Ethereum (ETH) has risen by approximately 4% in the last day, but it’s still 17% lower compared to the past month. Lately, ETH has been attempting to hold above the $3,000 mark, a significant psychological and technical point that could impact its future direction.

As a researcher studying the cryptocurrency market, I’ve noticed that indicators like the Relative Strength Index (RSI) and Directional Movement Index (DMI) suggest that Ethereum (ETH) has exhibited bullish momentum recently. However, this strength seems to be waning. The question now is whether ETH can resume its uptrend or if it will encounter more corrections. This depends on ETH’s capacity to maintain crucial support levels and break through immediate resistance zones.

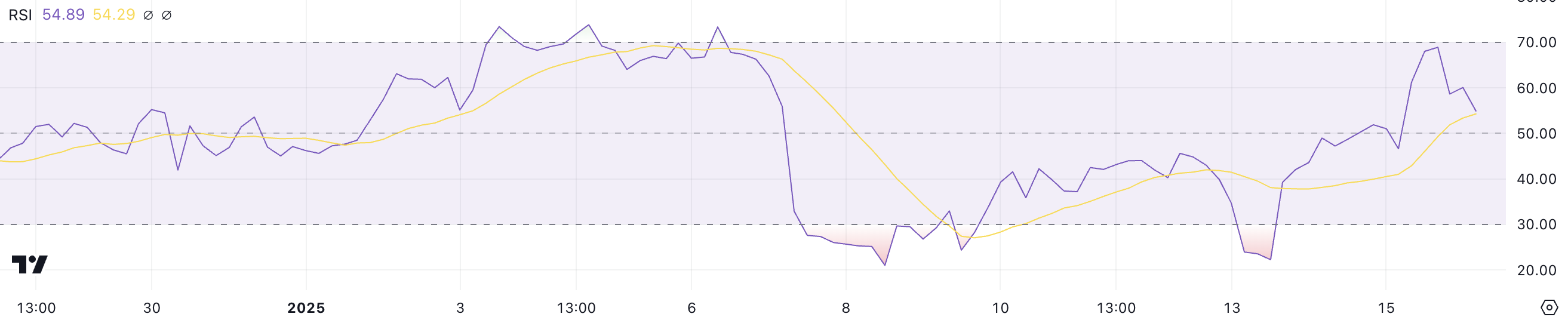

ETH RSI Is Down From Overbought Levels

The Ethereum Relative Strength Index (RSI) stands at 54.8 right now. It had dipped to 22.2 three days back and spiked to 68.9 the day after, demonstrating a swift change in momentum. This transition suggests that Ethereum moved from being oversold to approaching overbought conditions before finding balance closer to neutral levels.

As a researcher, I find it intriguing to observe that the RSI (Relative Strength Index) has dropped from 68.9 to 54.8. This downturn could indicate a tapering off of bullish enthusiasm, as it seems sellers have managed to reclaim some ground following the recent significant rally.

The Relative Strength Index (RSI), which is a type of indicator that measures the rate at which prices are changing, shows values between 0 and 100. When the RSI falls below 30, it usually means the market is oversold, suggesting it could be due for an increase in price. Conversely, when the RSI exceeds 70, it often signals that the market is overbought, which might lead to a decrease or correction in price.

Currently, the Relative Strength Index (RSI) for ETH stands at 54.8, which means it’s in a neutral zone, indicating an equilibrium between buying and selling activity. The decline from 68.9 might be a sign that the current rally is starting to slow down, potentially leading to a phase of consolidation or a slight correction. Unless fresh bullish factors arise to revive the uptrend, this could be the case.

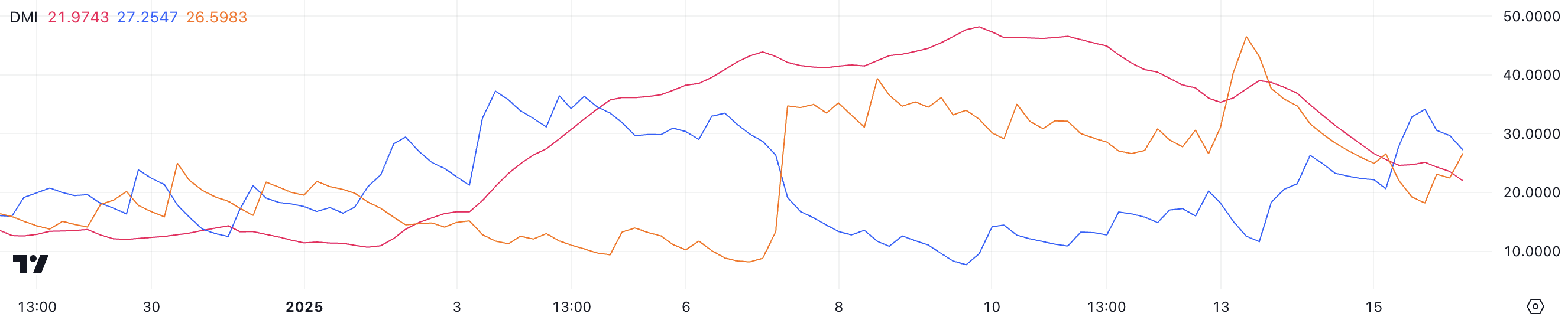

Ethereum’s Uptrend Could Be Fading Away

The Ethereum DMI chart shows that the ADX, which measures trend strength, has dropped from 39 to 21.9 over the past three days, suggesting a noticeable weakening of the current trend.

Yesterday’s bullish momentum seemed to weaken as the Plus Directional Index (or +DI) dropped from 34.1 to 27.2, suggesting a decline in buying power. Meanwhile, the Minus Directional Index (or -DI) increased from 18.2 to 26.5, implying that selling pressure is growing stronger. This pattern suggests that buyers might be losing control in the market and sellers are gaining more influence.

In simpler terms, the ADX (Average Directional Movement Index) gauges how strong a trend is, with numbers over 25 suggesting a robust trend and figures under 20 hinting at a weak or uncertain market condition. Right now, the ADX stands at around 21.9, implying that the strength of the Ethereum price’s attempt to create an uptrend may be starting to diminish.

In simple terms, when the Differential Indicator (DI) shows only a slight edge over the Negative DI, it indicates a power shift that might persist unless bullish strength resurges. Consequently, Ethereum may find it challenging to maintain its upward trajectory and could instead move into a period of consolidation or even experience a reversal.

ETH Price Prediction: Will It Recover $4,000 Levels In January?

As a researcher, I’m observing an interesting development in the Ethereum market. The short-term average prices are making an effort to surpass their long-term counterparts, a situation that typically signals a bullish trend. In simpler terms, it seems we might be on the verge of a significant price increase for Ethereum.

However, indicators such as the ADX and RSI suggest that the bullish momentum may be weakening.

If the current downward trend flips, Ethereum (ETH) might first encounter its initial support at approximately $3,158. A drop beneath this point may cause further declines towards $3,014. If even this level proves insufficient, Ethereum could potentially drop to as low as $2,723, signifying a possible correction of around 18.4%. On the contrary, if the upward trend renews its vigor, Ethereum may challenge its resistance at $3,545.

As an analyst, I’m optimistic that surpassing this current level could potentially open up a path towards reaching $3,745. If the positive trend persists, Ethereum’s price might even strive for $4,106. This significant leap would mark Ethereum’s first time trading above $4,000 since mid-December 2024, a noteworthy milestone indeed.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-01-16 23:31