In a week that could star in a Mel Brooks spoof, crypto ETFs went through a money-merrier of a sprint as bitcoin and ether staged a dramatic exit, leaving the audience wondering if the risk bucket ever took a vacation. Solana stayed surprisingly spry, and XRP slipped into its first weekly net outflow since launch. Grab your popcorn, folks-it’s a financial farce with a punchline!

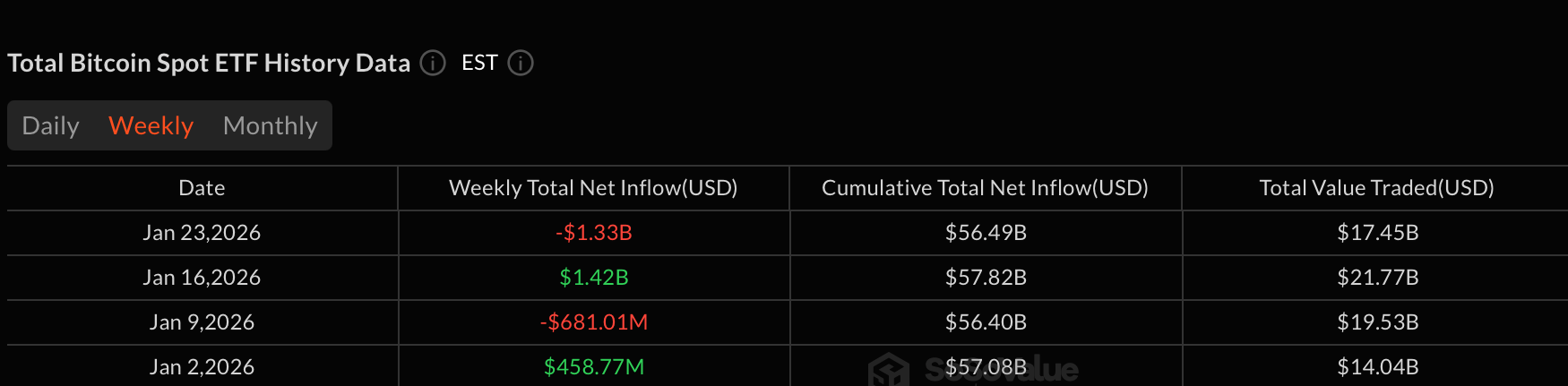

Rout Deepens for ETFs as Bitcoin Posts $1.33 Billion Weekly Outflow

The selling pressure that defined the week after the U.S. market holiday on Jan. 19 never truly let up. From January 19 to January 23 (ET), crypto ETFs faced one of their most punishing stretches of the new year, with risk appetite fading sharply across the largest products.

Bitcoin spot ETFs recorded $1.33 billion in net outflows, marking the second-largest weekly exit on record. Losses were led by Blackrock’s IBIT which shed $537.49 million over the week as institutional selling remained heavy. Fidelity’s FBTC followed closely with $451.50 million in redemptions, confirming that even the most liquid vehicles were not immune.

Grayscale’s GBTC continued its steady bleed, losing around $172 million, while Ark & 21Shares’ ARKB and Bitwise’s BITB posted weekly outflows near $76 million and $66 million, respectively. Smaller but persistent exits were also seen from Franklin’s EZBC (-$10.36 million), Valkyrie’s BRRR (-$7.59 million), and Vaneck’s HODL (-$6.3 million). The persistent outflows throughout the week cemented a decisive risk-off tone.

Ether spot ETFs fared little better, posting $611.17 million in net outflows. Blackrock’s ETHA accounted for the bulk of the damage with approximately $431.50 million in weekly redemptions. Fidelity’s FETH lost about $78 million, while Bitwise’s ETHW gave up roughly $46 million.

Grayscale’s ETHE saw net weekly losses of around $52 million, though its Ether Mini Trust partially offset pressure with a decent $17.82 million net inflow. Vaneck’s ETHV rounded out the red with nearly $10 million in exits.

XRP ETFs recorded $40.64 million in net outflows, their first negative week since launch. Grayscale’s GXRP was the primary drag, losing more than $55 million, which overwhelmed steady inflows into Franklin’s XRPZ, Bitwise’s XRP, and Canary’s XRPC that together added just over $15 million.

Solana ETFs were the rare bright spot. Despite volatile conditions, they finished with $9.57 million in net inflows. Fidelity’s FSOL led contributions with $5.28 million, supported by steady demand for Bitwise’s BSOL, Vaneck’s VSOL, and Grayscale’s GSOL, comfortably offsetting a small pullback from 21Shares’ TSOL.

Overall, the week underscored a sharp reset in crypto ETF positioning. Bitcoin and ether absorbed heavy institutional exits, while Solana showed resilience and XRP hit its first real test, signaling a market still searching for firm footing.

FAQ 📉

- Why did crypto ETFs see heavy outflows this week?

institutional investors decided to roll out the red carpet for risk-off-think of it as the “crowd leaving the party” edition of finance. - How large were Bitcoin ETF outflows?

Bitcoin spot ETFs lost $1.33 billion, the second-largest weekly outflow on record. - What happened to Ether and XRP ETFs?

Ether ETFs shed over $611 million, while XRP posted its first weekly net outflow since launch. - Which crypto ETF showed resilience?

Solana ETFs stood out, posting $9.57 million in net inflows despite market stress.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-01-26 22:37