As a seasoned researcher with years of experience tracking the cryptocurrency market, I find myself intrigued by Ethereum’s performance this cycle. While ETH‘s 32% year-to-date growth is nothing to sneeze at, it pales in comparison to Bitcoin and Solana’s impressive gains. It seems that Ethereum’s days as the undisputed second fiddle in the crypto world may be numbered.

This cycle, Ethereum (ETH) hasn’t been able to match the pace of other significant cryptocurrencies in terms of price increase. Despite a 32% rise so far this year, ETH trails significantly behind Bitcoin‘s 112% and Solana’s 115% growth. Among the top ten coins, Ethereum has shown the least expansion, only surpassing Avalanche in terms of performance.

This subpar showing of ETH suggests increasing apprehension among investors, with indicators such as whale transactions and overall exchange inflows pointing towards a hesitancy to invest in Ethereum.

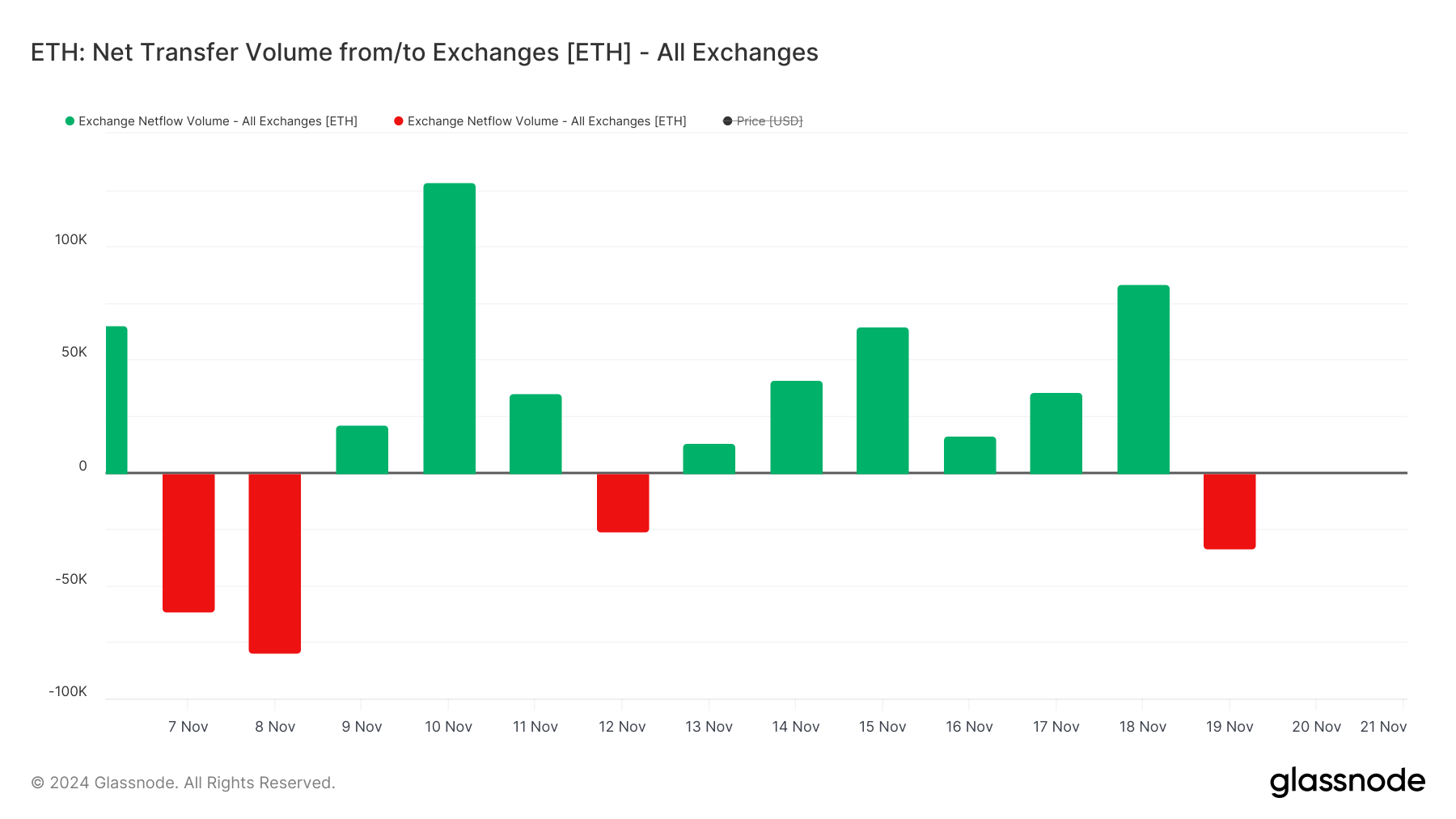

ETH Net Transfer Volume Was Positive for 6 Consecutive Days

In the past few weeks, there have been significant ups and downs in the amount of Ethereum moving between exchanges and other locations. Specifically, from November 13th to November 18th, the net flow (the difference between the amount going out and coming in) was positive throughout this period, reaching a high of 83,500 on November 18th.

Two weeks ago, it peaked at 128,000 on November 10. But since then, on November 19, the direction changed and the rate dropped to -33,400.

Transferring large amounts of Ether (ETH) to exchanges frequently suggests a bearish attitude, because users might be planning to sell. On the other hand, withdrawing ETH from exchanges could indicate a bullish trend, as owners usually hold their assets in personal wallets with the intention of long-term investment.

