As a seasoned analyst with over a decade of experience in the cryptocurrency market, I have witnessed numerous price swings and trends across various digital assets, including Ethereum. The recent surge in ETH is intriguing, and while it’s still early days, the technical indicators suggest that bullish momentum could be building.

The Relative Strength Index (RSI) at 56.2 indicates a steady recovery from oversold conditions, hinting at a possible mild upward movement in ETH price. However, the Average Directional Index (ADX), while showing a crossover of the +DI over the -DI and increasing buying pressure, remains weak, suggesting that the trend is not yet firmly established.

If Ethereum manages to break above the critical resistance at $3,523, we could see significant gains towards $3,827 and potentially $3,987 in the short term. On the other hand, if the current momentum fails to sustain, ETH may revisit support at $3,300 before possibly dipping further.

My advice would be to keep a close eye on Ethereum’s price action over the next few days. If the trend strength strengthens, it could be an excellent opportunity for long-term investors and traders alike. But remember, cryptocurrency markets can be unpredictable, so always do your research and never invest more than you’re willing to lose.

And as a final note, I’ve learned in my years of analyzing crypto that the market often throws us curveballs when we least expect it – like when Bitcoin suddenly decided to start accepting dogecoin as payment for pizzas back in 2013! So keep your eyes peeled for any unexpected twists and turns.

Ethereum (ETH) has seen a 3% increase in price within the past day, suggesting it’s on the road to recovery as the year comes to a close. Unlike Solana and Bitcoin, Ethereum failed to set a new record high in 2024, which were reached by its counterparts instead.

As a crypto investor, I’m noticing some positive signs that could indicate a growing bullish trend. Technical indicators like RSI and DMI are pointing towards an increase in momentum, with Ethereum approaching a significant resistance level at around $3,523. Whether ETH manages to push through this resistance or gets pulled back to retest its lower support levels will greatly influence its short-term price direction.

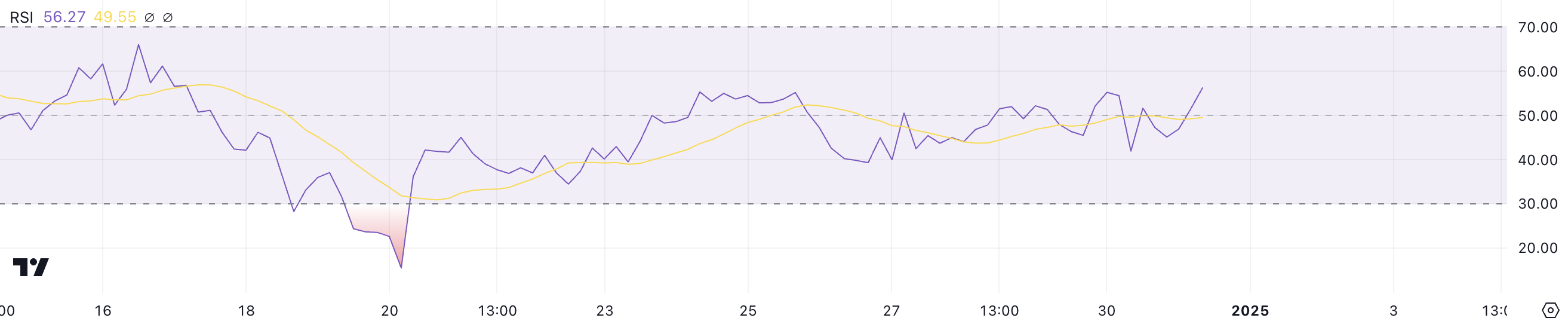

ETH RSI Is Going Up

The Ethereum Relative Strength Index (RSI) stands at 56.2 now, suggesting a steady recuperation since it fell below 20 on December 20th. This recovery suggests that buying demand has been growing steadily, moving Ethereum out of oversold territory and into an area that’s neutral to slightly bullish.

A Relative Strength Index (RSI) of 56.2 indicates that the momentum is tilting towards the optimistic end, suggesting a potential modest increase in the Ethereum (ETH) price as it becomes more stable.

The Relative Strength Index (RSI) is a tool used to assess the rate and intensity of price fluctuations, ranging from 0 to 100. When the RSI exceeds 70, it typically indicates that an asset is overbought, which might lead to a price decrease (potential pullback). Conversely, when the RSI falls below 30, it usually means the asset is oversold, possibly indicating an upcoming increase or recovery.

