As a seasoned crypto investor with over a decade of experience in this wild and unpredictable world of digital assets, I find myself both excited and cautious about the recent surge in open interest for Ethereum derivatives contracts to an all-time high of $23 billion. While I’ve seen such bullish predictions before, and they often lead to “fireworks” indeed, it’s essential to remember that the crypto market can be as volatile as a rollercoaster ride at Coney Island.

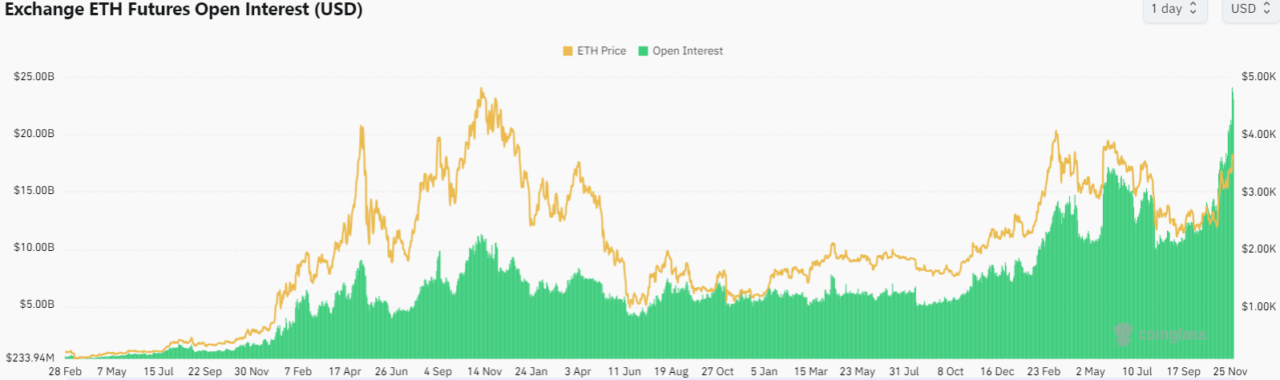

Data shows that open interest on Ethereum derivatives contracts has recently exploded upward to a new all-time high of $23 billion, up from around $7 billion at the beginning of the year, in an upward move that one analyst suggest is “guaranteed for heavy fireworks.”

Based on figures from CoinGlass, it’s clear that the value of Ethereum (ETH) futures contracts currently stands at approximately $23 billion. This significant figure indicates an increasing number of positions are being established in the crypto space, likely driven by new investments pouring into the market.

According to CryptoQuant analyst Maartunn, an increase in investment could cause increased market turbulence in the coming period, as it might intensify price fluctuations, potentially resulting in significant and explosive market movements.

The increase in open interest coincides with a timeframe where Ethereum’s price performance has been noticeably lower compared to Bitcoin‘s. According to CryptoCompare, while Bitcoin has surged more than 156% over the past year, Ethereum has only increased by 77%.

According to CryptoGlobe’s report, a significant Ethereum investor who amassed close to 400,000 ETH when the digital currency was priced approximately $6 per unit has resumed offloading their holdings.

As reported by on-chain analysis firm Lookonchain, a large investor (referred to as a whale) bought approximately 398,889 ETH for around $2.4 million between January and March 2016. With Ethereum’s price skyrocketing over the past eight years, these tokens are now valued at over $1.34 billion.

Currently, one unit of this digital currency trades for around $3,600, while its total market value stands at approximately $433 billion. According to Lookonchain’s data, a large Ethereum investor who had been inactive for more than eight years started offloading their holdings on November 7th.

Currently, Bitcoin is close to its record value, but Ethereum hasn’t yet reached its previous peak of approximately $4,600 set in 2021. As CryptoGlobe mentioned recently, there has been a significant decrease of about $750 million in the amount of Ether stored on cryptocurrency exchanges due to large withdrawals from these platforms, which houses Ethereum as the second-largest crypto by market cap.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2024-11-30 02:14