- Ethereum needs to conquer the mighty $1,895 before it can even think about $2K.

- Conviction buyers are still in control, with the RSI holding strong at 80. How’s that for confidence?

In a surprising twist, Ethereum [ETH] has been on a rather impressive climb over the past three days, jolting itself from a humble $1.5K to breezing past the much-anticipated $1.8K mark. You know, just a casual upward trajectory that’s got everyone talking.

According to Glassnode, it’s all thanks to the “conviction buyers” leading the charge. Momentum buyers? Pfft, they’ve barely made a move. The real action started back in March 2025, with those conviction buyers pushing things forward with a vengeance.

And speaking of conviction, check out that RSI: it’s chilling at a whopping 80. That’s some serious commitment. Meanwhile, sellers, who peaked around April 16th, have seen their RSI plummet to a measly 50. Ouch. Looks like the conviction buyers are running the show, and they’re betting on Ethereum pushing even higher.

Market cap grows, resistance is feeling thinner than your patience on a Monday morning

Thanks to the conviction buyers, Ethereum has powered through $1.8K, causing its market cap to soar by 12%, now sitting comfortably at $219 billion. I mean, who wouldn’t want to be part of that? It’s like a VIP club, except you can buy your way in.

But wait—there’s more! On-chain data suggests that the resistance ahead is about as intimidating as a paper towel. Analysts are eyeing a potential breakthrough, with the next significant sell wall hanging out around $1,860. If that wall crumbles, Ethereum could waltz back toward that oh-so-psychological $2K mark. Will it make it? Who knows, but it’s certainly fun to watch.

So, is a $2K move even possible for ETH?

According to AMBCrypto’s ultra-sophisticated analysis, Ethereum is building up some strong organic demand, which means that a move to the upside could be within reach. In fact, sellers are practically nowhere to be found. It’s like they’ve all gone on vacation.

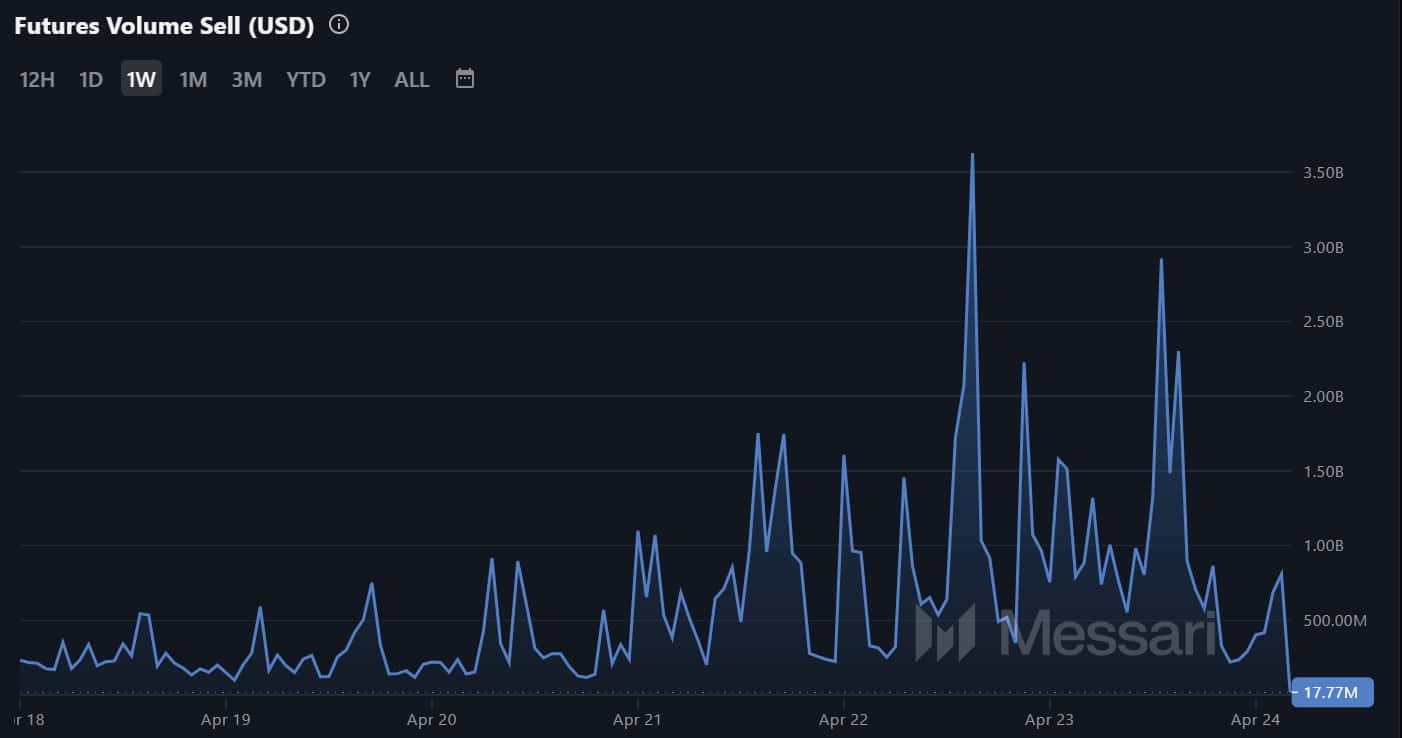

Let’s take a look at the numbers: Futures Volume Sell has dropped to $17.7 million over the past week, while buy volume is sitting pretty at $20 million. That’s a difference of $3 million, which sounds pretty good for anyone hoping for a bullish outcome.

