over a decade of experience in the crypto market, I’ve witnessed my fair share of ups and downs. The recent 15% decline in Ethereum is a stark reminder that volatility is an inherent part of this space.

Over the last seven days, Ethereum has plunged by around 15%, resulting in substantial financial setbacks for many investors.

The increase in the drop is causing sellers to feel more pressured, as they seem to prefer cashing out their earnings instead of holding during the market’s turbulence. If this tendency persists, it could worsen Ethereum’s descending trend.

Ethereum Losses Mount

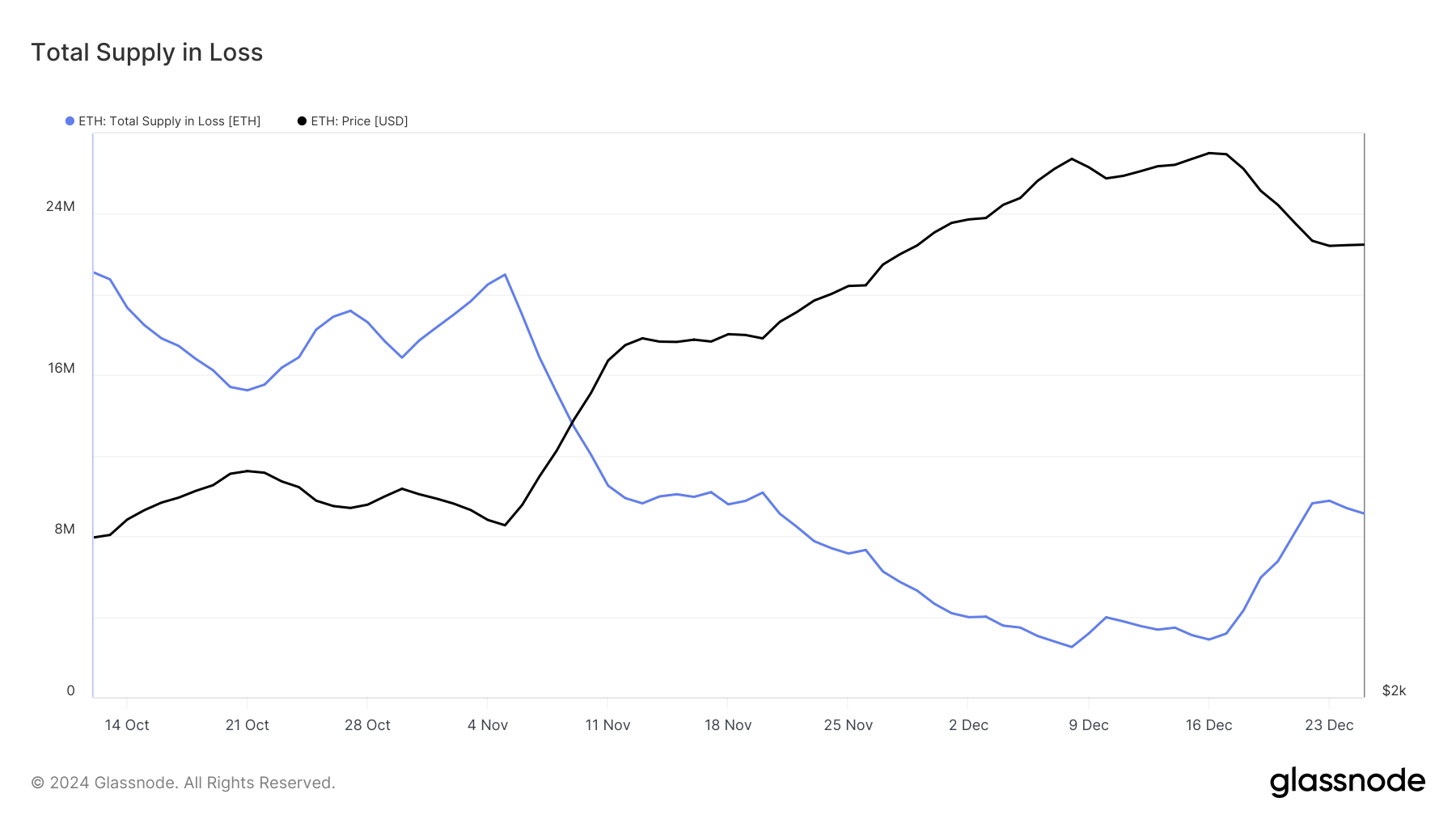

Over the past week, a sudden decrease in price has led to an increase of 7 million ETH in supply from 2.7 million ETH to 9.7 million ETH. This current supply is worth more than $23 billion, demonstrating the magnitude of these losses. This substantial jump in unrealized losses represents the most significant increase in over five months, raising worries about increased selling and its potential impact.

