Though the three great indices of the American market-S&P 500, Nasdaq Composite, and Dow Jones-ascend in their annual dance, not all stocks partake in the mirth. Among the stragglers, Energy Transfer (ET) lingers, its price a shadow cast by the sun of 2025. By September 9, it had waned 13%, a quiet lament in the symphony of market triumphs.

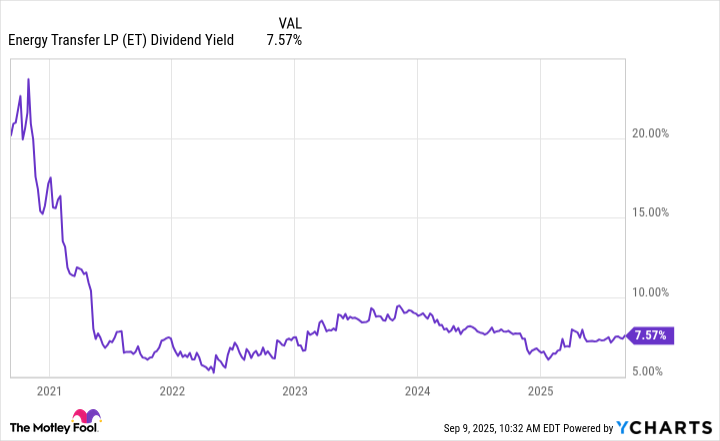

Yet in this decline, a curious paradox emerges. Energy Transfer’s dividend, a sonorous note in the cacophony of financial uncertainty, sings with a yield surpassing 7.5%, a melody sixfold the S&P 500’s average. One might argue it is not the stock’s ascent that captivates, but the steadfastness of its payout-a relic of an era when capital spoke in certainties rather than conjectures.

The Midstream Realm: A Quiet, Steady Heart

Energy Transfer dwells in the midstream, that unassuming corridor between the upstream’s feverish exploration and the downstream’s polished commerce. Here, the company’s role is neither grand nor glamorous: it transports, stores, and processes the lifeblood of industry-natural gas, crude oil, and the nascent LNG. Like a river’s current, it flows with the rhythm of necessity, unshaken by the tempests of commodity prices.

The upstream, ever the restless dreamer, chases the horizon of discovery, while the downstream, a shrewd merchant, trades in the fruits of labor. The midstream, however, is the patient scribe, its income secured by long-term contracts, its fate tethered not to the whims of the market, but to the immutable laws of infrastructure.

This is the domain of Energy Transfer, where the hum of pipelines and the clink of storage tanks form a lullaby of stability. Its business model, a tapestry of enduring agreements, ensures that even in the harshest seasons, cash flows with the regularity of the tides.

The Dividend: A Song Unbroken

In the realm of limited partnerships, where the structure of enterprise is a delicate dance of tax evasion and distribution, Energy Transfer’s dividend stands as a monument. Unlike the corporate colossi, which hoard earnings in their vaults, LPs pass the torch to investors, their payouts a testament to the old adage: “To each according to their share.”

Its yield, a siren’s call to the income-seeker, has not faltered below 5.2% in five years-a feat as rare as a snowfall in July. This is no mere number, but a covenant, a promise etched in the ledger of time. The dividend, tied not to the fickle whims of earnings, but to distributable cash flow, is a compass in the storm.

Even in the shadow of the pandemic, when many LPs faltered, Energy Transfer’s DCF endured, a steady flame in the dark. This resilience, born of prudent management and a balance sheet honed to perfection, is the hallmark of a company that knows the weight of its own legacy.

The Balance Sheet: A Fortress Rebuilt

In the second quarter, Energy Transfer’s DCF attributable to partners fell to $1.96 billion, a modest decline from the previous year’s $2.04 billion. Yet the company, with the air of a man who has weathered storms, declares itself “at its strongest financial position in partnership history.” This is no idle boast, but a truth etched in the meticulous pruning of its liabilities.

Operationally, the quarter bore fruit in unexpected abundance: gas gathering surged 10%, crude transport 9%, and NGL exports 5%. These figures, though modest in their presentation, are the seeds of a future where growth is not a gamble, but a certainty.

With $5 billion earmarked for 2025’s growth projects-Permian Basin expansions, pipelines, and NGL infrastructure-Energy Transfer moves with the deliberation of a craftsman. Its investments, though unflashy, are the bedrock of a long-term vision, a testament to the patience of those who understand that true prosperity is not a spark, but a flame sustained.

Thus, the company stands as a relic of a bygone age, its dividends a reminder of an era when capital was a virtue, not a weapon. For the investor with the patience of a sage, it offers not a fleeting thrill, but a quiet, enduring promise-a melody that, like the seasons, shall return.

🌿

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

- Why Nio Stock Skyrocketed Today

- Gold Rate Forecast

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- EUR TRY PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-09-15 10:37