As a seasoned crypto investor with over five years of experience under my belt, I find myself both encouraged and cautious regarding Ethereum‘s current position. The 48% YTD gain is impressive, yet it pales compared to Bitcoin‘s stellar performance this year. However, the recent uptrend seems to be losing steam as indicated by the weakening ADX trend strength, which serves as a reminder that even the mightiest bull runs must take a breather.

2024 has seen Ethereum (ETH) surge by a substantial 48.19%. However, it’s important to note that Bitcoin (BTC) has outperformed ETH with a remarkable 123% increase this year. Despite Ethereum’s impressive growth, its upward trend seems to be slowing down as the ADX suggests a decrease in trend strength.

Whales have been amassing increased amounts of Ether (ETH), reaching the highest number of significant holders since September. The resistance level at approximately $3,523 will play a pivotal role in deciding if ETH can continue its upward trend toward $4,100 or potentially face a reversal and retest lower support zones.

ETH Uptrend Is Still Strong, But It Could Be Losing Its Steam

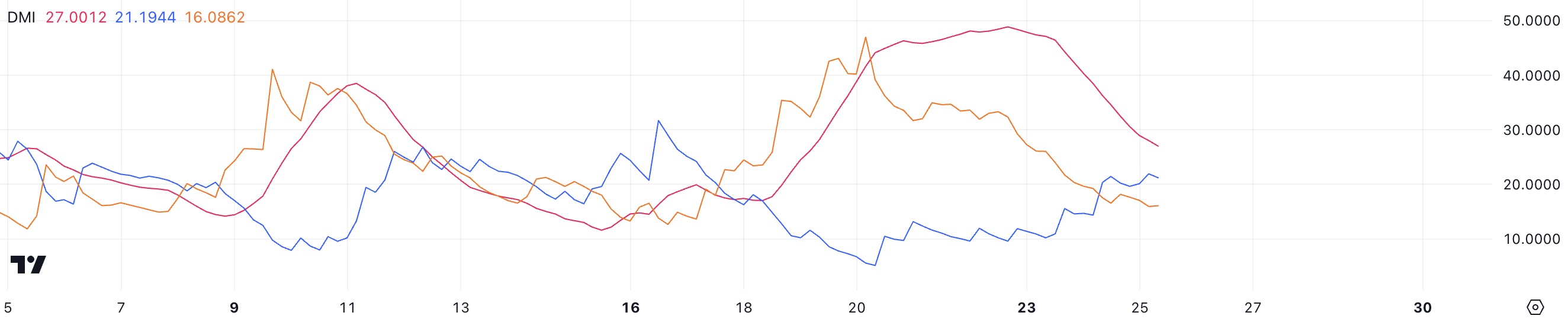

The Ethereum Directional Movement Index (DMI) chart reveals that its Average Directional Index (ADX), which measures the strength of the trend, has dropped significantly from 46 to 27 within two days. This decrease suggests that the strong upward movement of ETH in recent days may be losing momentum, despite a period of price consolidation following a 9% increase over the last three days.

Although the Average Directional Index indicates a decrease in momentum, the Positive Directional Indicator at 21.1 is significantly greater than the Negative Directional Indicator at 16, implying that buying force continues to dominate over selling activity, albeit with less vigor compared to earlier periods.

The ADX (Average Directional Movement Index) is a popular tool that quantifies the intensity of a market trend, ranging from 0 to 100 regardless of its direction. A reading above 25 signifies a robust trend, whereas a value below 20 suggests a weak or non-existent trend.

As an analyst, I find myself observing Ethereum’s ADX standing at 27, indicating a moderately strong ongoing uptrend. However, the downward trend in its value suggests a temporary halt in momentum, as the market appears to be consolidating. This could imply that the price of ETH is finding stability, perhaps paving the way for the uptrend to continue or for a change in sentiment if sellers start gaining ground.

Ethereum Whales Just Reached Its Highest Level Since September

The count of whales owning at least 1,000 Ether has hit its peak since September, standing now at 5,631. This represents a rebound from the 5,565 recorded on November 26, indicating growing interest and amassing among significant investors.

An increase in whale activity suggests that major investors are becoming more confident, which is typically seen as a positive sign for the future direction of Ethereum’s price.

Monitoring the behavior of whales (large investors) is important as they possess massive stakes that have the potential to impact market movements considerably. A rise in the number of whale accounts usually indicates that they are stockpiling, a situation that could contribute to price consistency or initiate bullish trends.

Since September, there has been an increase in the number of major Ethereum investors (referred to as “whales”). This accumulation may indicate that these large investors are preparing for possible price increases, suggesting a positive outlook in the near future. The growing interest from whales could serve as a base for Ethereum’s price to remain robust or potentially climb higher if this trend persists.

ETH Price Prediction: The Closest Resistance Is Fundamental

For Ethereum’s immediate price fluctuations, the current resistance at $3,523 holds significant importance. Should this barrier be surpassed, we might see Ethereum reaching towards $3,763 in the near future.

If the positive trend remains strong, Ethereum’s price might keep rising towards $3,987 and even challenge prices near $4,100 once more, indicating a robust continuation of its upward trajectory.

If ETH doesn’t manage to surge past $3,523, there’s a possibility it might experience a drop instead, touching the support level at $3,256.

Should the current support fail, it’s possible that the Ethereum (ETH) price could decrease more, potentially reaching around $3,096. This suggests a rise in selling activity.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- PENGU PREDICTION. PENGU cryptocurrency

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2024-12-26 00:35