As a seasoned crypto investor with scars from bull and bear markets etched deep into my trading psyche, I find myself cautiously optimistic about Ethereum‘s current rally. The price surge above $3,900 is indeed promising, but the on-chain analysis suggests that we may not be in the clear yet.

Once again, the price of Ethereum (ETH) has risen above $3,900. This bounce has hinted at a further price increase for the altcoin before the end of the year.

Could it be that the cryptocurrency will reach a new all-time high in such a brief span, according to this on-chain analysis? The analysis suggests if that might occur or not.

Ethereum Loses Bullish Dominance in Two Major Zones

At present, Ethereum is being traded at approximately $3939. This represents an impressive 67.30% rise in its value over the course of 2024. A significant factor contributing to Ethereum’s surge this year has been its Open Interest (OI).

In simpler terms, the Open Interest (OI) represents the total worth of all active contracts available in the market. When OI rises, it signifies that more funds are being poured into contracts related to a particular cryptocurrency. This trend in the derivatives market suggests growing demand or buying pressure, which might potentially drive up prices.

From another perspective, a drop in the Open Interest (OI) suggests an increase in selling activity. This decrease implies that traders are progressively winding up their trades and removing funds from the market.

Based on Santiment’s analysis, Ethereum’s Open Interest (OI) reached $14.50 billion on December 15th. However, as of now, it has dropped to $13.94 billion, suggesting that investors are less engaged with ETH. This decrease could potentially signal another price drop for Ethereum if the current level of Open Interest continues.

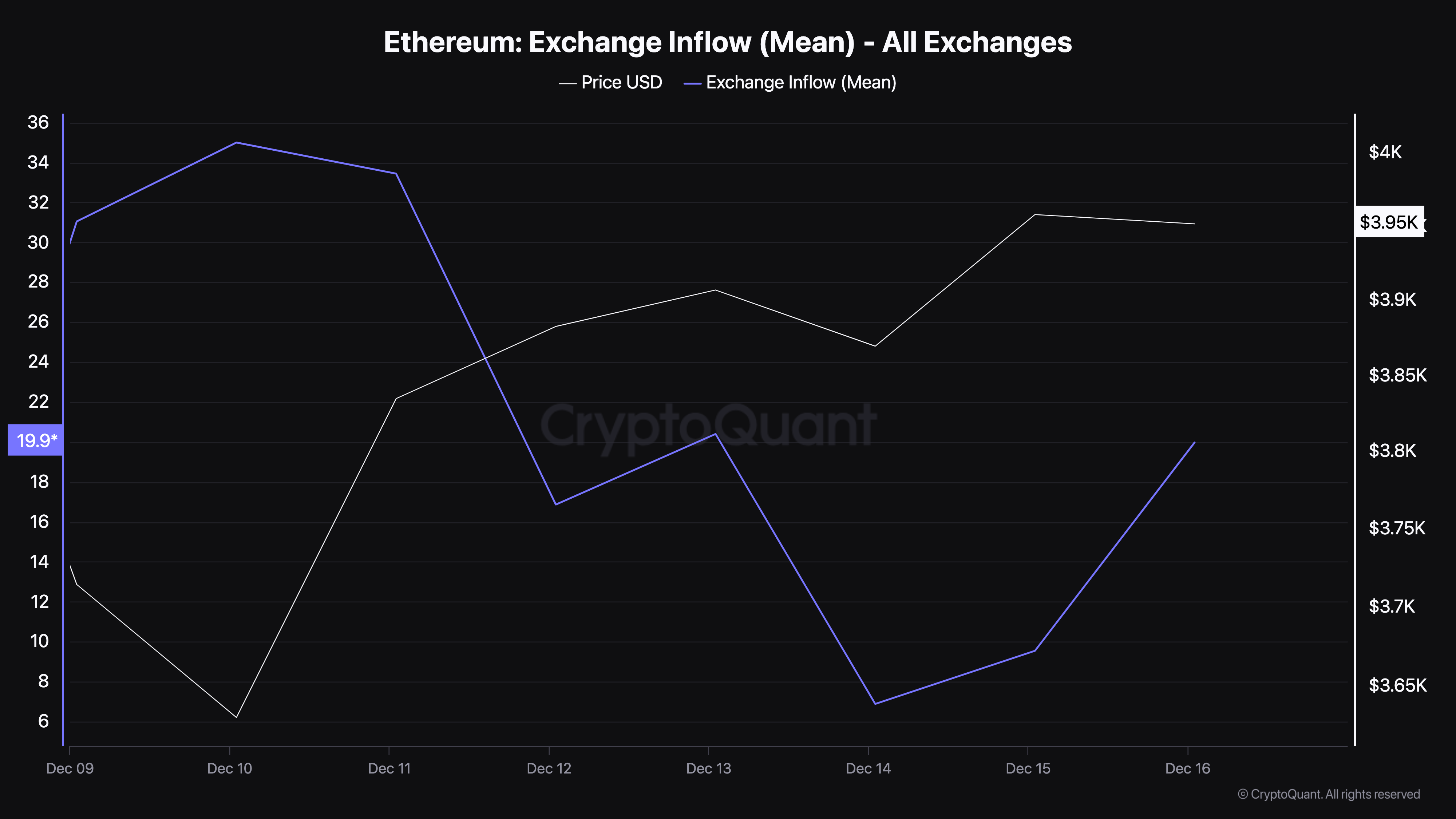

One way to rephrase this in a more natural and easy-to-read manner: One piece of evidence that reinforces this bias is the amount of Ethereum being sent to exchanges (exchange inflow). When a large number of coins are transferred to an exchange per transaction, it could indicate that investors are selling more, which may increase selling pressure and potentially cause prices to drop.

In simpler terms, a rise in the rate at which ETH is being sold on exchanges, as indicated by an increase in exchange inflow since December 14 (according to CryptoQuant), seems to imply a strengthening of selling pressure. A lower exchange inflow would suggest less selling pressure.

Maintaining its current state might prevent the cryptocurrency from reaching $4,500 or setting a fresh record high by the end of 2024.

ETH Price Prediction: Now $4,500 Yet

As I analyze the daily chart, it appears that the Parabolic Stop-and-Reverse (SAR) indicator has moved above the price of Ethereum. This technical indicator serves as a signal to me, suggesting that Ethereum may have met resistance in its upward movement or found solid support during a downtrend.

When the dotted lines fall below a currency’s price, it suggests strong underlying support that might push the price upwards. At present, however, these dotted lines sit above Ethereum’s current price, implying that the cryptocurrency may be encountering resistance as it tries to rise further.

So, if Ethereum’s trading price stays under the specified indicator, it seems likely that the price will decrease, potentially reaching around $3,315. Under such circumstances, it appears unlikely that Ethereum will establish a new record high price by the end of this year.

If Open Interest rises significantly and the exchange inflow decreases to a nearly negligible level, the prediction could prove incorrect.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- SD Gundam G Generation ETERNAL Reroll & Early Fast Progression Guide

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

2024-12-16 23:42