As a seasoned researcher with a decade of experience in the cryptocurrency market, I must say that the current state of Ethereum (ETH) is a fascinating study. The 88% profit rate among ETH holders, the highest since June, indicates a strong bullish sentiment among investors, which is a positive sign. However, the increasing short positions against a surge past $4,000 suggests that traders are playing it safe, perhaps recalling the old adage, “Buy on the rumor, sell on the news.

According to analytics company IntoTheBlock, an astounding 88% of Ethereum (ETH) holders are currently enjoying profits – the highest figure since June. The remaining 12% who are still in the red, account for only 2.8% of the total ETH supply. This implies that there may be minimal selling pressure from this group as Ether’s price surge continues.

Despite the positive sentiment among holders, traders are increasingly betting against a surge past $4,000. According to CoinGlass data, up to $1.43 billion in short positions could face liquidation if Ether reaches this price point.

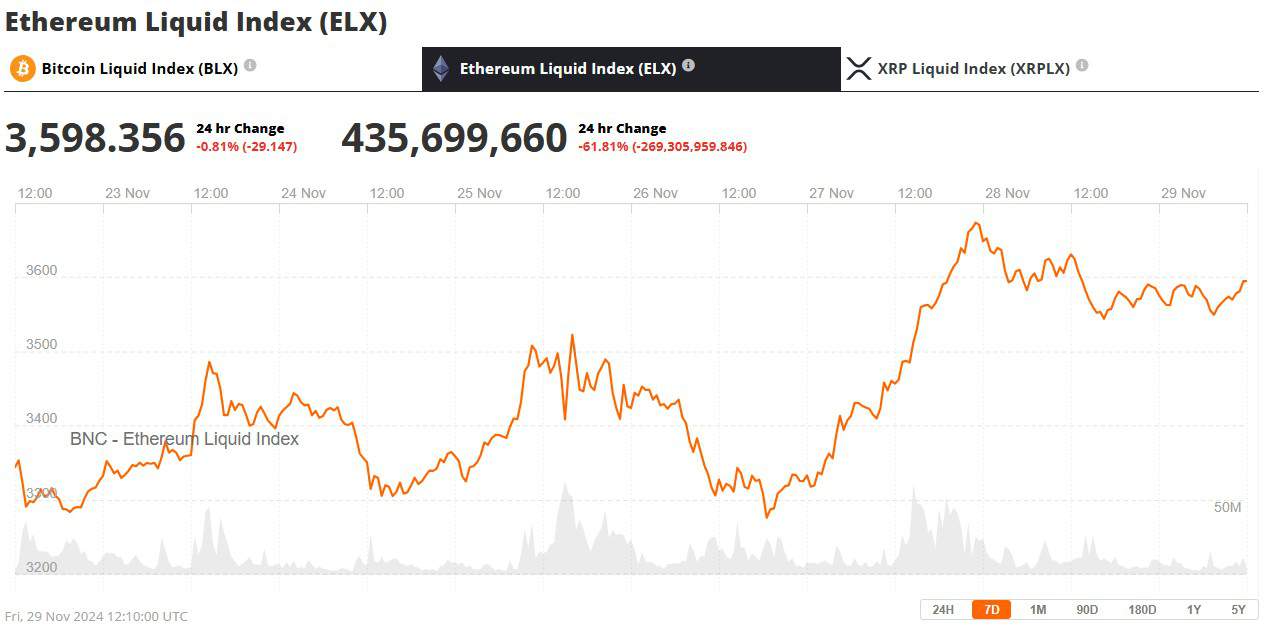

At the moment of this writing, Ethereum was priced at approximately $3,598 according to Brave New Coin’s Ethereum Liquid Index. The digital currency last breached the $4,000 barrier on March 12, coinciding with Bitcoin reaching its peak value of $73,679. Since then, Ethereum has seen a range between $2,223 and $4,066, despite the introduction of spot Ether ETFs on July 23, an event that some analysts anticipated would lead to substantial price hikes.

In recent times, the funding rates for Ether have significantly increased. As noted by CryptoQuant contributor ShayanBTC, despite this increase, these rates are still below the levels seen when Ether reached its peak price of $4,900. This could indicate that Ether might not be in an “overheated” state yet, implying there may be potential for further price growth.

At the time of publishing, the funding rate for Ether on Binance, a major cryptocurrency exchange, was 0.0162%.

The current distribution of trader positions in the Ether market is almost equal, with 50.41% holding long positions and 49.59% having short positions. This close balance suggests that the overall market sentiment is neutral. However, an increase in short positions near the $4,000 level indicates that traders are doubtful about a quick surge or breakout happening soon.

Open interest in Ether futures stands at $119.5 billion, a slight decrease of 0.54% over the last 24 hours. Trading volume over the same period totaled $185.9 billion, down 27.93%. Liquidations amounted to $191.5 million, a decrease of 32.38%, suggesting reduced volatility in the market.

As a researcher, I’ve noticed an interesting distribution of positions on Binance: Long positions hold 47.74% of the total, while shorts account for a slightly larger 52.26%. The respective values in positions are $845.30 million and $925.41 million. Remarkably, this trend is also observed on other significant platforms like OKX and Bybit, where short positions tend to exceed long ones.

In a somewhat cautious market climate, certain investors continue to express optimism regarding Ethereum’s potential. On a popular social media platform X, well-known trader Ash Crypto shared their belief that Ethereum is on the verge of surpassing $4,000 with their 1.3 million followers. Fellow trader Borovik displayed even more excitement, declaring they would get an Ethereum logo tattoo if the cryptocurrency manages to reach $15,000 during this cycle.

Financial expert Lark Davis consistently shares with his 1.2 million followers that he expects Ether’s value to reach $15,000, indicating a portion of the market that believes in substantial future growth potential for this digital currency.

The Ethereum network is consistently bustling with activity. Based on available data, around 74% of Ether owners have been holding onto their asset for more than a year, suggesting strong belief among investors. Notably, large transactions amounting to $68.6 billion were carried out in the last seven days, which involves approximately 930,500 individual transactions.

As a crypto investor, I’ve noticed that according to IntoTheBlock’s data, about 53% of the total Ether is held by large investors, or whales. This implies that these significant players hold a considerable amount of sway over the Ethereum market.

Approaching the psychologically important level of $4,000, Ether finds itself at a critical juncture where optimistic investor feelings collide with cautious trading strategies. The forthcoming days could hold the key to whether Ether will surpass its resistance level or if accumulating short positions indicate a price adjustment is imminent.

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

2024-11-29 15:24