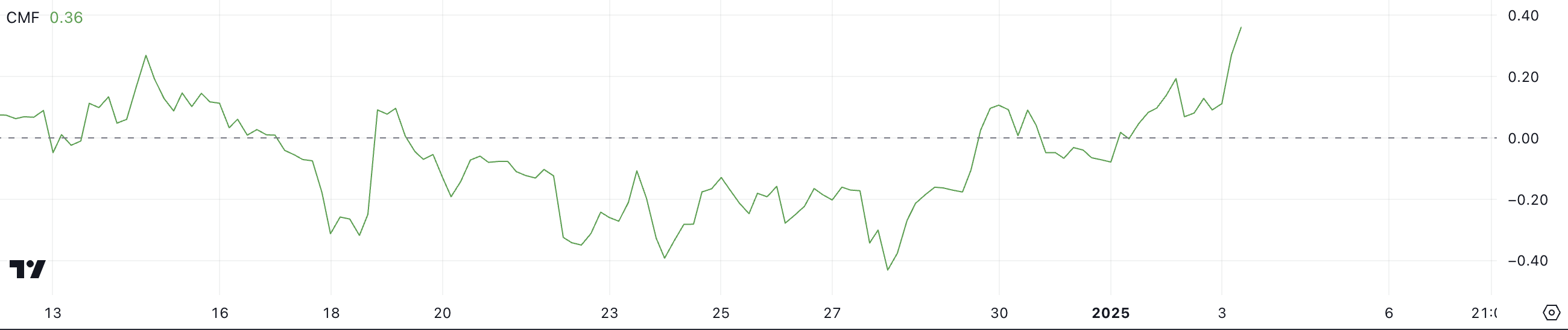

As a seasoned crypto investor with over a decade of experience navigating the volatile and unpredictable world of digital assets, I find myself intrigued by Ethena’s (ENA) recent surge in price. With a market cap now reaching $3.5 billion and a Chaikin Money Flow (CMF) at its highest level since November, I am cautiously optimistic about the token’s potential for growth.

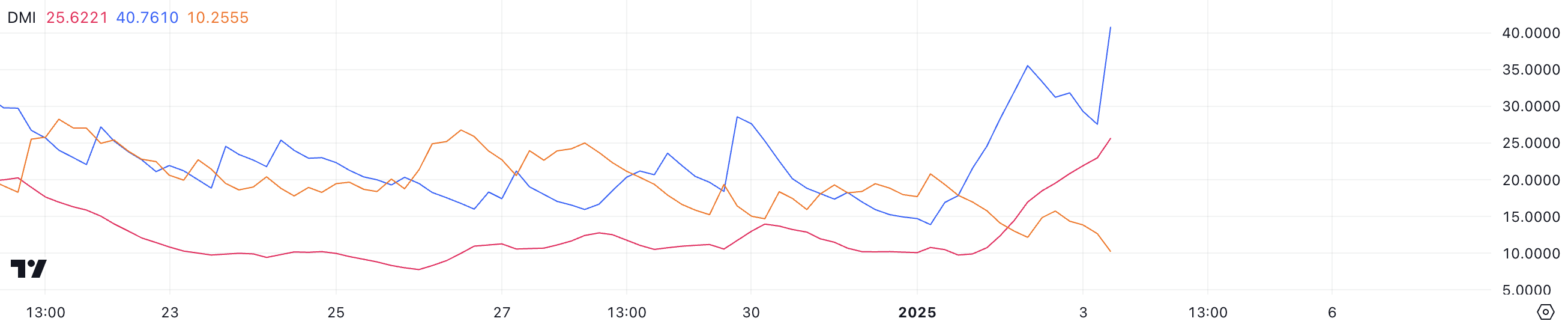

Having seen my fair share of crypto market ebbs and flows, I know that it is essential to approach any investment with a measured and informed perspective. The CMF’s sharp rise from nearly 0 just two days ago, coupled with the strong uptrend indicated by the DMI, suggests that ENA is experiencing significant buying pressure. This could indicate growing confidence in Ethena’s potential for price appreciation, as increased capital inflows often support upward price movement.

However, I am not one to get carried away by short-term hype. I will closely monitor the token’s price action and technical indicators to gauge whether this momentum is sustainable. A possible 13.7% upside if ENA breaks through the resistance at $1.22 sounds enticing, but it’s important to remember that the market can be unpredictable, and there are always risks involved in investing in digital assets.

In my experience, the crypto market is like a rollercoaster ride – exhilarating, unpredictable, and full of twists and turns. But just like on a rollercoaster, it’s essential to enjoy the ride while keeping a steady hand on the wheel. So, as I watch Ethena’s price action unfold, I’ll be keeping my fingers crossed for continued growth – but with a healthy dose of skepticism and a solid risk management strategy in place.

