So, crypto’s having a moment. Or, rather, a downward moment. The entire digital asset class has collectively decided to take a nap, hitting levels not seen since… well, before everyone started talking about NFTs as retirement plans. Ether, the stuff that powers Ethereum, is down 57% from its 2025 high. Which, let’s be honest, was probably inflated by people who thought they could flip JPEGs for a profit. It’s like Beanie Babies, but with more coding.

Ethereum, in theory, is the cool kid in the blockchain playground. It’s the platform where all these ‘decentralized applications’ – or dApps, because acronyms are essential in tech – hang out. Apparently, these dApps are going to revolutionize everything from finance to gaming. Which is great, if you enjoy waiting five minutes for a digital cat to load. The idea is that every time someone uses one of these apps, they pay a fee in Ether, creating demand. It’s a lovely ecosystem, assuming enough people actually use the apps and aren’t just collecting digital dust.

The question, of course, is whether buying Ether during this ‘dip’ will turn you into a millionaire. It’s the same question people ask about every asset after it loses a significant chunk of value. Is it a steal? Or are you just catching a falling knife? And, more importantly, are you prepared to explain to your financial advisor why you’re investing in something that sounds like a sci-fi movie?

The Top Destination for Decentralized Apps (and Potential Headaches)

These dApps run on ‘smart contracts’ – which sounds incredibly sophisticated, but basically means lines of code that automatically execute agreements. No humans involved! Which is fantastic, until something goes wrong. Then you’re arguing with a computer program. The whole system is ‘decentralized’ – meaning it runs on thousands of computers around the world. Which is great for redundancy, but also means there’s no central authority to call when your digital cat gets stuck in a digital wall. Ethereum boasts 100% uptime. That’s impressive. It also feels like a challenge to the laws of physics.

There are thousands of these dApps already. Uniswap is one of the popular ones. It’s a decentralized exchange where you can trade cryptocurrencies. No account needed! Just connect your crypto wallet and… pray. It’s far more convenient than Coinbase, which, let’s face it, is basically a heavily regulated bank pretending to be cool. Coinbase makes you jump through hoops to comply with anti-money laundering rules. Uniswap just lets you send money into the void. It’s a trade-off.

So, Uniswap is convenient. And every transaction generates more demand for Ether. It’s a virtuous cycle! Or, it would be, if anyone actually used it for anything other than speculating on the price of other digital assets.

Could Ethereum Be a Millionaire-Maker From Here? (Don’t Quit Your Day Job)

Tom Lee, a name you’ll recognize if you’ve ever scrolled through a financial newsletter, thinks Ether could hit $62,000 by 2035. That would make it more valuable than Nvidia. Which, admittedly, is a high bar. But let’s be real, predicting the future is a fool’s errand. Especially when it comes to technology that most people don’t understand.

Of course, there’s competition. Solana is trying to be the faster, cheaper Ethereum. It’s the same story as every tech disruption: someone always comes along and says, “We can do it better.” Which they usually can, at least for a little while.

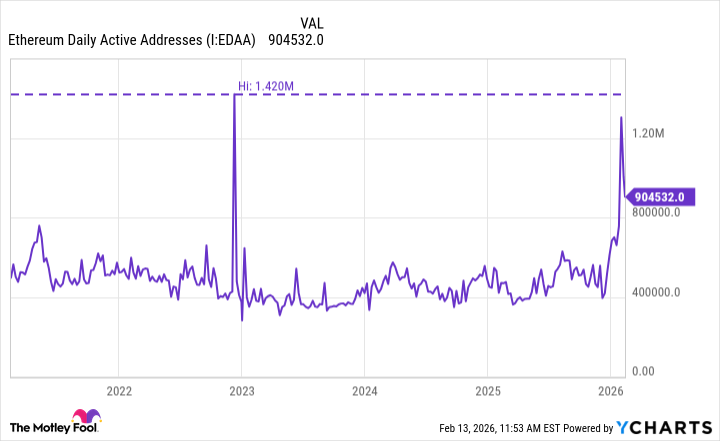

On the plus side, the number of daily active addresses on Ethereum has doubled. That’s good! It means more people are using the network. Or, at least, more wallets are moving Ether around. It’s not quite the 1.4 million peak from 2022, but it’s a start.

If Lee’s prediction is right, a $33,000 investment today could turn into a million dollars in a decade. Sounds amazing! But a more realistic target might be the 2025 high of $4,830. That’s a 135% gain. Still good! But it would require a $425,000 investment to become a millionaire. Which, let’s be honest, is a lot of money to gamble on digital cats.

Look, I’m not saying don’t invest in Ether. I’m just saying, no matter how much money you have, be careful. And maybe, just maybe, consider investing in something a little less… volatile. Like, I don’t know, a diversified index fund? Or, even better, a really good accountant.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- All weapons in Wuchang Fallen Feathers

- Where to Change Hair Color in Where Winds Meet

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

2026-02-17 13:33