As a seasoned analyst with over two decades of experience in both traditional and digital markets, I have seen my fair share of bull runs and bear markets. The current situation with Ethereum (ETH) seems to be a challenging one, but the recent 5% price surge offers a glimmer of hope.

Over the past few days, Ethereum’s (ETH) price has found difficulty in surpassing $4,000 again, a struggle which has sparked discussions among investors about whether or not ETH will manage to reach this level before the end of 2024.

Yet, the recent 5% price hike over the past 24 hours could indicate a potential change in investor sentiment. For Ethereum to reach its previous $4,000 level again, certain crucial elements need to fall into place. Here’s what we should expect:

Ethereum Holders Get Set to Break the Hurdle

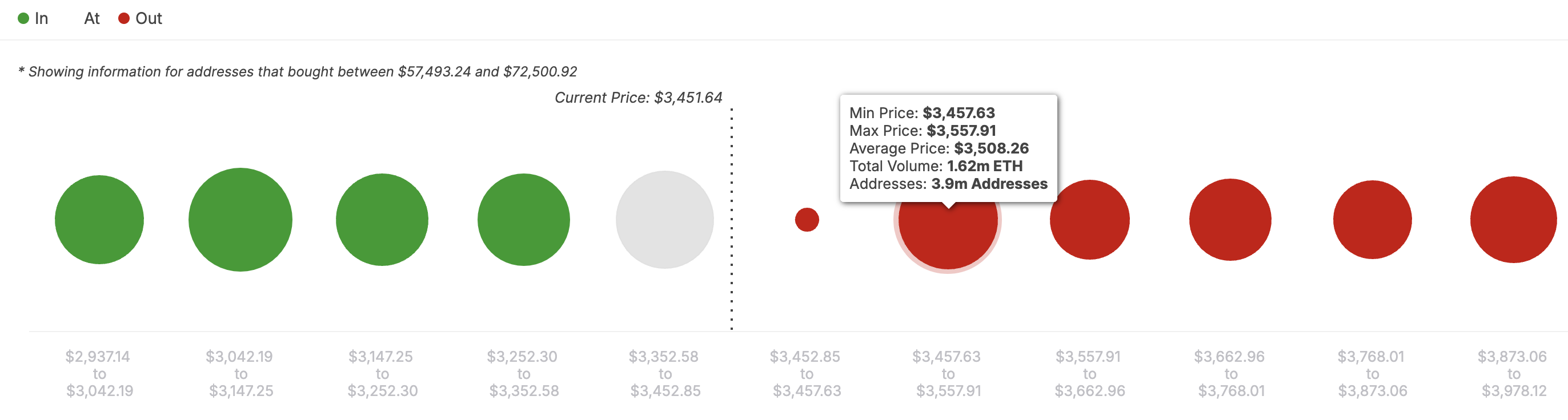

Based on the In/Out of Money Around Price (IOMAP) analysis, the Ethereum price currently finds robust support at approximately $3,352. This level indicates that over 3.34 million Ethereum holders collectively own around 3.18 million coins, and are all in a profitable position.

In simpler terms, the IOMAP (Interactive Order Matching and Aggregation Protocol) organizes addresses according to their potential profits, losses, or break-even points. The more significant the quantity or addresses within a profit-taking or accumulation range, the greater the support or resistance level becomes. Consequently, larger volumes outside the money point towards stronger resistance, while larger volumes within the money suggest stronger support.

According to the data shown, the primary obstacle for Ethereum’s price to exceed is at approximately $3,508. This is due to around 3.9 million Ethereum holders collectively acquiring about 1.62 million ETH. If buying demand continues to grow, it could potentially push the cryptocurrency past this barrier and closer to trading around $4,000.

