In just the past day, Ethereum (ETH) has seen a significant drop of almost 8%, bringing it close to losing its massive $400 billion market capitalization. This downward trend has led to ETH’s Relative Strength Index (RSI) falling to 27.1, which is its lowest since December 20, suggesting that the market is oversold and investor sentiment is weak.

The ADX signal suggests a robust downward trend at present, driven largely by negative momentum since the -DI has exceeded the +DI. If this downward trend persists, Ethereum may encounter crucial support points; however, a shift in trend could see it attempting to breach resistance and recover its upward thrust.

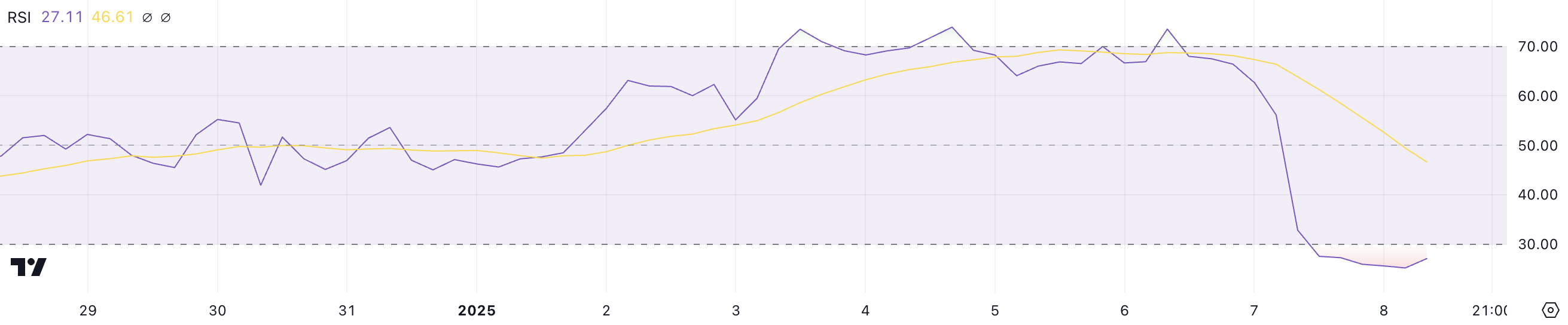

Ethereum RSI Reached Its Lowest Level Since December 20

In simpler terms, the Relative Strength Index (RSI) for Ethereum has significantly decreased from 66.3 to 27.1 in a single day. The RSI is a technical tool that evaluates the rate and intensity of price changes, ranging between 0 and 100.

Generally speaking, if a value is over 70, it suggests an ‘overbought’ state, which could lead to a reversal or pullback. On the other hand, values below 30 are considered ‘oversold’, often signaling a potential recovery. The Relative Strength Index (RSI) for ETH currently stands at 27.1, its lowest level since December 20, demonstrating strong bearish momentum and high selling pressure in the market.

At such heavily discounted price points, Ethereum’s Relative Strength Index (RSI) indicates that the current selling spree could be excessively aggressive, possibly setting up favorable circumstances for a recovery if demand returns.

Nevertheless, the significant drop indicates a lack of confidence in the market, potentially leading to further decreases if this trend continues.

OR

The big fall suggests that the market is feeling uncertain, which might result in more declines if the trend continues as it is.

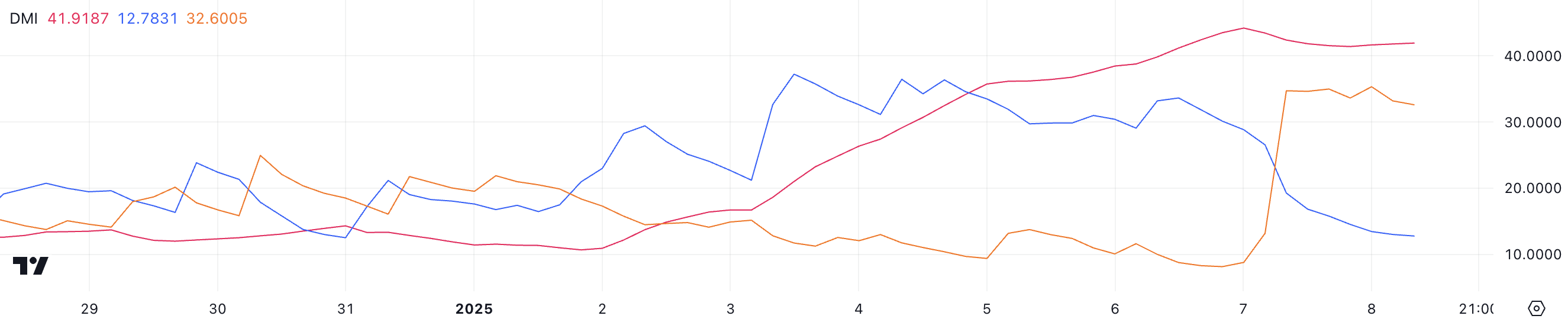

ETH DMI Shows the Downtrend Is Strong

The Ethereum Average Directional Index (ADX) stands at 41.9 right now, signifying a robust market direction. ADX is a technical analysis tool that gauges the intensity of any trend, regardless of its direction, on a scale ranging from 0 to 100. When the value exceeds 25, it indicates a powerful trend, while values less than 20 hint at weak or non-existent momentum.

As an analyst, I’ve noticed a consistent strengthening of Ethereum’s ADX trend since December 3, indicating that while the market direction remains bearish, the underlying momentum behind this trend is growing steadily and appears to be holding firm.

The buying pressure indicator (+DI) has significantly decreased from 33.6 yesterday to 12.7 now, suggesting a strong decline in bullish energy. On the flip side, the selling pressure indicator (-DI) has jumped up from 8.7 to 32.5, showing an increase in bearish control.

This setup indicates that the Ethereum (ETH) price is strongly moving downwards, as sellers are dominating the market. Should this downward movement continue, the price of Ethereum might see further drops unless a significant increase in buying activity emerges to combat the escalating bearish influence.

ETH Price Prediction: Death Cross Looms While $3,448 Resistance Holds Key

In simpler terms, when the Exponential Moving Averages (EMA) on Ethereum cross each other in a way that the short-term EMA falls beneath the long-term EMA, this is known as a “death cross.” This pattern is considered bearish because it suggests a potential downturn or further correction.

If the value of Ethereum (ETH) falls beneath its crucial support points at $3,297 and $3,096, there’s a possibility it could drop as low as $2,723 – representing a possible decrease of approximately 18.8%.

If Ethereum manages to maintain its position above important support levels and changes its downward trajectory, there’s potential for it to challenge the resistance at approximately $3,448. A successful breakthrough could then propel ETH towards $3,546, with further gains potentially taking it to $3,827.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2025-01-09 01:17