As a seasoned analyst with over two decades of experience in the financial markets, I must say that the recent analysis by Ali Martinez regarding Ethereum (ETH) is indeed intriguing. The channel he has identified, with an upper boundary around $6,000, seems to be a promising trajectory for ETH if it manages to maintain its current momentum.

This year, Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has lagged behind Bitcoin (BTC). However, fresh analysis hints that ETH might soon outperform and even surpass its past record high to close the gap.

Based on a graph presented by well-known crypto expert Ali Martinez, Ethereum has successfully maintained its $2,400 support line. It may now aim for the upper boundary of the channel, approximately $6,000.

As a crypto investor, I recently came across a chart shared by Martinez on the platform X (previously known as Twitter), which has garnered attention from his 76,000+ followers. This chart indicates that Ethereum (ETH) is currently moving within a clearly defined channel. The upper boundary of this channel appears to be around $6,000, suggesting potential upward movement for the cryptocurrency as it navigates within this channel.

Ethereum’s ETH price has managed to maintain the $2,400 support and could potentially reach the projected upper limit of approximately $6,000!

— Ali (@ali_charts) October 29, 2024

Over the past few days, I’ve noticed a significant decrease in the Ethereum holdings on various cryptocurrency exchanges, amounting to approximately $750 million. This substantial withdrawal of Ethereum, the second-largest digital currency by market cap, has been quite noteworthy.

As a crypto investor, I’ve noticed that a decrease in Ethereum supply on exchanges is usually seen as a bullish signal. This is because if the demand stays strong or even increases, it could potentially drive up prices. It’s common for investors to withdraw their Ethereum from exchanges and hold onto them long-term by self-custodying their funds, aiming to reap potential future gains.

People who own Ethereum might decide to transfer their assets away from exchanges and instead, securely store them within the Ethereum network to receive returns on their investment. This is achieved by participating in the network’s Proof-of-Stake consensus system.

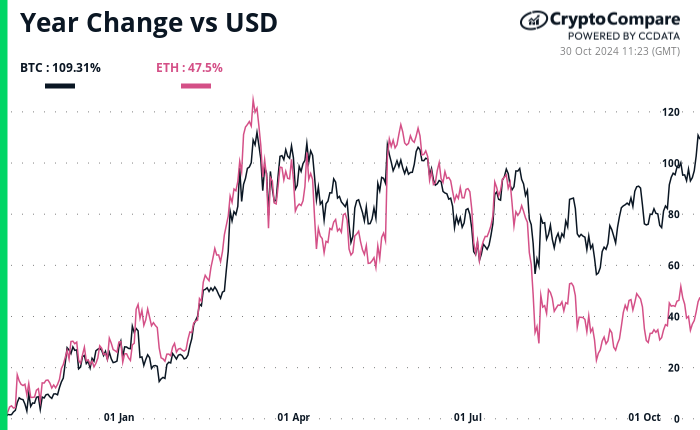

In comparison to Bitcoin, Ethereum has not performed as well, rising by only about 47.5% in the past year, while Bitcoin increased by approximately 109%. This is based on data from CryptoCompare.

Read More

- Margaret Qualley Set to Transform as Rogue in Marvel’s X-Men Reboot?

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- DODO PREDICTION. DODO cryptocurrency

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Everything We Know About DOCTOR WHO Season 2

2024-10-31 01:55