As a seasoned researcher with a decade of experience in the ever-evolving cryptocurrency market, I find the recent surge in Ethereum (ETH) price particularly intriguing. The declining supply on exchanges and the return of whales to accumulate ETH are two strong indicators of a bullish trend.

Ethereum‘s (ETH) value has surged by a robust 43.88% over the past month, demonstrating a powerful upward trend. The reduction in Ethereum supply on exchanges indicates that investors are growing more optimistic, transferring their tokens to long-term storage for safekeeping.

Concurrently, whales are increasing their holdings of ETH, fueling a sense of optimism. Additionally, the EMA patterns are tilting favorably, suggesting that the market is preparing for a captivating period ahead.

ETH Supply on Exchanges Is Decreasing

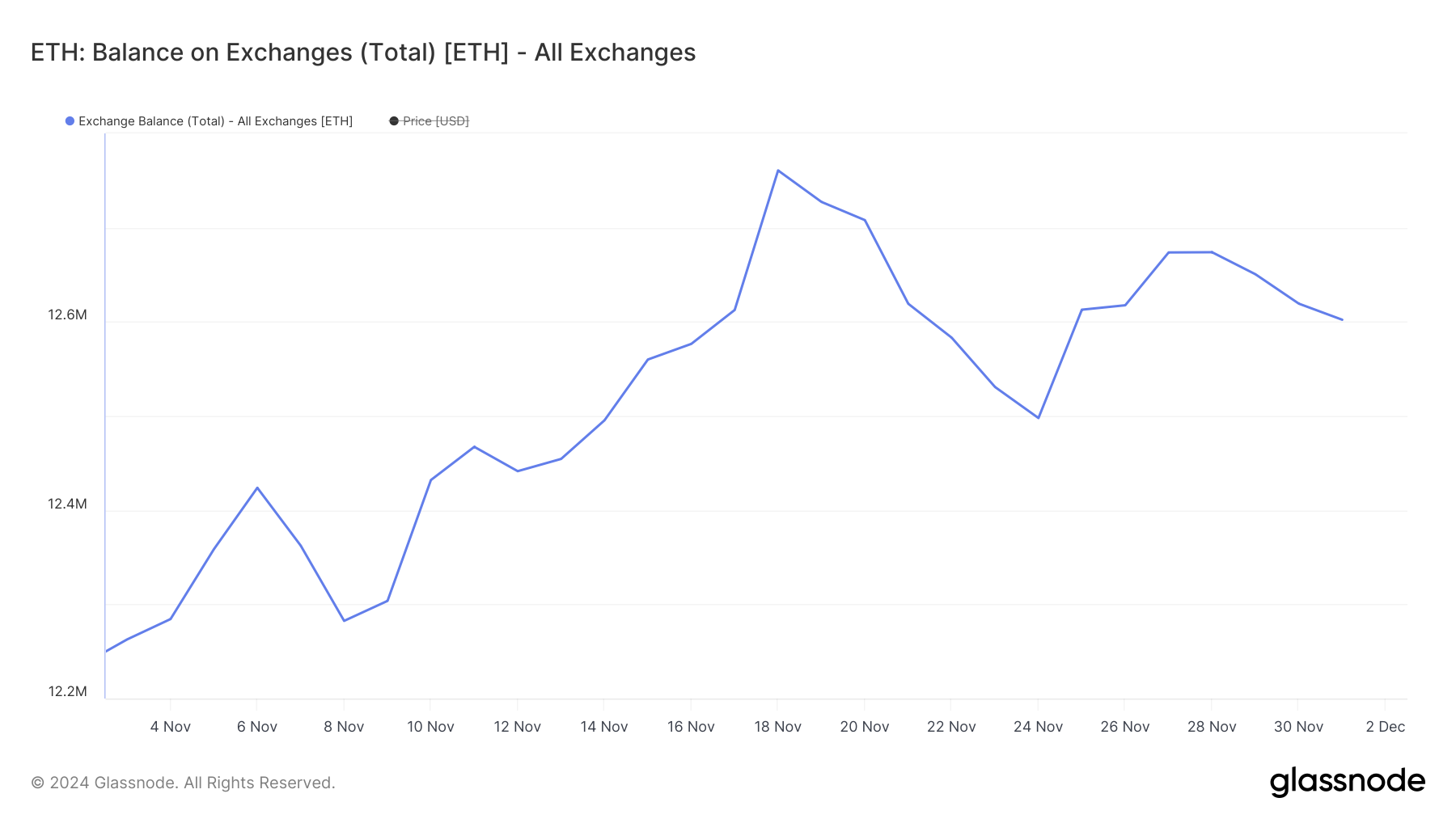

From November 3rd through November 18th, a notable increase was observed in the amount of Ethereum held on exchanges. This figure went up from approximately 12.2 million to around 12.7 million.

This increasing pattern shows more Ethereum being stored on markets where it can quickly be bought or exchanged. This action typically suggests a pessimistic outlook, as users might be readying themselves to sell their ETH due to market uncertainties or anticipation of prices dropping.

The decrease in Ethereum (ETH) held on exchanges, down to 12.6 million as of December 1, might indicate a change in investor attitudes. When individuals remove ETH from exchanges, it typically means they are less likely to sell the cryptocurrency.

Storing Ethereum for the long term is typically seen as a positive or optimistic action, suggesting that owners expect its value to rise over time. This could potentially indicate increasing faith in Ethereum’s pricing trend.

