As an analyst with over a decade of experience in the crypto market, I find myself in agreement with Michael van de Poppe’s optimistic outlook on Ethereum (ETH). Having navigated numerous bull and bear markets, I can attest that price corrections are a normal part of the cycle.

Crypto expert Michael van de Poppe is confident that Ethereum’s (ETH) bull market in 2024 will continue, despite not being able to maintain the $4,000 price point. On social media platform X (previously known as Twitter), he discussed his reasons for this optimistic viewpoint.

Currently, Ethereum is being traded at approximately $3,716. The question arises: might Ethereum reach even higher points in the upcoming weeks?

Ethereum Rally Is Not Over, the Analyst Says

Based on van de Poppe’s analysis, the current trading range for ETH offers a chance to buy at reduced costs. He points out in his post that the recent decrease in price is typical.

Instead, he pointed out that ETH’s price is approaching a significant barrier that could verify its upward trend. The chart presented by van de Poppe indicates that this resistance level lies around $3,800. If Ethereum manages to surpass this level, the bullish trend could potentially resume from where it paused later in the month and continue into 2025.

As an analyst, I find ETH to be a promising asset for accumulation. Following a standard correction post-testing a new resistance level, I anticipate a continued upward trend from later this month and through the upcoming new year.

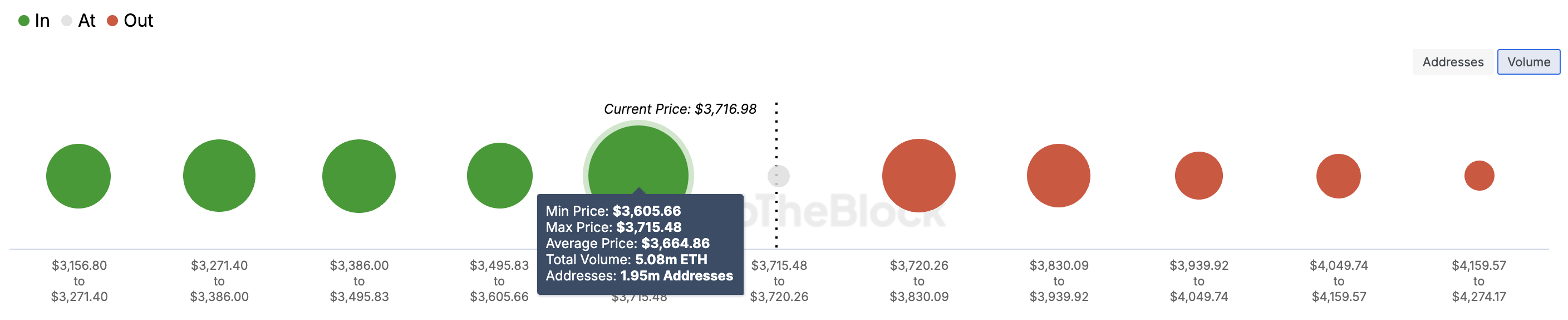

It’s intriguing that van de Poppe’s viewpoint appears to be consistent with the categorization suggested by the In/Out of Money Around Price (IOMAP). This tool groups addresses according to those who bought at prices lower than the current one and those who purchased at higher prices.

Generally speaking, when a larger number of coins trade at a specific price level, that area becomes either strong resistance or strong support, depending on whether the coins are trading above (in-the-money) or below (out-of-the-money) that level. In simpler terms, if more trades occur at prices above a certain level (out-of-the-money), it creates strong resistance since sellers tend to dominate in that region. Conversely, if more trades happen at prices below the level (in-the-money), buyers are more active, making it a strong support area.

Looking at the data presented, it’s clear that the amount of ETH at $3,715 is significantly larger compared to the range between $3,830 and $4,274. Given this situation, there’s a strong possibility that Ethereum’s bull run could resume shortly, potentially pushing the price upwards towards approximately $4,500.

ETH Price Prediction: Is $4,500 On the Way?

Looking at the daily chart, Ethereum’s price remains above the falling triangle pattern. This indicates that although there has been a recent decrease in value, Ethereum might avoid a major price adjustment.

For a price surge to occur, trading activity needs to escalate significantly. Additionally, it’s crucial for the bulls to prevent Ethereum from falling below the $3,505 mark. Given the current situation, there are indications that they may hold this support level.

Should Ethereum’s prediction hold true, its value might soar up to $4,096; an extremely optimistic forecast could even push it towards $4,500. However, if the bears manage to drag the price below $3,505, this projection could be voided, possibly causing a slide down to $3,182.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-12-12 04:12