As a seasoned crypto investor with a knack for deciphering market trends and a penchant for Ethereum, I must admit that CryptoQuant’s prediction of ETH surpassing $5,000 has piqued my interest. Having weathered numerous bull and bear markets, I’ve learned to read between the lines of technical indicators, and the realization price upper band analysis seems to be pointing towards a promising future for Ethereum.

As a researcher delving into the intricacies of the blockchain world, I’ve recently come across an interesting prediction from CryptoQuant, a well-respected platform for analyzing cryptocurrency markets at an institutional level. According to their proprietary price band analysis, Ethereum (ETH) could potentially breach the $5,000 threshold.

A South Korean company, known for its data-driven insights for institutional investors and traders, uses a method called the “realized price upper band” to make predictions. This term refers to a technical indicator that needs careful explanation. The term “realized price” signifies the average price at which all Ether tokens were last traded on the blockchain, essentially reflecting the average cost basis of all ETH holders. This company then sets boundaries around this realized price, with the upper and lower bounds representing statistical limits for price movement based on past trading trends.

At the moment, the upper limit is set at around $5,200, which coincides with the high points reached during Bitcoin‘s 2021 bull run. The analysis conducted by this firm reveals three crucial levels: the upper limit at $5,200, the current trading price of $3,920, and a historical price level of $2,300. There is also a lower support band at $1,100. Based on their assessment of these price bands in conjunction with improving market conditions, CryptoQuant predicts a possible strong upward trend.

Ethereum (ETH) might surpass $5,000 as its demand and supply dynamics become more robust. The current upper price band of $5,200 resembles the level from the 2021 bull market high, suggesting a promising outlook for additional increases.

— CryptoQuant.com (@cryptoquant_com) December 13, 2024

2024 saw Ethereum’s price fluctuations and bounce-backs paint a captivating narrative of volatility and fortitude. As we look at the year-to-date graph, it’s evident that ETH has managed multiple substantial price changes, with the most striking increase happening in late November when the cryptocurrency breached the $3,500 threshold.

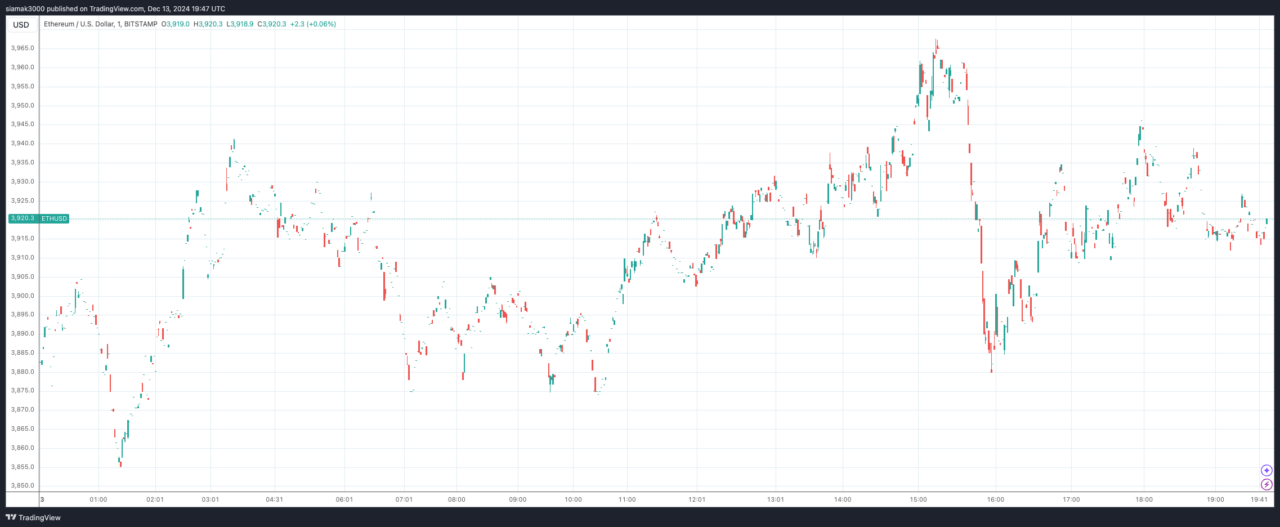

Today’s Ethereum trade (December 13) shows typical daily fluctuations around the $3,920 level. It peaked close to $3,965 during the late-afternoon trading period, but has since stabilized within a tighter band between approximately $3,910 and $3,925. This stability follows an overall uptrend that started early in the morning when the price rebounded from $3,870.

At present, the price level indicates a substantial rebound compared to the mid-summer slumps when Ethereum’s value dropped below $2,500 temporarily. Over the course of the year, it can be observed that although there have been occasional dips, Ethereum has generally trended upwards, with a particularly strong ascent in the last quarter of 2024.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Franklin Templeton’s 2025 Crypto Predictions: BTC Reserves, Crypto ETFs, and More

- ANDOR Recasts a Major STAR WARS Character for Season 2

- USD CAD PREDICTION

2024-12-13 23:10