As a seasoned analyst with over two decades of experience in the financial markets, I must admit that watching the ETH/BTC ratio plummet to its lowest point since March 2021 has been quite intriguing. It’s like observing a game of cat and mouse, with Bitcoin consistently outperforming Ethereum in this race.

The ETH/BTC ratio, a metric measuring Ethereum’s price performance compared to Bitcoin, has reached its lowest point since March 2021. This development comes amid BTC’s brief rise to $98,000.

Over the past week, I’ve observed a 7.45% surge in the primary cryptocurrency. On the other hand, Ethereum, often referred to as an altcoin, seems to be maintaining its position within the same vicinity. This stability has sparked discussions among investors about the potential future trajectory of Ethereum, as some express apprehension about its long-term growth prospects.

Ethereum Continues to Lag Behind Bitcoin

As an analyst, in the month of February, I observed a significant surge in the ETH/BTC ratio, peaking at 0.060 – a yearly high. This spike sparked widespread speculation that Ethereum’s price might surpass Bitcoin’s, signaling the advent of an ‘altcoin season’. However, contrary to these expectations, Bitcoin’s price has persistently set new record highs, thus far failing to validate this assumption.

As a crypto investor, I’ve noticed an interesting contrast between Ethereum and Bitcoin. While Bitcoin has surged past its all-time high, Ethereum hasn’t managed to retest that level yet, even though it reached $4,000 earlier in the year. This difference in performance might be linked to various factors. For example, both digital currencies have had ETFs approved this year, but the impact seems different for each.

Despite Bitcoin receiving billions of dollars in investments, Ethereum’s ability to attract capital has been unpredictable. This inconsistency in institutional investment has propelled Bitcoin towards $100,000, resulting in a significant drop in the ETH/BTC ratio to approximately 0.033 – its lowest point in nearly four years.

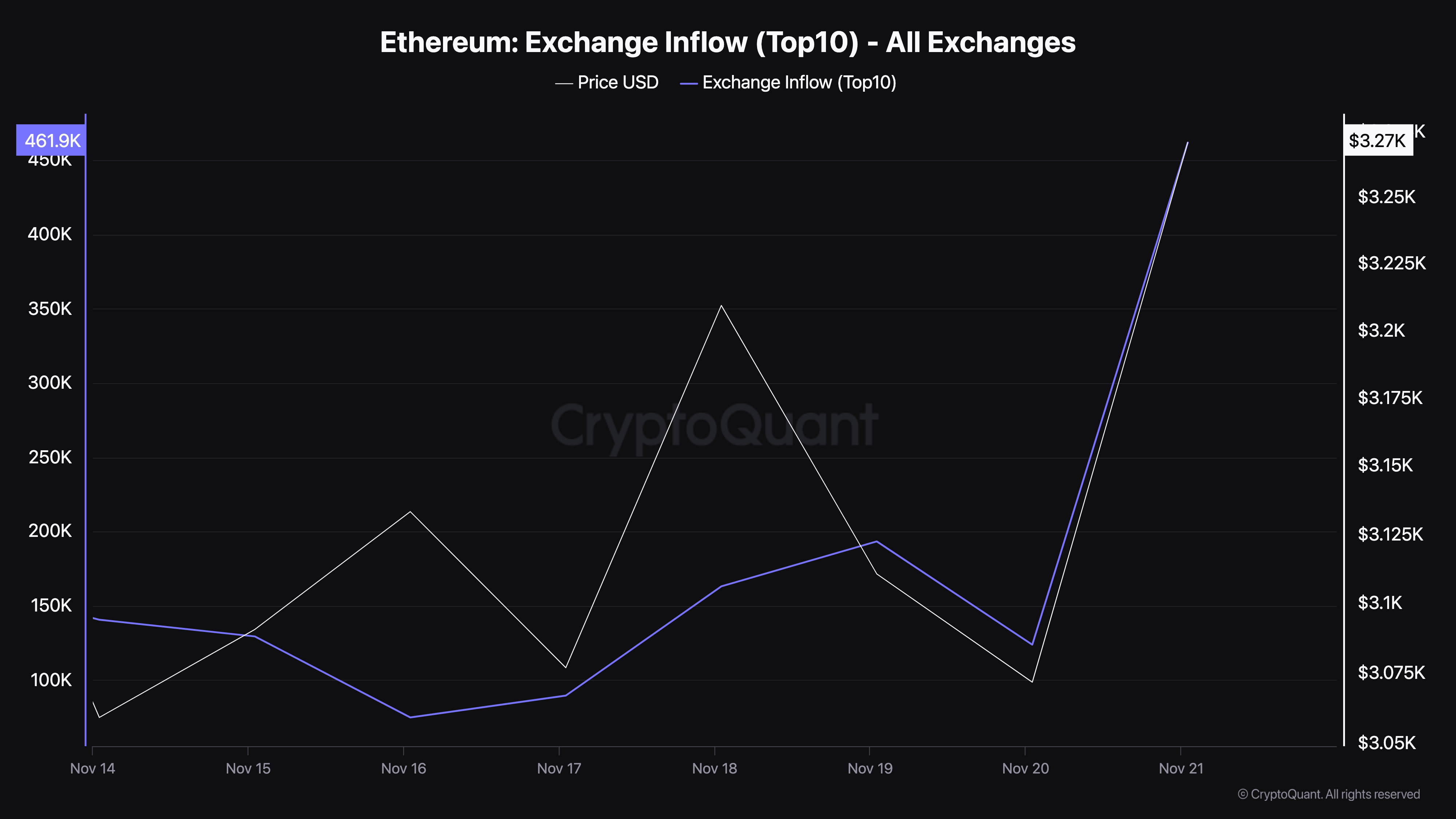

As a crypto investor, I’ve observed that Ethereum’s inconsistent performance can largely be linked to persistent selling pressure. To illustrate, data from CryptoQuant indicates that inflows of Ethereum into the top 10 exchanges have surged to around 461,900 ETH, which translates to approximately $1.50 billion at current prices.

This significant rise in incoming trades suggests that investors are making substantial deposits, which could signal a strong desire to offload Ethereum. These types of actions often boost the amount of ETH available for trading on exchanges, thereby increasing the chance of a price decrease.

Conversely, when the flow of exchange inflows is low, it usually suggests that investors are keeping their assets, a situation that does not align with the current circumstances for ETH.

ETH Price Prediction: Crypto Could Retrace

Currently, ETH is being traded at $3,317, marking a rise compared to yesterday’s closing price. However, it remains under the Parabolic Stop And Reverse (SAR) indicator. This technical analysis tool creates a sequence of dots that follow the price trend. In an upward trend, these dots are positioned below the price, while in a downward trend, they are above the price.

A “shift” or change in direction of the dots – moving from one position to another – frequently hints at a possible change in trend. In this case, the indicator sits above Ethereum’s current price, implying that the cryptocurrency might soon reverse its recent positive movements.

If the ETH/BTC rate decreases, it’s possible Ethereum’s price may drop to around $3,083. But if there’s strong demand for buying Ethereum, this could be averted, potentially causing its value to soar past $3,500 and heading towards $4,000 instead.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- WrestleMania 42 Returns to Las Vegas in April 2026—Fans Can’t Believe It!

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- How a 90s Star Wars RPG Inspired Andor’s Ghorman Tragedy!

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

2024-11-21 18:46