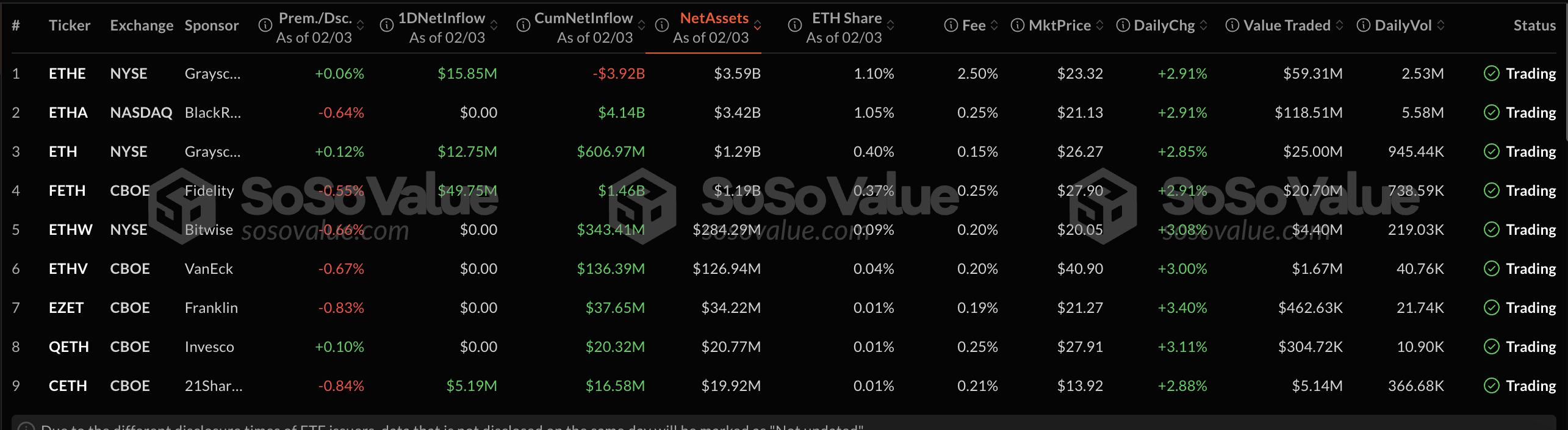

US Ethereum ETFs hit record volume Monday as investors bought the dip despite market downturns. The nine ETFs saw $1.5 billion in total trading volume, with a $84 million inflow from new investors.

Although the ETFs are performing quite well, trouble remains on the horizon. Their trade volumes are becoming increasingly uncoupled from Ethereum itself as the community faces leadership crises and shaken public confidence.

Ethereum ETFs See Record Trading Volumes

Ethereum has been in a challenging spot lately, but its ETFs are pulling huge numbers. Ethereum was already struggling with declining user counts and falling prices, but Trump’s tariff threats brought huge shocks to the whole crypto market.

However, even while the altcoin was struggling, ETF investors bought the dip in huge amounts, leading to $1.5 billion in trading volume.

Essentially, the broader market shocks triggered huge levels of panic-selling, stop-loss triggers, and forced liquidations. As a key asset for the DeFi space, ETH is vulnerable to swings from overall leveraged trading.

These outflows pumped up the ETFs’ trading volume, and Ethereum delivered net inflows, including $84 million from new investors.

After these complicated actions, Ethereum’s price somewhat recovered from Monday’s early market crash.

However, the leading altcoin has been struggling for a few different reasons. Leadership restructuring at Ethereum has shaken public confidence in the firm, feeding price concerns.

Meanwhile, Ethereum ETFs also have a few bullish factors under their belt. They set a new record for inflows in December, attracting more than $2 billion in institutional interest despite a flagging price.

This trend continued throughout January, with heightened ETF trade despite widening cracks in the Ethereum Foundation.

Additionally, a few outside factors helped juice this rally. Donald Trump’s son, Eric Trump, encouraged his followers to invest in Ethereum via social media.

“In my opinion, it’s a great time to add ETH,” Eric Trump posted.

Open interest in ETH futures contracts on the CME also climbed around 6%, signaling institutional interest. Together, these revenue streams helped guarantee big gains.

Ultimately, Ethereum ETFs are doing well, but the underlying asset’s broader future is still uncertain. Community turmoil is causing serious cracks in the asset’s support base.

This is especially concerning because ETH enjoys prestige and reputation due to its long history in the space. Ultimately, these ETF trades may only paper over broader concerns.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-02-04 21:26