Well now, ain’t this a fine kettle of fish! Exchange-traded contraptions tied to Ether have been hemorrhaging money faster than a gold miner with dysentery. With just three trading days left in 2025, these Ethereum ETFs are fixin’ to set a record – the kind you don’t brag about at dinner parties.

Santa took one look at Ethereum ETFs and said “Ho-ho-NO!” 🎅🏼

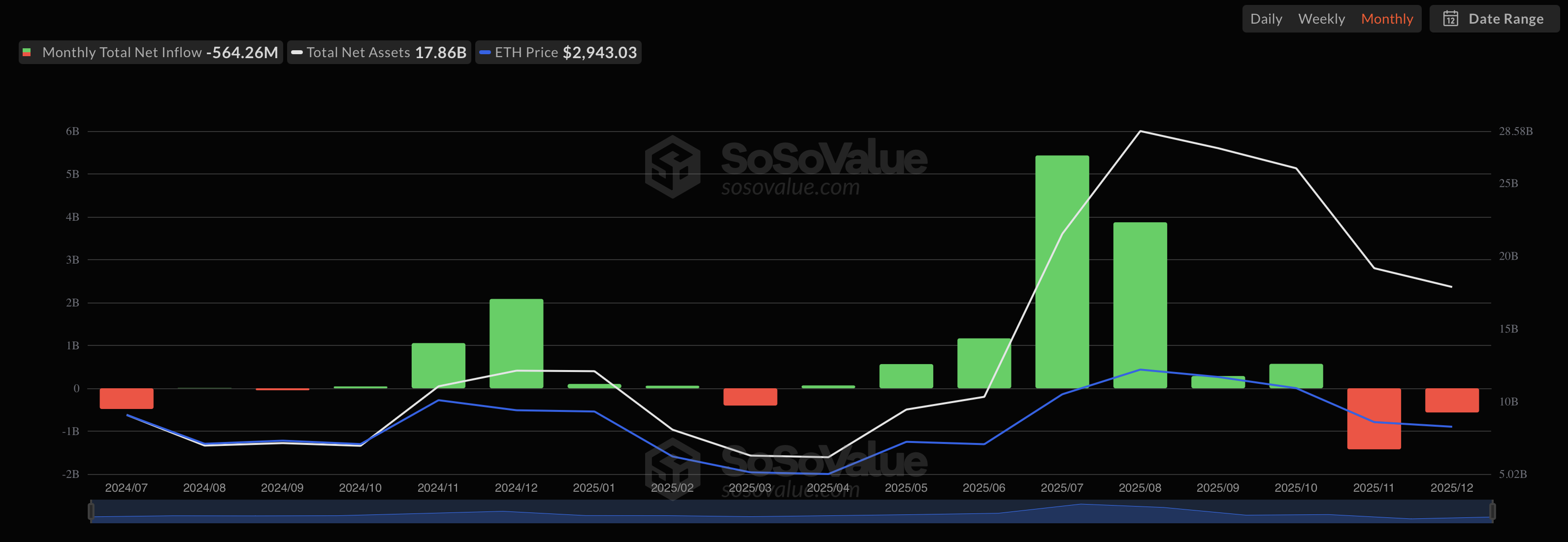

This December’s been uglier than a mud fence for spot Ethereum ETFs in Uncle Sam’s backyard. Investors have been pulling out faster than a Mississippi riverboat gambler who’s seen his opponent’s ace. Over $564 million vanished quicker than common sense at a political rally, according to them fancy SoSoValue numbers.

The total money locked up in these Ether ETFs has shrunk back to June levels – which is about as comforting as finding out your whiskey’s been watered down. $17.86 billion remains, which is 37.5% less than August’s high – proving that what goes up must come down, especially if it’s in crypto.

December 2025 is shaping up to be the second worst month for Ethereum ETFs – sort of like being the second drunkest man at the saloon. It’s already outpaced July 2024 and March 2025’s outflows of $460 million and $408 million respectively, because misery loves company.

But let’s raise a glass to November 2025 – the undisputed heavyweight champion of financial pain, with outflows topping $1.42 billion. That’s enough to make a grown man cry into his cornflakes.

Meanwhile, Ethereum’s price has been bouncing between $2,800-$3,300 like a drunken cowboy trying to mount his horse. From its $4,953 high, it’s been a seven-week rodeo of disappointment.

Bitcoin ETFs: When $4 billion vanishes and nobody notices 🤷♂️

At press time, Ethereum’s trading at $2,926 – down 41% from its peak and 13% year-to-date, proving that what goes up must come down… and stay down.

Bitcoin ETFs ain’t faring much better, bless their hearts. With $804 million gone this month, it’s their third worst performance ever – like coming in third place in an ugly contest.

Combine that with November’s bloodbath, and you’ve got over $4 billion vanished – about 3.5% of the total value. That’s enough money to buy every politician in Washington… twice.

The biggest losers? Grayscale’s GBTC and Fidelity’s FBTC took hits bigger than a mule kick to the ribs. Somebody pass the whiskey.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-12-27 15:34