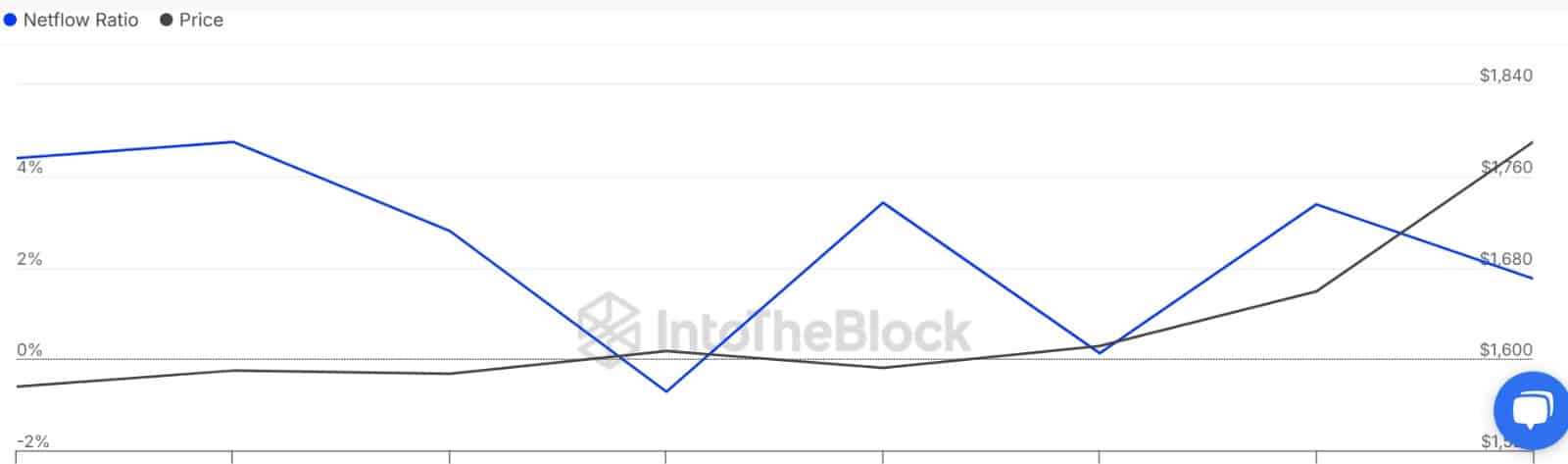

And, just in case you thought the whales were swimming away from Ethereum, think again. The ETH Large Holders Netflow to Exchange Netflow Ratio has dropped to 1.76%. This signals that the big fish are keeping their ETH close to their chests, hoarding it like treasure. Smart move, if you ask me.

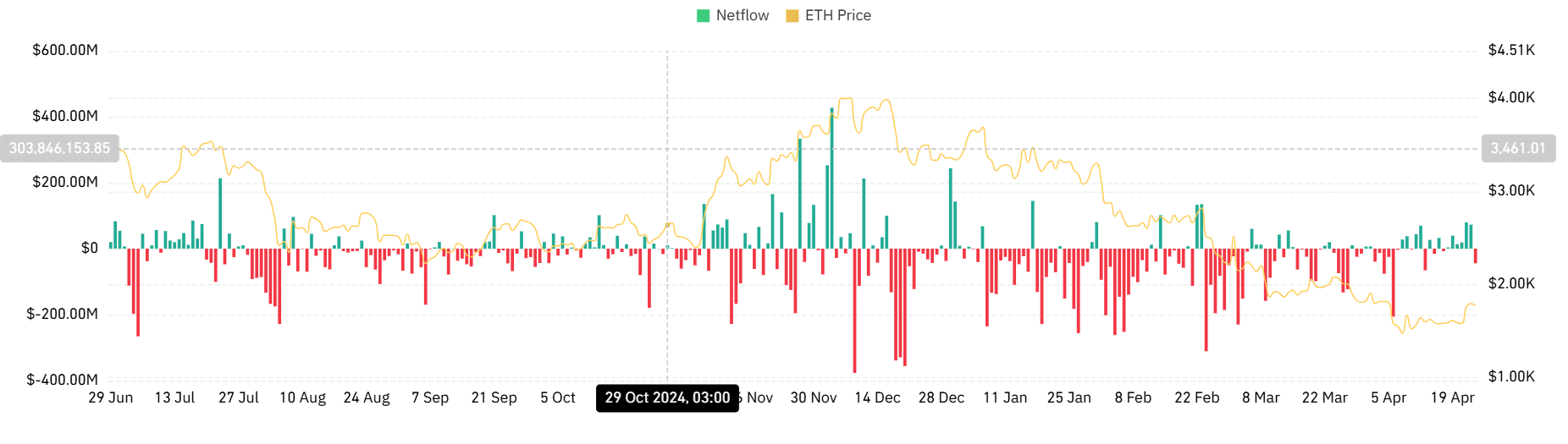

On top of that, Ethereum’s Spot Market has cooled off, and ETH is showing negative exchange netflow. Over the past day, netflow dropped to -$44.4 million after six straight days of positive flow. Sounds like investors are hoarding more than they’re selling, which is usually a good sign for price action.

ETH Needs to Keep its Head Above $1.8K to Stay in the Game

But hold your horses! For this rally to keep running, Ethereum absolutely needs to maintain a price above $1.8K. According to Glassnode, if the price manages to flip the $1,895 cost-basis cluster—where a whopping 1.64 million ETH is parked—then a smooth path toward $2K could be on the cards. That’s the stuff dreams are made of, right?

But let’s not get too ahead of ourselves. If the bulls lose steam here, Ethereum might be staring down a trip back to the $1.6K support zone. And we all know that’s not nearly as fun as $2K.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Minecraft update ranked from worst to best

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Zenless Zone Zero 2.0 – release date, events, features, and anniversary rewards

2025-04-24 15:11