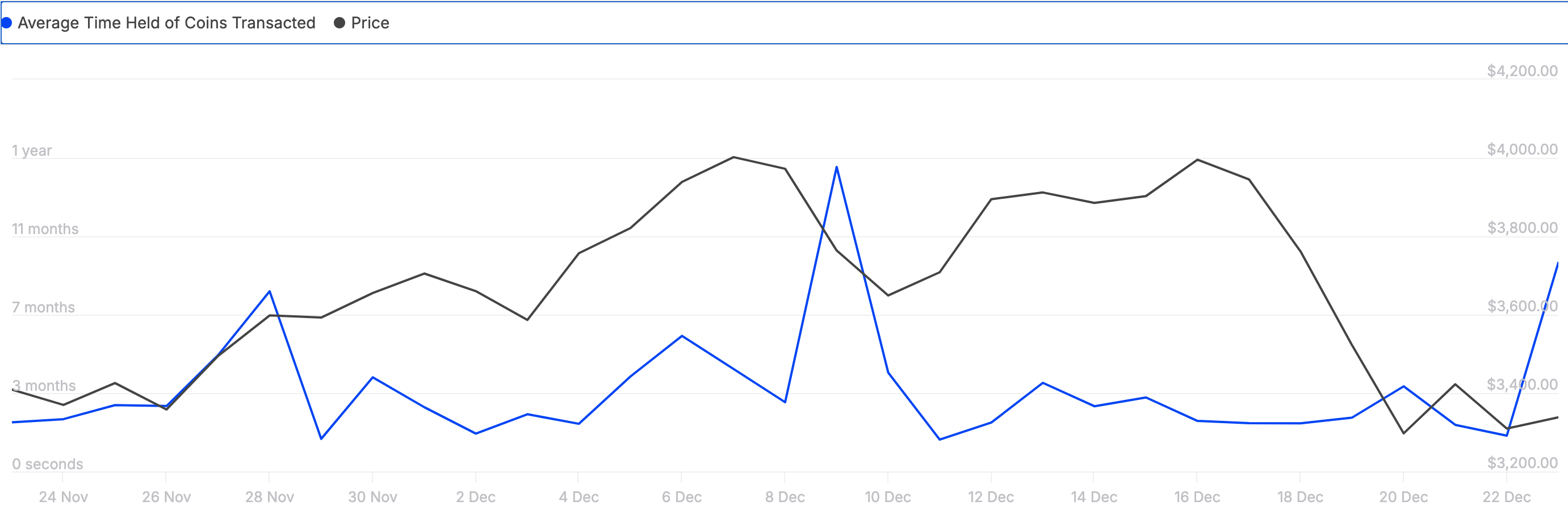

One method of rephrasing this statement could be: The duration a cryptocurrency is kept without being sold or traded, known as Coin Holding Time, provides another piece of evidence pointing towards a bullish outlook.

As the length of time assets are held increases, this suggests that investors have chosen not to sell for a longer period. Conversely, if the holding time shortens, it typically means that investors are unloading their assets.

According to information from IntoTheBlock, the length of time people are holding onto Ethereum has grown by an impressive 332% over the past week. If this upward trend persists, it could lend credence to the bullish arguments about Ethereum that have been discussed previously.

ETH Price Prediction: Higher Values Soon?

