Ethereum (ETH) is on a roll, darling. It just had its strongest six-week inflow streak since December 2024, and crypto buffs are losing their minds over it. Last week alone, crypto inflows hit a whopping $286 million. Yes, you read that right — millions, not pennies.

This fresh mountain of cash pushes the total inflow over seven weeks to a cool $10.9 billion. Investors are acting like they’re drunk on sunshine, despite the US throwing a regulatory tantrum and macroeconomic chaos keeping everyone on edge. Classic, right?

Ethereum Takes the Cake in Crypto Inflows

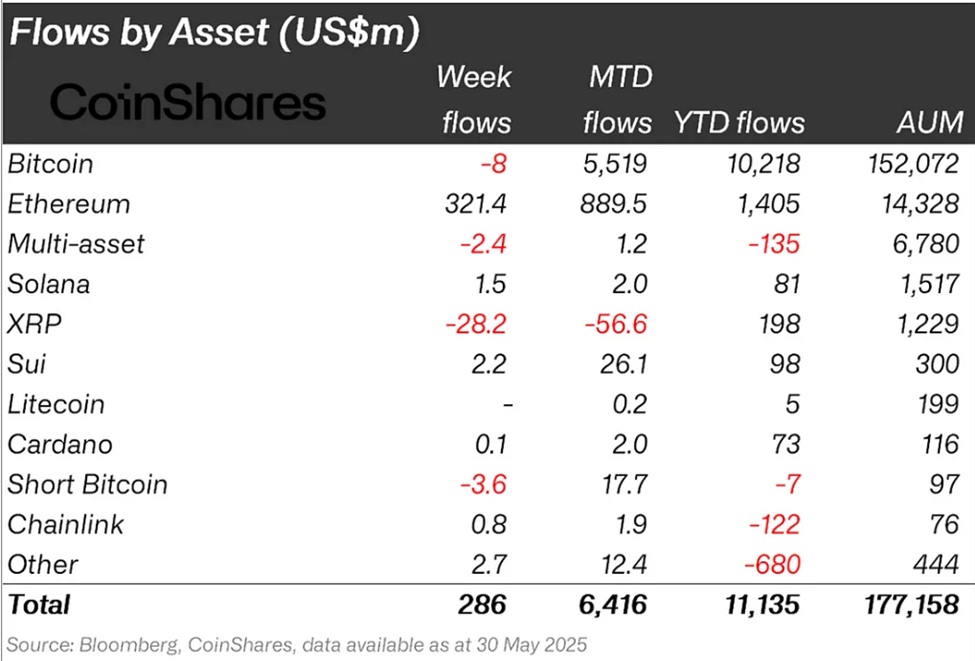

According to the very serious CoinShares report, Ethereum snagged $321 million last week alone. Apparently, it’s the cool kid in the crypto playground – the biggest single-week gain in 2025. Who knew a smart contract hero could be so popular?

It’s all about confidence, baby. After six weeks of money flowing in—a total of $1.19 billion—Ethereum’s vibes are gliding higher than a cat on a Roomba.

Meanwhile, Bitcoin, the classic old-timer, had a bit of a wobble. Early in the week, investors loved it, then got jittery when federal courts decided US tariffs are kinda illegal, throwing some macro volatility into the mix.

“The President’s assertion of tariff-making authority… exceeds any tariff authority delegated to the President,” said the judges. Basically, the US courts told the government to take a chill pill. Oops.

Bitcoin’s products ended the week with a modest $8 million outflow — the first dip after six solid weeks of inflow totaling a jaw-dropping $9.6 billion. Other altcoins? Not so lucky. XRP dropped $28.2 million in their piggy bank, which is like losing your shoes in a swamp. 🥿

Butterfill hints this could mean the investor story is starting to sound a bit tired amid all the regulatory grey clouds.

Regionally, the US is still king, dropping $199 million into the crypto pot. But hey, it’s not just Americans living their best lives — Hong Kong is making a strong comeback with inflows of $54.8 million since their ETPs launched about a year ago. Fancy that.

Despite all the inflow fireworks, total assets under management (AuM) for crypto funds dipped to $177 billion from a peak of $187 billion — probably just a short-term wobble caused by a general feeling of “meh” about the markets. Yep, we’ve all been there.

Two weeks ago, inflows hit record highs at $3.3 billion, making it the highest yearly total. All this madness was partly fueled by fears of the US market’s fragility after Moody’s decided to give US credit a not-so-flattering downgrade. Classy.

Ethereum’s Record-Setting Streak — What’s the Buzz?

Post-Pectra upgrade in May, which apparently made staking smoother than a baby’s bottom, Ethereum’s momentum is still going strong. Investors are hyped for the future, with $205 million swinging its way during that week, and overall, $575 million flowing into Ethereum so far this year.

“Ethereum was the standout performer, with US$205m in inflows last week and $575 million YTD, thanks to the Pectra upgrade and new co-chief Tomasz Stańczak — basically, Ethereum is the coolest kid on the block right now,” Butterfill muttered with a sly grin.

Institutional interest? Oh, it’s bubbling up. Word is BlackRock is gearing up for the US SEC to give a thumbs-up to a spot Ethereum staking ETF within two weeks. If that happens, ETH could shoot up to $12,000 — no big deal, just the usual crypto stuff.

“BlackRock’s pushing the SEC hard to approve the ETH staking ETF — expect fireworks. Ethereum might blast off to $12k if they get their way,” said the crypto oracle Coinvo.

This could mean mainstream adoption is just around the corner. Meanwhile, on-chain data shows Ethereum exchange balances are at their lowest in seven years. Exchange balances dropping? Sounds like long-term holders are sitting back and enjoying their popcorn while everyone else fidgets. 🍿

“ETH supply shock incoming. Exchange balances of Ethereum are collapsing—now at their lowest levels in 7 years,” Coin Bureau explained with a smirk.

All signs point to a potential breakout — if regulations play nice and don’t spoil the party. But hey, in crypto, you never know — it’s a wild ride with a sprinkle of chaos and a dash of hope. Buckle up! 😉

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-06-02 16:26