Ethereum (ETH) has been on a wild ride, hasn’t it? Spending most of February in a narrow price range, struggling to gain momentum, and then, bam! The market-wide downturn triggered by Donald Trump’s trade policies sends ETH to multi-month lows. 😱

With bearish sentiment on the rise and ETH struggling to regain strength, investors are left wondering: will March bring further declines or a potential rebound? 🤔

ETH Struggles as Supply Grows and Selling Pressure Mounts

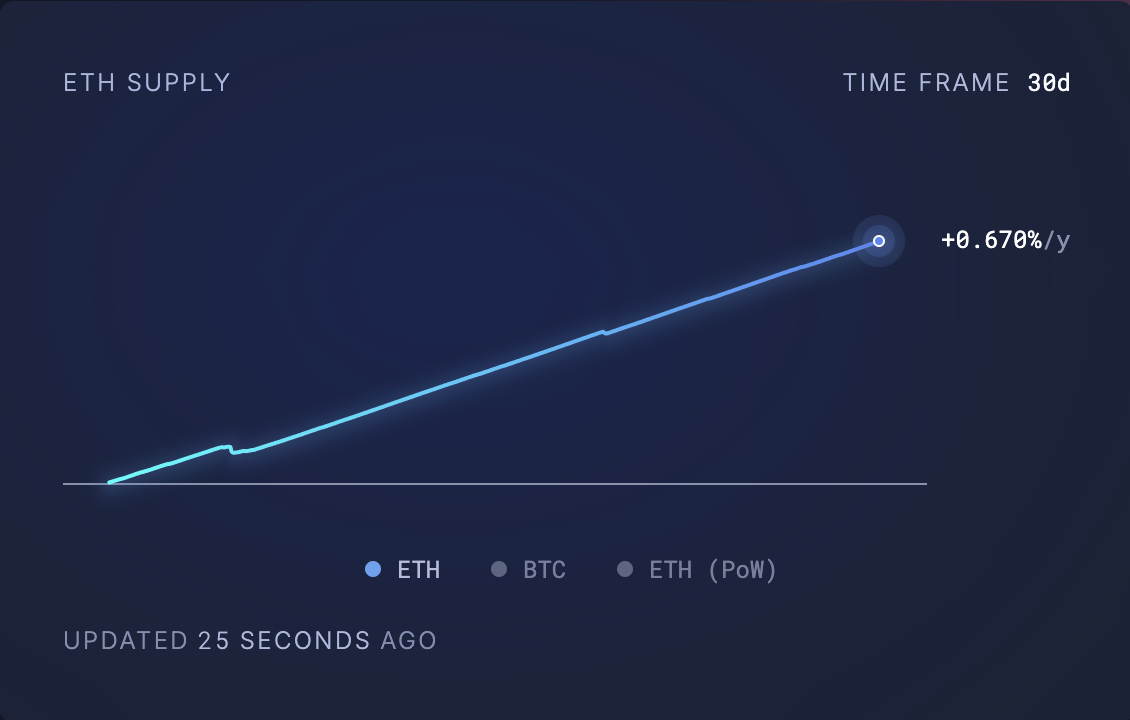

The steady surge in ETH’s circulating supply is causing quite a stir among market participants in March. According to Ultra Sound Money, 66,350 ETH coins, valued above $138 million at current market prices, have been added to the altcoin’s circulating supply in the past 30 days. 😲

When more ETH tokens enter circulation, the overall supply available for purchase increases. If demand fails to keep pace, this surge in supply can exert downward pressure on the coin’s price as more tokens become available for selling. 📉

With a lack of strong buying interest to absorb the excess supply, this trend suggests ETH could face sustained weakness through March. 😞

