As a seasoned crypto investor with a decade of experience navigating the volatile digital asset landscape, I find myself intrigued by Ethereum‘s current predicament. The repeated failure to close above the $4,000 mark is reminiscent of my early days in crypto, where psychological levels often proved to be formidable obstacles. However, the recent accumulation by whales holding tens of thousands of ETH offers a glimmer of hope.

Ethereum’s value has had difficulty breaking and staying above $4,000 twice during the last six months. Even though it came close to this significant psychological threshold, Ethereum didn’t hold its ground, suggesting a more robust bullish belief is needed to drive the price beyond this hurdle.

If Bitcoin can’t maintain prices above $4,000, it seems that investors are showing caution and may be cashing out their profits, which could be contributing to the slowdown in its upward trend.

Ethereum Whales Accumulate

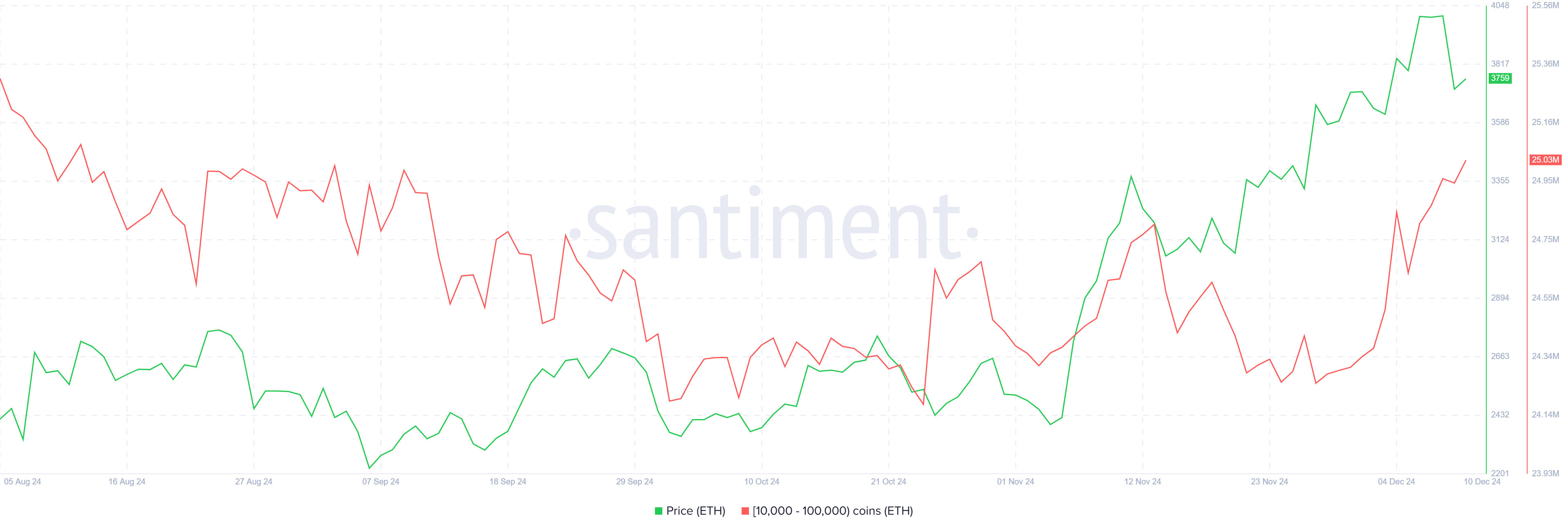

Large Ethereum wallets containing anywhere from 10,000 to 100,000 ETH each, have been actively buying Ethereum over the last five days, amassing a total of approximately 400,000 ETH worth over $1.5 billion. This substantial purchase activity underscores the belief of these big investors in Ethereum’s future potential growth.

Whale purchases underscore Ethereum’s allure as a promising investment option. Even though it has been difficult for Ethereum to break the $4,000 mark lately, these substantial acquisitions indicate that institutional and wealthy investors remain unfazed by temporary market fluctuations.