With increasing losses, investors seem to be opting more for selling their assets instead of holding on for recovery. This rising pattern of selling could potentially drive prices down, and if market conditions don’t change, Ethereum may find itself in a prolonged period of bearish trends.

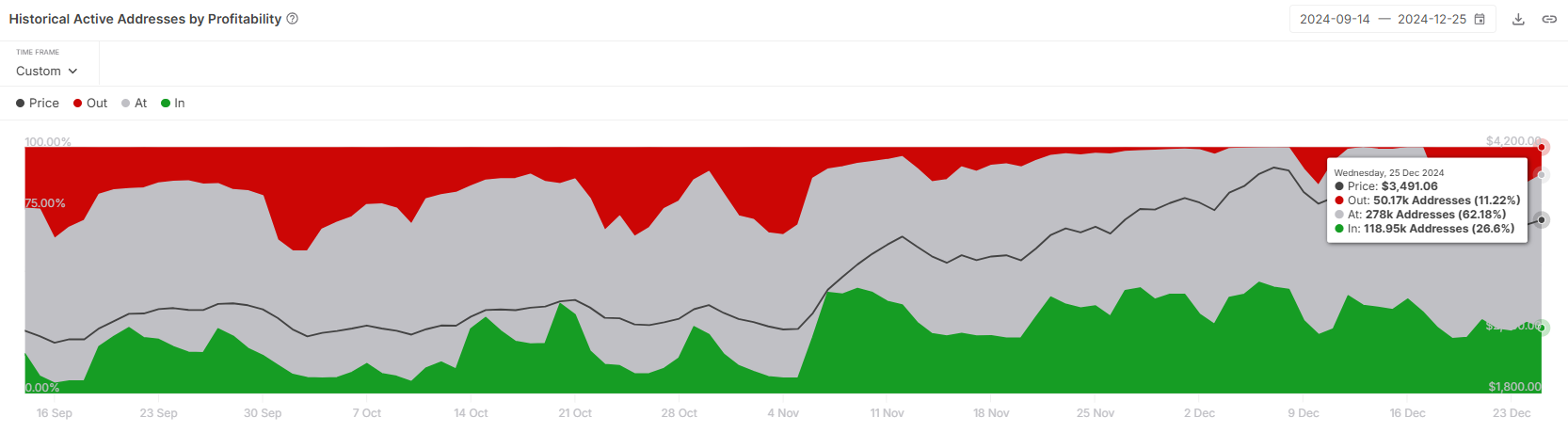

On Ethereum’s broader scale, there are indications pointing towards possible weakness. Right now, more than a quarter (28%) of users on the network are enjoying profits from their transactions. Typically, when this percentage surpasses 25%, the chance of people selling off their holdings (profit-taking) increases substantially, which can lead to additional price drops.

At this high profit margin, it may indicate that more shareholders could decide to cash out and secure their profits, exacerbating the current downward trend. If this pattern continues, Ethereum might find it difficult to sustain its current value, potentially causing a sharper drop in price.

