Ethereum (ETH) has seen a 6% increase in price over the last week, working to gather steam and potentially push toward the $4,000 mark. The recent appearance of a golden cross, along with a Relative Strength Index (RSI) at 63.6, suggests a possibility for further growth in the near future.

As a crypto investor, I’ve noticed a positive trend: Whale accumulation has picked up again, as the number of wallets holding at least 1000 Ether has bounced back after a temporary dip earlier this January. Currently, Ethereum is flirting with significant support and resistance levels. Whether it can continue its upward momentum or face a correction depends on its ability to maintain this bullish trend. This crucial factor will play a decisive role in whether Ethereum can keep up its rally or encounter a reversal.

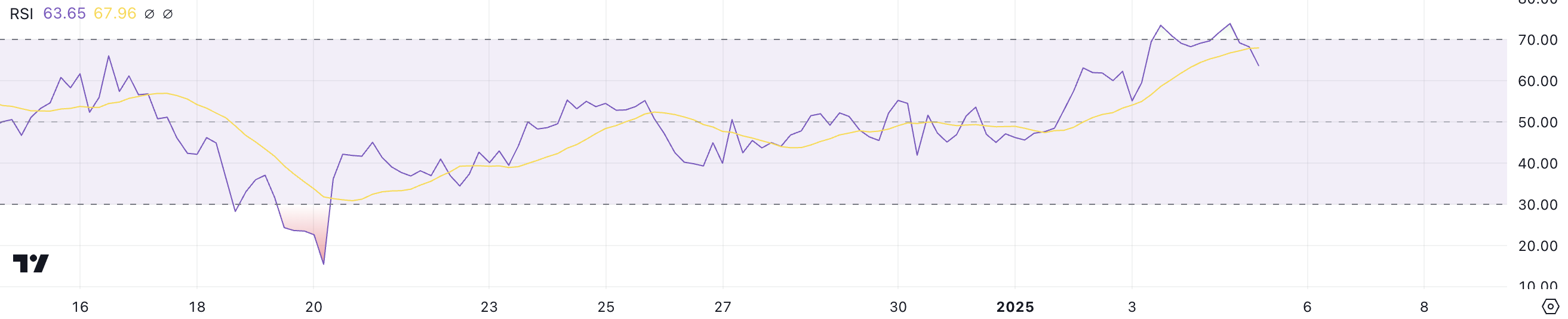

ETH RSI Is Down From 70

The Ethereum Relative Strength Index (RSI) is presently at 63.6, having momentarily exceeded the overbought zone of 70 during January 3 and 4. This RSI tool evaluates how quickly and intensely prices are moving, ranging from 0 to 100, giving us an idea about market momentum.

Readings exceeding 70 suggest the market is overbought, hinting at a possible correction, whereas readings less than 30 imply an oversold situation, suggesting potential price growth. At present, Ethereum’s RSI falls below 70, indicating that buying pressure has decreased but bullish tendencies are not entirely absent.

In simpler terms, the Relative Strength Index (RSI) of Ethereum (ETH) at 63.6 indicates a mostly optimistic view for the immediate future. As it pulls back from overbought territory, this could mean that ETH is entering a period of stabilization or slight adjustment as traders collect their earnings.

Nevertheless, the Relative Strength Index (RSI) remains steadily above 50, which indicates ongoing buying interest. If the RSI climbs back up towards 70, Ethereum may experience a resurgence in upward movement. Conversely, if it falls below 50 again, this could suggest a weakening of bullish sentiment, possibly triggering a broader price correction.