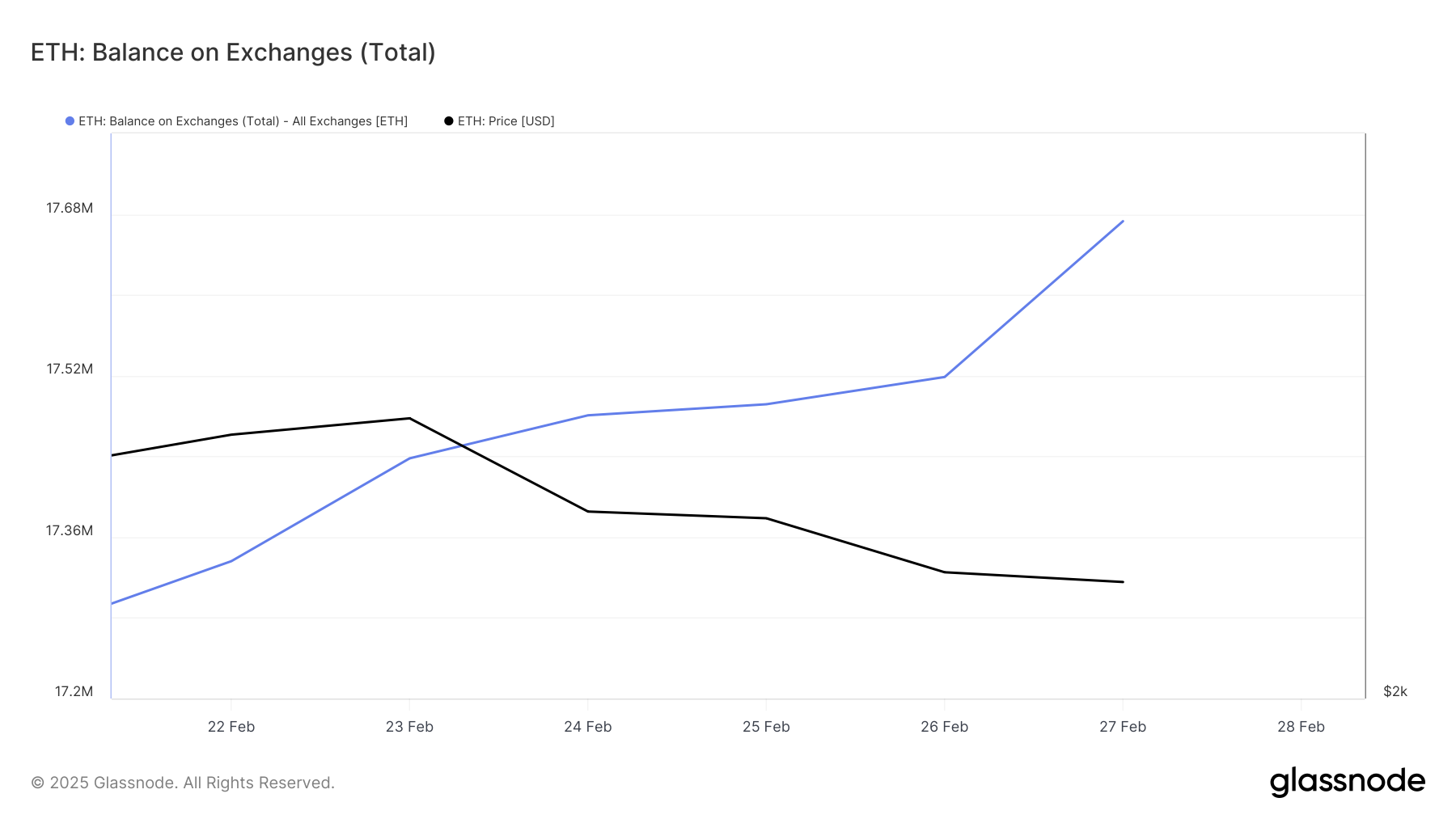

Moreover, ETH’s rising exchange balance is another reason to worry. After it plummeted to a year-to-date low of 17.27 million ETH on February 21, it has since rocketed. At press time, 17.67 million ETH coins are held on exchange wallet addresses, climbing 2% over the past seven days. 📈

ETH’s exchange balance tracks the number of coins held on exchange addresses. When this balance spikes, a large amount of ETH is being moved onto exchanges, often signaling that holders are preparing to sell. 💸

This increase in sell-side liquidity has added to the downward pressure on the coin’s price, especially as selling activity continues to outweigh buying demand. If sustained in the coming days, it will worsen bearish sentiment, as more traders will look to offload holdings rather than accumulate, exacerbating the price decline. 📉

A Buying Opportunity?