ETH Price Prediction: A Rise is Far Away

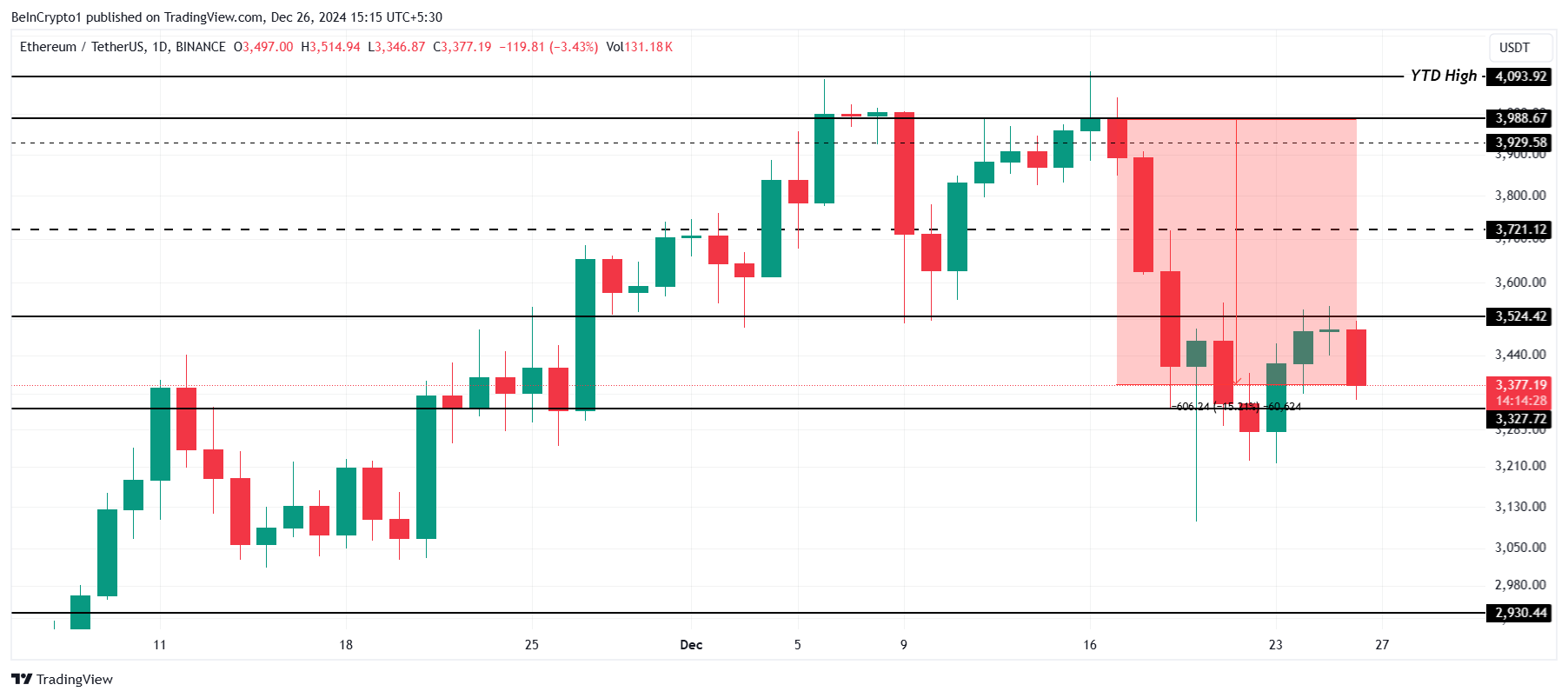

The price of Ethereum dropped to $3,377 after a 15% decrease over the past week, which is the second time in a month that it couldn’t sustain $4,000 as a support point. This double failure strengthens the bearish outlook, implying that Ethereum might be at risk for more downward adjustments since it wasn’t able to maintain this crucial level.

If the current downtrend continues and selling pressure intensifies, ETH risks losing the $3,327 support level. A break below this point could drive the price below $3,000, signaling a significant bearish phase for the altcoin king.

On the upside, Ethereum faces a barrier at $3,524. Flipping this resistance into support could trigger a rebound, pushing the price toward $3,721. Such a move would invalidate concerns of further losses, providing a much-needed boost to investor confidence and market sentiment.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2024-12-26 18:20