Whales Are Accumulating ETH Again

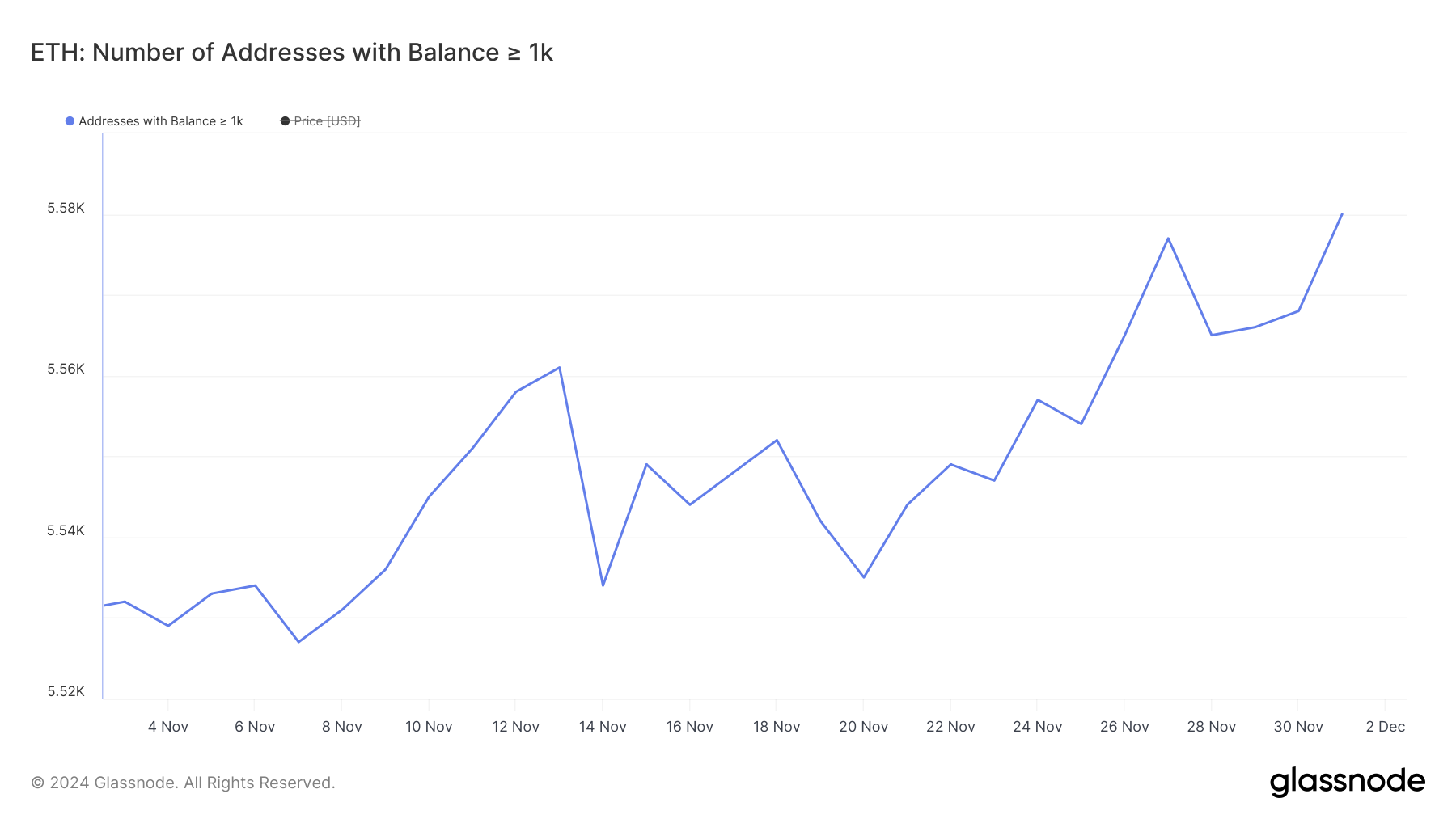

As a researcher, I’ve observed a resurgence in Ethereum hoarding by the whales towards late November, with substantial activity kicking off on November 20th. This pattern of accumulation is noteworthy, as it suggests renewed enthusiasm from large-scale investors who hold enough power to potentially sway market dynamics.

This type of action frequently captures the interest of market players, since the activities of whales (large investors) may signal strategic decisions influenced by their predictions about future price trends.

Monitoring Ethereum (ETH) whales is essential because their holdings and trading activities can substantially influence the market. An increase in the number of whales, as observed from 5,535 on November 20 to 5,580 – its highest level since October 13, indicates a high level of confidence among significant players.

The buildup of Ethereum could potentially signal a rise in its price, as large investors (whales) often maintain long-term investments, which decreases the available supply and pushes prices up due to increased demand.

ETH Price Prediction: A Potential 10% Correction?

As an analyst, I’m observing a bullish trend in Ethereum’s Exponential Moving Averages (EMA), where the short-term averages are hovering above their long-term counterparts, indicating a generally positive market sentiment. However, a recent dip below the shortest EMA indicates a potential temporary loss of immediate price momentum.

This suggests caution, as a slow recovery of the price might point towards a potential reversal or downturn in the upward trend.

Should Ethereum’s upward momentum regain its vigor, it may challenge significant resistance at approximately $3,688 and $3,763. Overcoming these barriers could potentially propel the Ethereum price towards $4,000, a level not observed since late December 2021, suggesting a robust bullish recovery.

Conversely, should the short-term Exponential Moving Average (EMA) continue to drop and a downward trend materializes, the price of Ethereum might experience a dip down to approximately $3,255. This potential adjustment represents a possible 10% decline in value.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-12-02 23:00