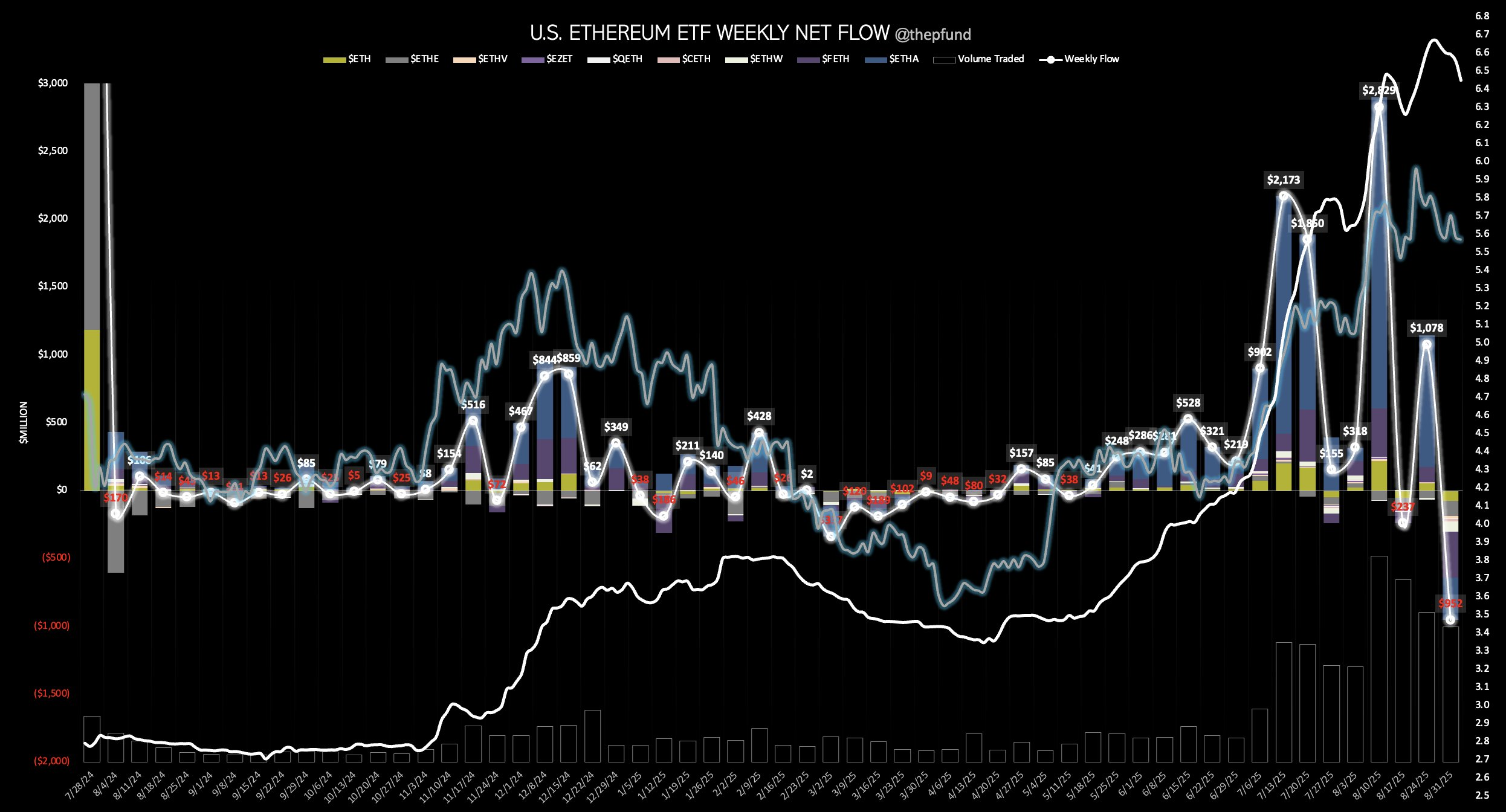

On September 5, Ethereum ETFs decided to throw the biggest garage sale of the year, with investors hauling away $444 million in a frenzy of “thanks, but no thanks.” 🛍️💸

Apparently, the second-largest outflow since their July 2024 debut was less of a sell-off and more of a “see ya, wouldn’t wanna be ya” moment. Investor appetite? More like investor indigestion. 🍽️😷

ETH Funds: The Week the Music Stopped 🎵⏸️

According to SoSo Value (yes, that’s a real name), BlackRock’s ETHA led the charge, shedding $307.68 million-because nothing says “confidence” like a 70% contribution to the day’s total withdrawals. 🏆💔

Grayscale’s funds were like, “Hold my beer,” and collectively lost over $80 million, while Fidelity’s FETH and 21Shares’ CETH joined the party with $37.77 million and $14.68 million in withdrawals, respectively. 🎉🤡

By September 5, the five-day capital exodus had hit $952 million, making it the largest weekly outflow since the funds launched. Someone call Guinness-we’ve got a record! 📈📉

Market analysts, ever the party poopers, blamed “profit-taking” and “caution” due to crypto’s wild price swings. Because nothing says “caution” like dumping millions in a single day. 🚨🤪

Meanwhile, Ethereum’s derivatives market is sweating more than a contestant on a game show. CryptoQuant’s JA Maartunn noted that sellers outweighed buyers by $570 million in ETH futures, because who doesn’t love a good sell-off? 📉💼

Historically, this level of selling happens near market tops, which is just Wall Street’s way of saying, “We’re hedging because we have no clue what’s next.” 🌪️🤷♂️

ETH Futures Under Pressure

Net Taker Volume is heavily skewed: sellers are hitting the bid with $570M more than buyers.

Historically, this level of aggressive selling has appeared near local tops.

– Maartunn (@JA_Maartun) September 6, 2025

But fear not, Ethereum die-hards! Co-founder Joseph Lubin is here to remind us that ETH’s potential is “far beyond current valuations.” He predicts a 100x multiplier and a flip of Bitcoin’s monetary base. Because why stop at the moon when you can aim for the entire galaxy? 🚀🌌

Lubin also believes Wall Street will eventually embrace Ethereum, staking and running validators like it’s going out of style. JPMorgan’s blockchain experiments? Just the tip of the iceberg, apparently. 🏦⛓️

So, while the ETFs are having their moment of panic, Lubin’s long-term vision remains as unshakable as a cat refusing to leave a cardboard box. 🐱📦

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- The Weight of First Steps

- Opendoor’s Stock Takes a Nose Dive (Again)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-06 17:47