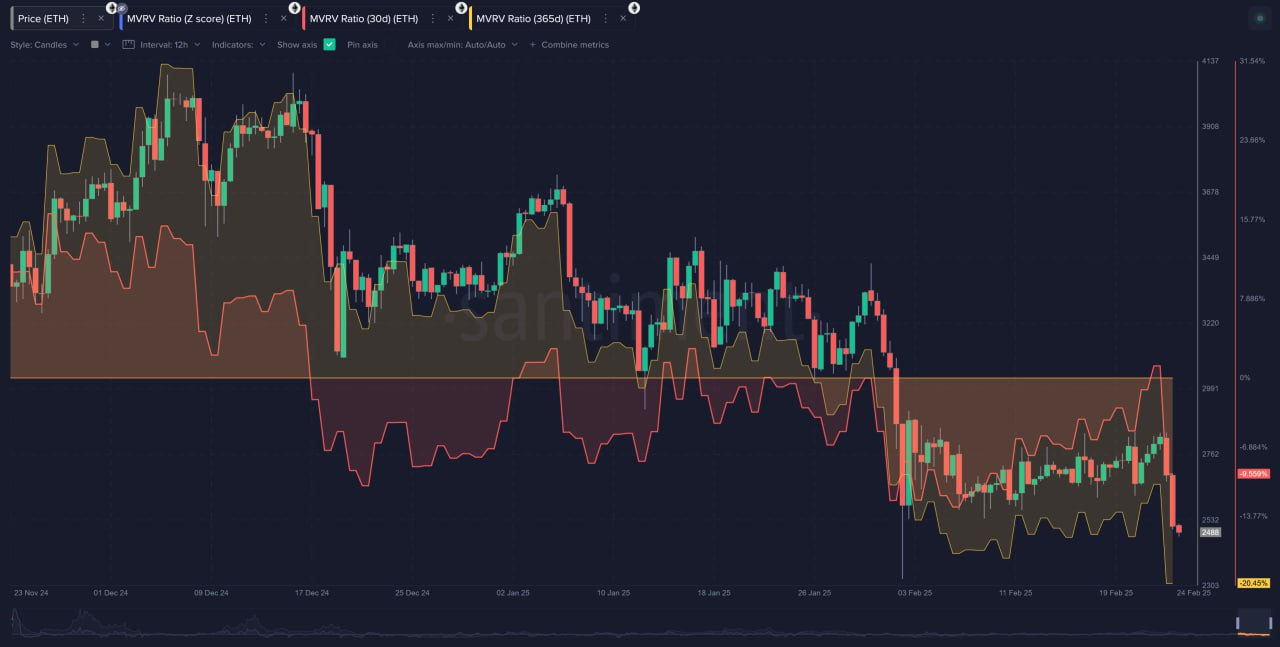

Despite ETH’s performance, some analysts believe this could present a buying opportunity for those looking to book gains in March. In an interview with BeInCrypto, Santiment analyst Brian Quinlivan opined that ETH’s current price levels may offer an attractive entry point for long-term investors.

According to Quinlivan, both short-term and long-term ETH holders are deeply in the red, a condition rarely seen among the top 50 cryptocurrencies. Historically, such moments of capitulation have preceded major price rebounds, as accumulation from large investors tends to follow periods of heavy selling.

“The asset (ETH) can be one of the better performers in 2025 due to its underwhelming performance in 2023 and 2024 relative to other alts and top caps. Both the short-term and long-term holders for Ethereum are well into the negatives, which isn’t the case for most top 50 tokens. So adding on to your position is doing so during a de-risked time compared to the average moment in ETH’s history,” Quinlivan noted.”

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-28 18:57