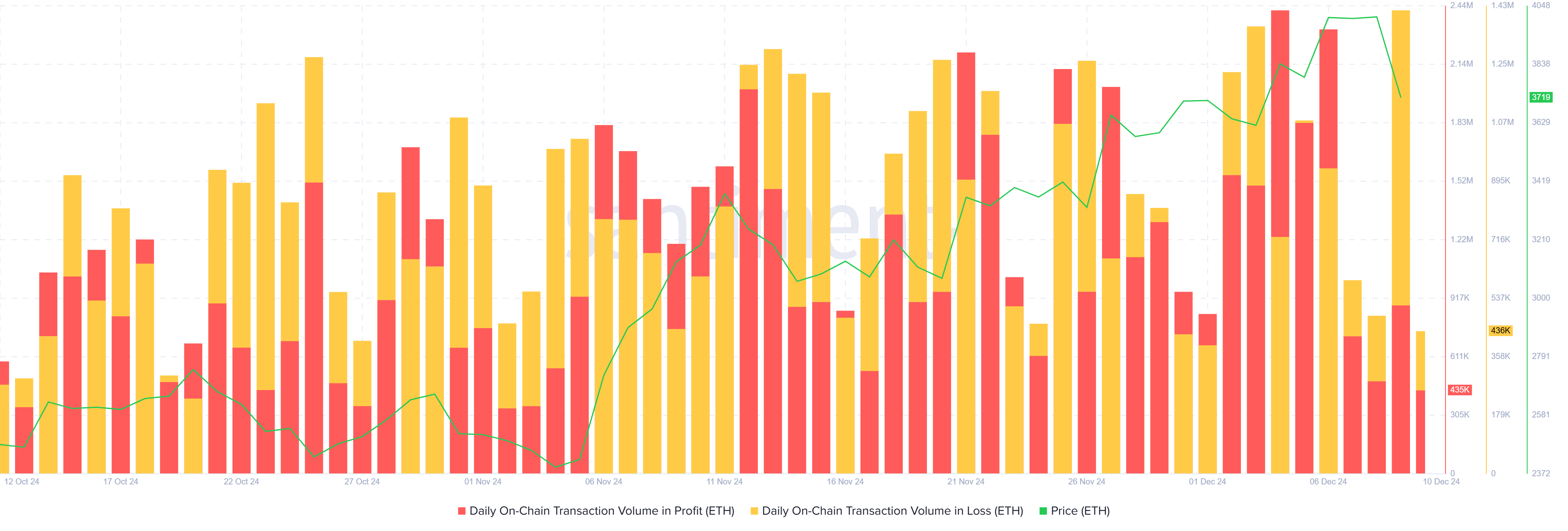

The distribution of transactions on Ethereum shows that most are profitable compared to those losing money, implying that many Ethereum owners are enjoying gains. This trend increases the possibility of people cashing out their profits, which might lead to temporary selling spikes, potentially causing a drop in Ethereum’s price.

The dominance of profitable transactions also indicates that Ethereum has a large number of investors with a vested interest in securing returns. While this reflects healthy market activity, it also means that the risk of price corrections remains elevated. Profit-taking, especially after a strong rally, could hinder Ethereum’s ability to break through the $4,000 barrier and sustain its growth trajectory.

ETH Price Prediction: Decline or Recovery

Yesterday, Ethereum’s price saw a 7% decrease and is currently being traded at around $3,761. The leading altcoin is trying to establish $3,721 as a support level to prevent any additional drops. This critical point will help decide if Ethereum can sustain its bullish trend or face a more significant retreat in the upcoming days.

To surpass $4,000, Ethereum first needs to fortify itself at approximately $3,721. If successful, Ethereum might achieve a fresh yearly peak that surpasses $4,093. This upward trend could also pave the path for Ethereum to establish new record highs, further bolstering its optimistic forecast.

Should Ethereum not hold its ground above $3,721, it might slide towards $3,524. A continued fall could push Ether down to $3,327. In such a scenario, the bullish argument would weaken, potentially leading to a larger market correction.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Summer Game Fest 2025 schedule and streams: all event start times

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

2024-12-10 18:38