In the vast, unrelenting theater of capital, where fortunes rise and fall like the tides of some inscrutable cosmic will, Frisch Financial Group, Inc. has enacted a quiet but significant reduction in its holdings of Direxion NASDAQ-100 Equal Weighted Index Shares (QQQE). The firm, a custodian of wealth in the New York strongholds of finance, divested 45,311 shares-$3.89 million in value-during the third quarter of 2025, as disclosed to the SEC. Such acts, though seemingly mundane, are but threads in the loom of market philosophy, weaving narratives of caution, ambition, and the eternal struggle between order and chaos.

What Happened

On November 7, 2025, the Securities and Exchange Commission bore witness to a transaction that, in the annals of financial history, may one day be cited as a moment of quiet introspection. Frisch Financial, having held 180,506 shares of QQQE by quarter’s end, reduced its stake by nearly a quarter, leaving the position valued at $18.34 million. This was no mere arithmetic adjustment but a statement-a recalibration of faith in the equal-weighted doctrine amid the tempest of market forces. The price of QQQE, $101.08 on that date, bore the faint scars of a year’s labor, rising 8.12% yet trailing the S&P 500 by 3.88 percentage points, a subtle rebuke to the egalitarian ideals of its construction.

What Else to Know

The divestment diluted QQQE’s presence in Frisch’s portfolio to 4.27% of reportable assets, a retreat that speaks volumes of the firm’s evolving priorities. Among its top holdings, JPST, RSP, VTV, BINC, and GOOGL stood as pillars of a more concentrated strategy, their percentages etched into the ledger of capital allocation like hieroglyphs in a temple of commerce. Yet one wonders: does this shift reflect a pragmatic recalibration or a deeper existential doubt in the equal-weighted creed? The question lingers, as heavy as the air before a storm.

Company Overview

| Metric | Value |

|---|---|

| AUM | N/A |

| Dividend Yield | 0.58% |

| Price (as of market close 11/07/25) | $101.08 |

| 1-Year Total Return | 8.12% |

Company Snapshot

- The fund’s strategy, an equal-weighted replication of the NASDAQ-100, is a rebellion against the tyranny of market capitalization-a democratic ideal in a world governed by Darwinian forces.

- By allocating capital evenly across 100 constituents, it seeks to temper the volatility of single-stock dominance, yet this very discipline may stifle the exuberant growth that defines the tech behemoths of our age.

- As a non-diversified ETF, it walks a tightrope between balance and risk, a paradox that invites both admiration and skepticism.

Direxion NASDAQ-100 Equal Weighted Index Shares (QQQE), with its $1.21 billion market cap, stands as both a monument to egalitarian finance and a cautionary tale. Its architects envisioned a world where no single stock, not even the titans of Silicon Valley, could cast a shadow over the collective. Yet in practice, this idealism may clash with the relentless logic of compounding returns, a force as indifferent as gravity.

Foolish Take

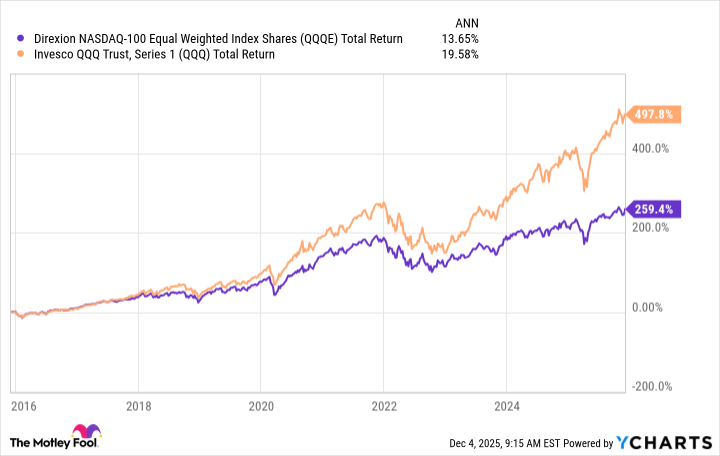

In the wake of Frisch’s filing, one is compelled to ponder the folly of averages. The QQQE, with its equal-weighted embrace of the NASDAQ-100, offers a counterpoint to the QQQ’s megacap hegemony. Where the latter bows to the altar of scale-Nvidia, Microsoft, Apple-the former grants each stock, from Biogen to Lululemon, a voice in the chorus. Yet history, that unyielding judge, has shown the QQQ’s 19.6% CAGR over a decade to be a formidable rival to the QQQE’s 13.7%. Is this disparity a condemnation of egalitarianism, or a testament to the inevitability of hierarchy in markets?

In this grand experiment, the investor is left to grapple with a paradox: the comfort of balance versus the allure of outsized returns. To choose equal weighting is to reject the chaos of concentration, yet in doing so, one may forsake the very forces that drive markets upward. It is a choice as old as civilization itself-a tension between order and progress, between the wisdom of the crowd and the audacity of the few.

Glossary

Exchange-Traded Fund (ETF): A vessel through which the masses sail the seas of speculation, its hull built of stocks, bonds, or other assets.

Equal Weighted Index: A construct of fairness, where each constituent is granted equal sway, regardless of size or might.

13F Reportable Assets: The secrets whispered quarterly to the SEC, revealing the holdings of those who command over $100 million in capital.

Assets Under Management (AUM): The measure of a firm’s dominion, a number that swells or withers with the tides of investor sentiment.

Non-diversified ETF: A gamble dressed in the garb of prudence, its bets concentrated enough to thrill, scattered enough to pretend otherwise.

Core Satellite Holding: A strategy as old as the stars-a central anchor, flanked by wandering moons of opportunity.

Dividend Yield: The whisper of corporate generosity, measured against the roar of capital gains.

Total Return: The sum of all victories and losses, a ledger of what remains when the dust settles.

Large-Cap Equities: The bedrock of stability, though stability itself is but a fleeting illusion.

Constituent: A member of the chorus, whether soloist or footnote.

Single-Stock Risk: The peril of placing too much faith in one name, one vision, one gamble.

Reportable Assets: The truths that must be spoken, though the silence between the lines often tells the fuller story.

And so, as the markets turn another page in their endless saga, we are left to wonder: does the equal-weighted ideal offer a path to redemption in a world ruled by power laws, or is it merely a noble delusion? The answer, perhaps, lies not in the numbers alone, but in the human spirit that seeks meaning within them. 🤔

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Weight of Choice: Chipotle and Dutch Bros

- The Best Actors Who Have Played Hamlet, Ranked

2025-12-04 17:52