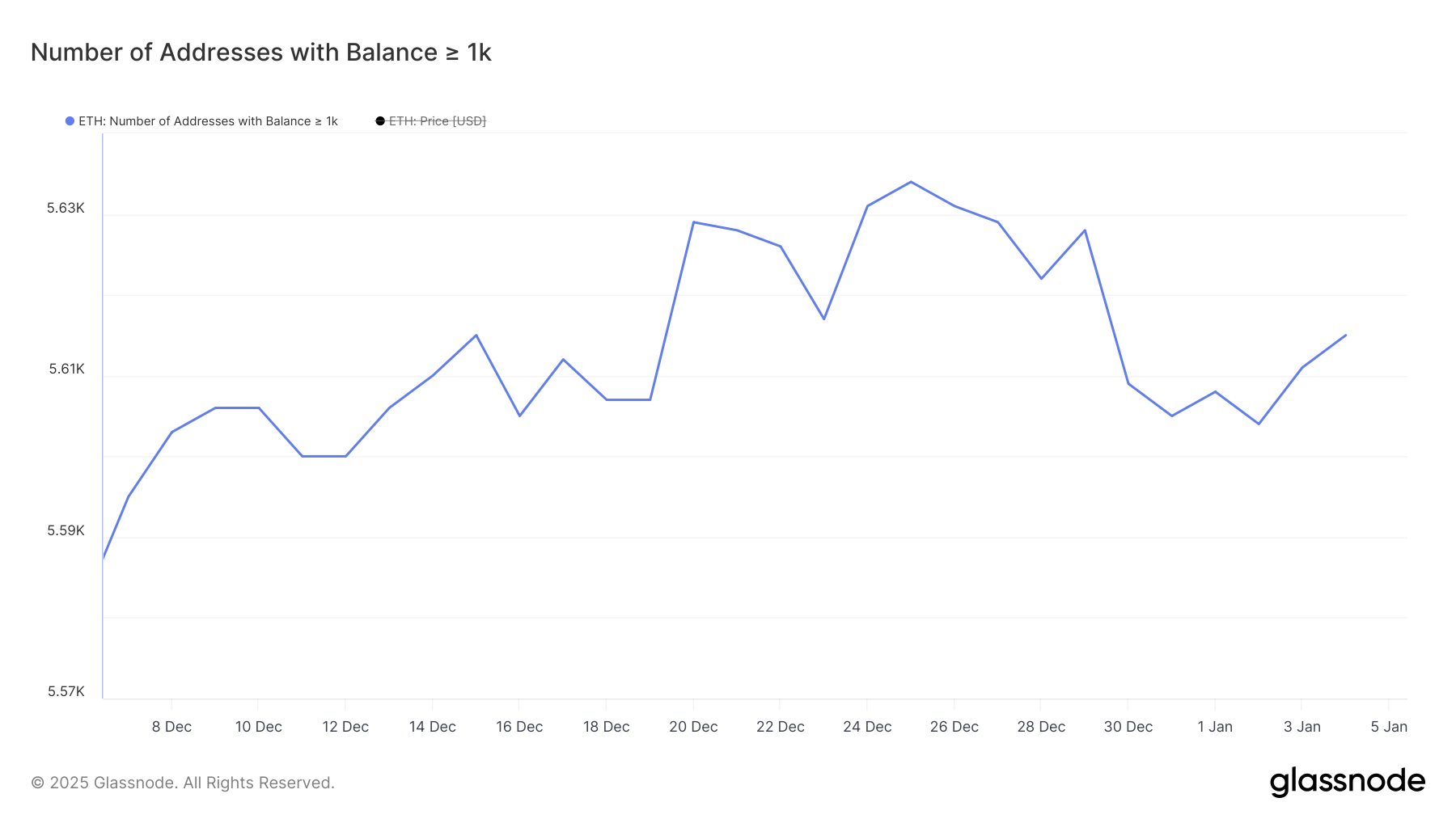

Ethereum Whales Are Accumulating Again

On December 25, the count of Ethereum investors holding over 1,000 ETH hit a monthly peak of 5,634. However, this number dropped slightly to 5,604 by January 2. Monitoring whale activity is essential because these substantial investors can significantly impact market movements.

A rise in the number of whales (large investors) holding an asset typically suggests increasing trust and could lead to price escalation. Conversely, a decrease might suggest decreased investor interest or heightened selling activity.

Following a rise to 5,604 on January 2, the whale count has increased once more and currently sits at 5,615. This uptick in whale behavior indicates growing investor enthusiasm, potentially bolstering the Ethereum price in the near future.

If the increase in large-scale ETH holdings persists, it may suggest increasing investor trust and escalating purchase demand, possibly driving additional price increases. On the other hand, a decrease in significant ETH holdings might hint at uncertainty among key investors, which could dampen ETH’s momentum.

ETH Price Prediction: Will the $3,543 Support Hold Strong?

Recently, the price of Ethereum created a ‘golden cross’ on January 4th, which is a positive sign that appears when the short-term moving average surpasses the long-term moving average. Although Ethereum’s price hasn’t experienced substantial growth since this event, the arrangement of these moving averages hints at possible future increases in value.

If the upward trend continues, bolstered by Relative Strength Index (RSI) levels and increased whale activity, the ETH price might challenge the resistance at $3,827. Should it breach this level, it could potentially lead to additional growth, with a potential target of $3,987 in the near future.

If the support at $3,543 doesn’t hold, ETH could struggle to keep its upward trajectory. In this case, there might be more sellers than buyers, which could cause a shift in momentum. Under such circumstances, ETH may revisit lower price points, with significant potential supports appearing around $3,300, $3,200, and $3,096.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-01-05 14:57