Although there was an outgoing flow on November 19th, this came after six straight days of inflows. This implies that while the current decrease could be a positive indication, it’s the prolonged outflows that are required for the trend to strongly indicate a bullish signal for the Ethereum price movement.

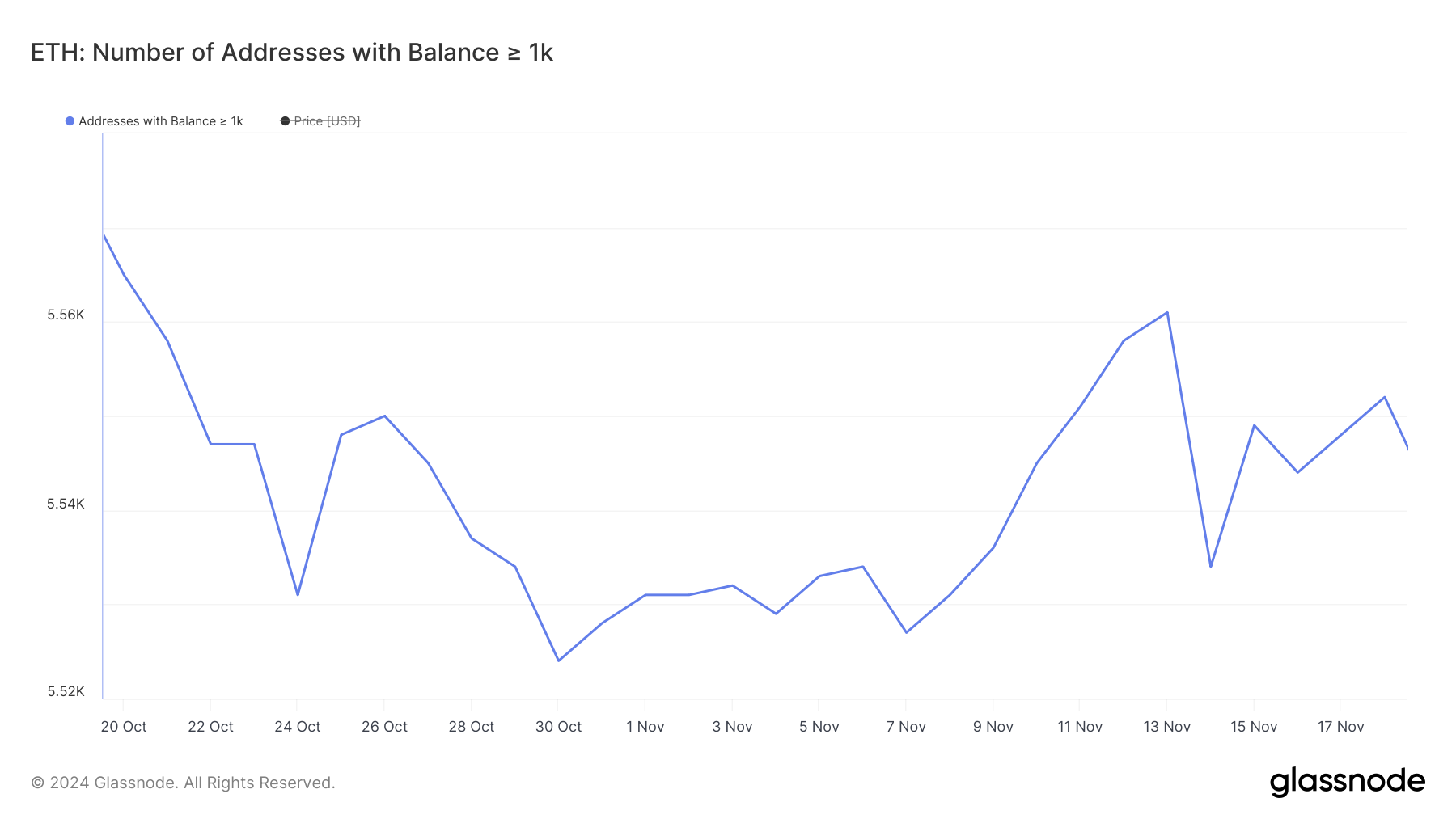

Ethereum Whales Appear To Be Hesitant

Between November 7th and November 13th, the number of Ethereum investors holding at least 1,000 ETH noticeably increased, rising from 5,527 to 5,561. This substantial growth indicates a strong phase of accumulation by large-scale investors, implying elevated interest during that specific time period.

As a crypto investor, I’ve noticed a significant dip on November 14th, with the number plunging to 5,534. Since then, it’s been an uphill battle to regain momentum, as we currently hover around 5,542. The continuous fluctuations suggest that there’s still a degree of doubt among the whales, their reluctance hinting at uncertainty regarding Ethereum’s potential for immediate price spikes.

ETH Price Prediction: A Correction or a 15% Upside?

In simpler terms, Ethereum’s temporary moving averages (EMA) are still higher than its long-term ones, but the difference between them is becoming smaller. If the short-term EMA drops below the long-term one, it would create what’s known as a “death cross,” which is a bearish indicator suggesting a potential stronger decline may follow.

Should Ethereum experience a downward trend, it might find its next strong support around $2,990. If it breaks through this point, there’s a possibility of additional drops, potentially taking the price down to approximately $2,570.

Instead, if whales regain their trust in ETH, it could potentially boost its price. This situation may initially cause the price to challenge the resistance level at $3,219, followed by an upward trend that might take it as high as $3,448, implying a possible gain of approximately 15%.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2024-11-20 20:27