Currently, Ethereum’s Relative Strength Index (RSI) stands at 56.2, placing it in a relatively neutral position yet poised to move into bullish territory soon. This situation could hint at the potential for modest increases in ETH’s value in the near future. However, with weak momentum present, substantial growth may be restrained unless buying pressure continues to escalate.

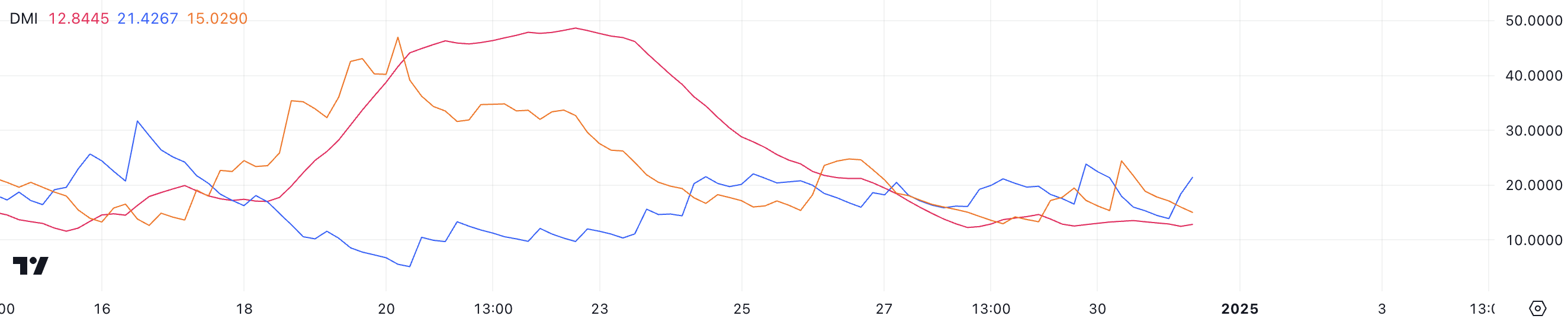

Ethereum DMI Hints at Bullish Shift

The ETH DMI chart shows that its ADX value is presently 12.8, and it has been under 20 since December 27. A low ADX number like this indicates that the current trend’s strength is relatively weak, meaning there isn’t a lot of strong momentum pushing prices in either direction at the moment.

Yet, the latest instance of the +DI surpassing the -DI, where the +DI climbed up to 21.4 and the -DI remained at 15, suggests that buying activity has begun overpowering selling activity. This arrangement hints at the initial phase of a possible upward trend, yet the low ADX value indicates that the trend is not yet strongly defined.

The Average Directional Index (ADX) is a tool that gauges the intensity of a market movement, whether it’s going up or down, ranging from 0 to 100. A score above 25 signifies a robust trend, whereas readings below 20 hint at a weak or non-existent trend. The +DI (Directional Indicator) monitors buying activity, while the -DI focuses on selling activity.

As the Plus Directional Indicator (or +DI) surpasses the Minus Directional Indicator (or -DI), a positive momentum for Ethereum (ETH) is developing. Yet, to ensure that ETH’s upward trend gains significant force, the Average Directional Index (ADX) needs to exceed 20, indicating a stronger trend momentum. In the immediate future, ETH might witness incremental increases; however, consistent growth relies on an enhancement of overall trend power.

ETH Price Prediction: A Potential 16% Upside

Should a robust upward trend emerge, the Ethereum price might challenge the resistance level at $3,523, which would represent a notable achievement in its ongoing recovery process.

If Ethereum (ETH) surpasses its current level, it might open up opportunities for more growth, with potential milestones at approximately $3,827 and possibly $3,987 – levels ETH last encountered on December 17th.

Based on my personal experience observing the cryptocurrency market for several years now, I have learned to always be prepared for unexpected price movements. If the current momentum doesn’t build a solid uptrend, I would not be surprised if Ethereum revisits its support level at $3,300. This level was tested by Ethereum on December 27 and 30 last year, and given the market’s volatility, it could potentially happen again. As someone who has seen numerous price fluctuations in this space, I always make sure to keep a close eye on support levels like these to protect my investments.

If we can’t maintain this level of support, it might result in additional drops. Potential future price points could be around $3,218 and $3,096.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2024-12-31 20:33