It appears that the bears have been having a ripping good time, shorting Ethereum with reckless abandon. But, old chap, this could be the perfect setup for a spot of bother – a GameStop-style short squeeze, if you will. Just imagine it: a sudden surge in demand, and those excessive bearish bets turn into rocket fuel, sending ETH soaring to dizzying heights! 🚀

While Bitcoin has been busy shattering the $100K mark, Ethereum has been stuck in the shadows, looking a bit like the poor relation. But fear not, dear reader, for this could all change in the blink of an eye. With shorts at record highs, even a tiny spark – a major buyer, ETF approval, or a shift in sentiment – could trigger a chain reaction, sending ETH to new and dizzying heights. Is ETH on the verge of a GameStop moment? 🤔

Ethereum’s GameStop Moment?

It seems that the bears are playing a rather dangerous game, old bean. According to CFTC CME data, leveraged short positions have hit record lows, signaling an unprecedented wave of bearish bets. The chart reveals a historic buildup of shorts – setting the stage for a potential short squeeze that could catch traders off guard. Even the slightest bullish catalyst can trigger chaos when the market becomes this one-sided. 😱

In a post on X, Zerohedge points out that Ethereum’s CME short positions have soared to 11,341 contracts, jumping 40% in a week and an astonishing 500% since November. Hedge funds are piling into short positions, but if they’re wrong, the consequences could be brutal. A sudden shift – whether new ETF approval, institutional buying, or a sentiment reversal – could force bears to cover in a frenzy, driving ETH’s price sharply higher. 🚨

Ethereum Supply Shock Unfolding: A Massive Price Surge is Imminent

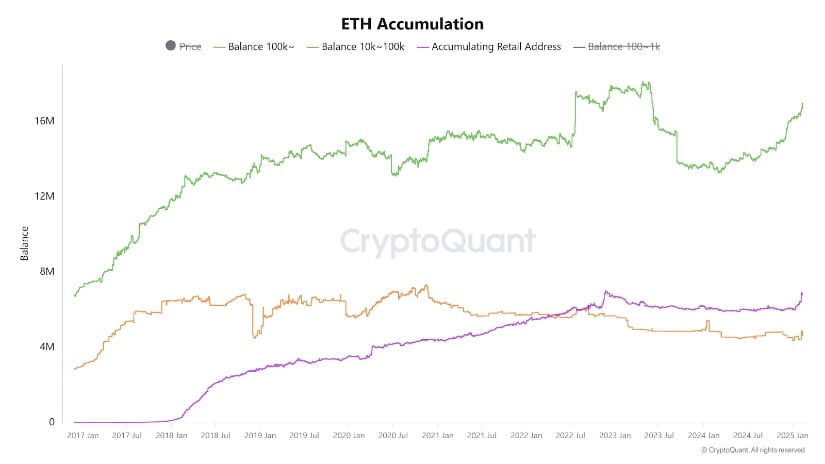

Despite Ethereum’s historic short positions reaching extreme levels, on-chain data shows that accumulation remains intact. While hedge funds aggressively bet against ETH, retail and mid-sized investors continue to stack coins, signaling confidence in the asset’s long-term potential. This growing demand, combined with excessive shorting, could set the stage for a major supply squeeze, forcing bears to cover their positions in a rush. 🚀

The image from CryptoQuant highlights the ongoing accumulation trend. The green line represents wallets holding between 10K and 100K ETH, which have been steadily increasing their balances. Retail investors, shown in purple, have also been accumulating consistently over time. This trend indicates that both mid-sized and smaller players are absorbing Ethereum, tightening available liquidity. If this continues, ETH could become highly susceptible to a supply shock, potentially triggering a sharp price surge. 💸

Short Sellers Beware: Short Liquidations Could Send ETH to $4000!

In a post on X, analyst CryptoPoseidon believes Ethereum’s shorts have been easily riding lower, but they now feel unsafe. The current levels suggest that bears may be in an uncomfortable position. As Ethereum pushes higher, the forced unwinding of short positions could accelerate, triggering cascading liquidations. Ethereum is already starting to find fresh support, and if it reverses higher, the move could be fueled by a historic short squeeze. If this momentum holds, any reversal attempt could swiftly take out key highs at $3,400, $3,800, and $4,000 – critical liquidity zones that could amplify Ethereum’s upside potential. 🚀

Adding to the volatility, Ethereum has an unfilled CME gap between $2,884 and $3,342, which could act as a magnet for price action. Historically, these gaps tend to be revisited, making them potential short-term targets. If Ethereum maintains its upward trajectory, a rapid move to close this gap could add even more pressure on short sellers, further fueling the rally and reinforcing ETH’s bullish structure. 🔥

BlackRock & Trump-Backed Fund Load Up on Ethereum!

BlackRock’s latest buying

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Gold Rate Forecast

- Every Minecraft update ranked from worst to best

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

2025-02-11 22:09