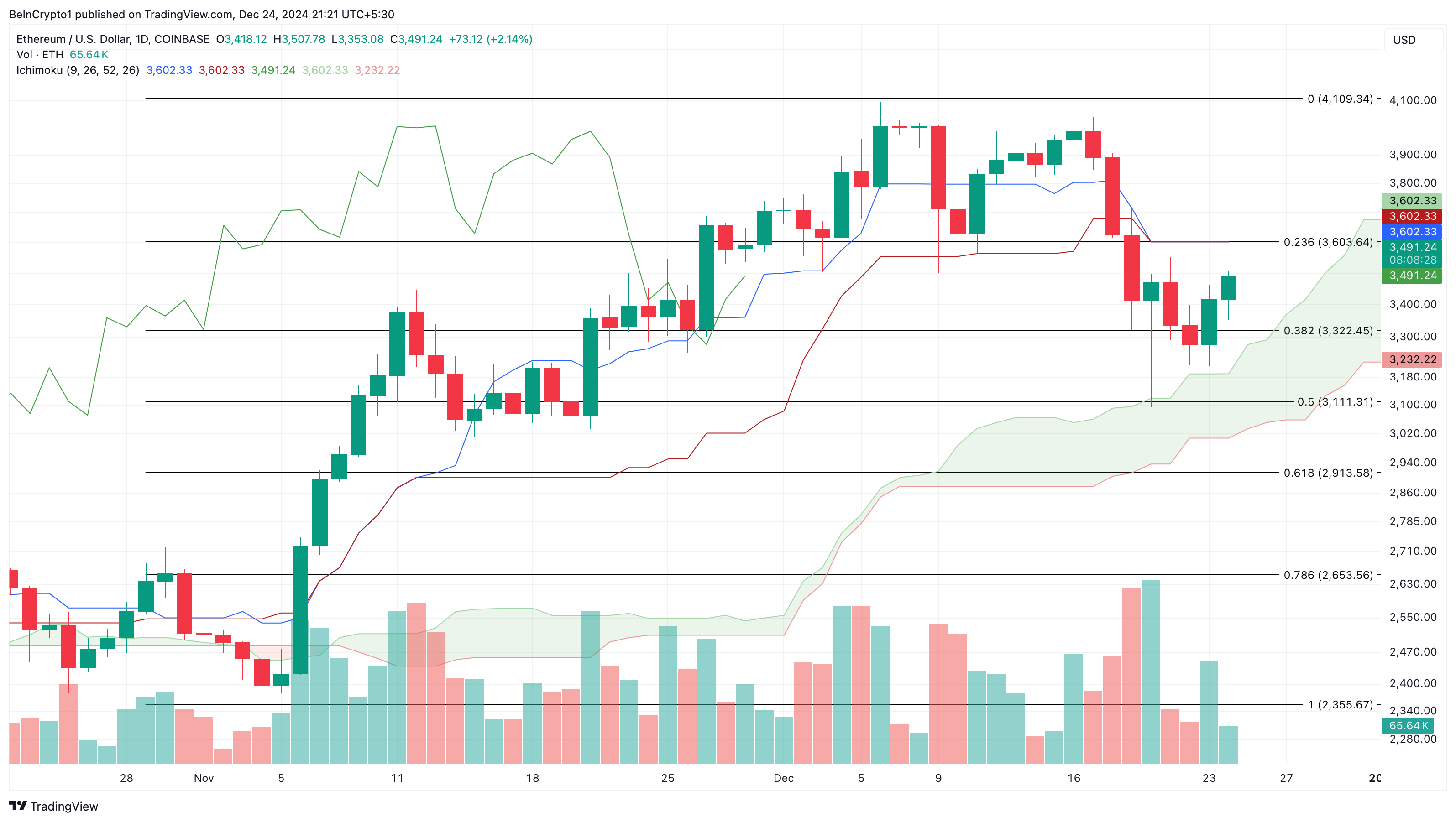

Looking at its technical aspects, Ethereum (ETH) has moved beyond the Ichimoku Cloud’s upper boundary. This Ichimoku Cloud tool helps identify potential support and resistance levels. When the cloud floats above the current price, it generally suggests a level of resistance.

When ETH’s price surpasses its cloud level, it suggests potential support, which may propel the price upward. As a result, there’s a possibility that the ETH cryptocurrency’s value could escalate to $4,109. If the bulls manage to maintain the price above $4,000, it could potentially increase to as high as $4,500.

If bears were in control, it’s possible that Ethereum’s price wouldn’t remain as high. Under such circumstances, the price could dip to around $3,111. If selling pressure increases significantly, the price may even fall below $3,000.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2024-12-25 04:26