Oh, and let me remind you of an old saying: “The only constant in the crypto market is change.” So buckle up, folks – it’s going to be a wild ride!

In just the past day, the value of Ethna (ENA) has climbed by more than 11%, resulting in a total market capitalization of approximately $3.5 billion.

As a seasoned investor with over two decades of experience under my belt, I have learned to pay close attention to technical indicators when making investment decisions. In this case, the rally we are considering is backed by some strong signals from these indicators. For instance, the recent golden cross suggests that short-term moving averages have crossed above long-term ones, which historically has been a bullish sign. Additionally, the sharp increase in its Chaikin Money Flow (CMF) to 0.36 indicates an uptick in buying pressure. This signals that more money is flowing into this investment than out of it, which can lead to price appreciation over time. Based on my experience, these are positive indicators that I would take note of before making an investment decision.

ENA CMF Reached Its Highest Level Since November

As a seasoned investor with years of experience under my belt, I have learned to keep a keen eye on various technical indicators when analyzing stocks. One such indicator that has proven useful is the Chaikin Money Flow (CMF). Recently, while examining Ethena’s chart, I noticed that its CMF has surged from nearly 0 just two days ago, now standing at an impressive 0.36. This swift uptick in the CMF suggests a substantial improvement in capital inflows and a strengthening of buying pressure over the short term.

This increase in positive momentum could be indicative of a promising investment opportunity for those with a medium to long-term outlook. However, it’s essential to remember that past performance is not always an indicator of future results, and I always advise conducting thorough research before making any investment decisions. Nonetheless, the CMF’s sharp rise in Ethena is certainly worth keeping an eye on for those looking to capitalize on potential opportunities in the stock market.

The Capital Movement Factor (CMF) serves as a momentum indicator by quantifying the inflow and outflow of funds associated with an asset using both price and trading volume. A CMF value greater than zero indicates a dominant trend of purchasing, while a value less than zero signifies a prevailing trend of selling.

With a Capital-to-Market Factor (CMF) of 0.36, Enigma Network Assets (ENA) exhibit robust optimistic tendencies, implying that investors are actively buying the token. This might be an indication of growing trust in Ethena’s potential for price growth, as increased investment typically fuels upward price trends.

If the Capital Market Factor (CMF) keeps rising, it’s likely that the Exchange-Traded Note (ETN) price will see persistent growth in the immediate future, given that buying interest stays stronger than selling actions. But if the CMF shows a downward trend, this might indicate a slowdown, possibly causing consolidation or even a drop.

Ethena DMI Shows a Strong Uptrend

According to the Ethena DMI chart, its Average Directional Index (ADX) has dramatically risen to 25.6 within the past two days, up from 9.9 previously. This significant jump suggests an enhanced trend strength, indicating a powerful upward movement. The ADX ranges from 0 to 100, with higher values indicating stronger trends.

Readings exceeding 25 signal a robust trend, whereas figures under 20 hint at feeble or non-existent momentum. Since the ADX has now clearly surpassed the 25 mark, it underscores that the ENA price is experiencing a powerful trend, in line with its ongoing upward trajectory.

As an analyst, I’m observing a clear bullish trend strengthening. My +DI (positive directional indicator) has surged to 42.1, suggesting robust buying power, while the -DI (negative directional indicator) lingers comparatively low at 9.9, hinting at diminished selling activity. This situation indicates that buyers are assertively driving the market, exerting considerable upward pressure on prices.

For a while, it appears that ENA’s upward trend might persist in the near future based on these DMI readings. Yet, for this upward movement to be sustained, it’s crucial that the ADX keeps rising and the plus directional indicator (DI+) stays stronger than the minus directional indicator (DI-).

ENA Price Prediction: Will Ethena Rise 13.7% Next?

The short-term moving averages of ENA’s EMA lines have just crossed over the long-term ones, which is known as a ‘golden cross.’ This pattern is considered bullish because it happens when shorter timeframe averages rise above longer ones. It suggests there might be an upcoming change in trend direction, indicating a possible prolonged period of price increases.

If the ongoing upward trend continues, the ENA price might reach a potential resistance point at around $1.22. Should it breach this barrier, we may witness further increases, potentially taking the price up to $1.32 – which represents a potential 13.7% rise.

Should the upward trend weaken and downward pressure (bearish momentum) becomes dominant, the level of $1.12 will be crucial in halting any additional drops.

If the price dips beneath the current point, it might spark more sellers, potentially causing the ENA price to fall to $1.02. If the $1 price point isn’t strong enough to halt the decline, the price could continue dropping to $0.84, indicating a substantial correction.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2025-01-04 02:59