As a seasoned analyst with years of experience navigating the tumultuous world of cryptocurrencies and their associated regulations, I must say that the situation surrounding Tether (USDT) in Europe is both intriguing and concerning.

Although Coinbase has stopped trading USDT in preparation for MiCA, platforms like Binance and Crypto.com are still dealing with the stablecoin, waiting for guidance from regulators. There’s a lot of discussion online about Tether’s future in Europe, and concerns persist about USDT’s adherence to the EU’s stringent regulations and its possible effect on crypto market liquidity.

Coinbase’s Proactive Delisting

The initial indication of potential issues for USDT in Europe surfaced earlier this month when Coinbase, a prominent U.S. exchange, removed Tether from its services for EU customers due to compliance concerns in anticipation of MiCA regulations. This action generated widespread discussion within the cryptocurrency community, with some participants praising the cautious stance, while others opined that Tether’s future should be determined based on explicit directives from European regulators.

Although Coinbase has taken a step, no European Union authority has officially declared Tether as non-compliant with its standards. The Markets in Crypto Assets (MiCA) regulation sets stringent rules for stablecoin issuers, such as obtaining e-money licenses, maintaining reserves in reputable banks, and providing comprehensive disclosures. Yet, the European Securities and Markets Authority (ESMA) has not yet verified whether Tether adheres to or falls short of these requirements.

Exchanges in ‘Wait-and-See’ Mode

Other prominent cryptocurrency exchanges, such as Binance and Crypto.com, have chosen to proceed with caution, whereas Coinbase acted swiftly. These exchanges are still offering USDT to their EU customers, seemingly waiting for clear instructions from European regulators before implementing similar measures as Coinbase. Some financial experts predict that these platforms might opt for a gradual removal of USDT (if necessary) in order to minimize potential market disturbances.

Juan Ignacio Ibañez, a part of the Technical Committee for the MiCA Crypto Alliance, points out that while no regulators have explicitly declared USDT as non-compliant, it doesn’t automatically mean it is. He further suggests that varying actions taken by exchanges—some choosing to delist immediately, others waiting for definitive statements—could potentially cause temporary confusion. Reports indicate that numerous European exchanges might remove Tether from their platforms by December 30th. Nevertheless, no concrete deadline has been announced by ESMA or any other EU regulatory body.

Implications for Liquidity and Market Stability

USDT (Tether), the most valued stablecoin by market capitalization, has been a vital source of liquidity on digital asset exchanges for quite some time. Removing it from significant European trading platforms might substantially impact cross-border transactions, arbitrage possibilities, and overall market depth. Numerous crypto traders frequently use USDT pairs to effortlessly switch between cryptocurrencies and assets resembling fiat money, particularly during periods of intense volatility.

Experts caution that if USDT (Tether) vanishes from European trading platforms, traders might shift towards options such as Circle’s USDC (USD Coin), which has an e-money license in the EU, or Euro-backed stablecoins. This change could bring new challenges, like higher transaction fees, limited trade options, or reduced liquidity. Pascal St-Jean, CEO of 3iQ Corp., a crypto asset management firm, emphasizes Tether’s importance by stating that “the majority of cryptocurrency assets are traded in pairs against USDT.

Regulatory Hurdles and Transitional Phases

According to MiCA regulations, stablecoin issuers must obtain licenses and keep their reserves open and visible. The implementation period of these rules finishes on December 30, 2024, but there’s a 18-month “grandfathering” period that could push compliance deadlines to around mid-2026 for certain organizations. During this transition phase, providers already in operation under national laws within EU member states can keep offering their services while they work towards full authorization.

The European Securities and Markets Authority (ESMA) has made public a document outlining various EU countries’ strategies for implementing these interim steps, with certain nations providing as long as 18 months of “grandfathering” while others opt for durations ranging from six to twelve months. This mix of transitional phases may result in differing tactics among member states, potentially adding to the complexity and inconsistencies within the stablecoin sector.

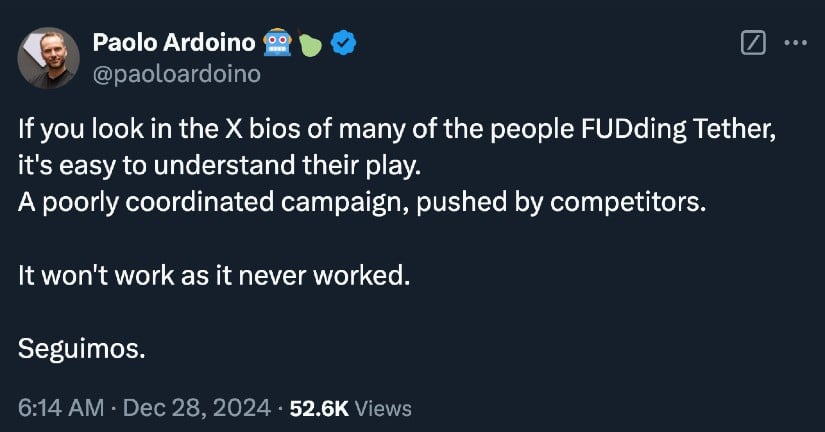

Social Media Speculation and Corporate Response

In the midst of regulatory confusion, there’s been a lot of chatter in crypto communities and social media about potential removal of Tether ($USDT) from EU trading platforms imminently. An influential figure on Twitter with the handle “@RippleXrpie” posted a comment suggesting that $USDT would be removed from EU exchanges by December 30, implying another stablecoin could take its place. Despite this speculation causing worry and apprehension, no official pan-EU mandate for delisting has been made public yet.

Paolo Ardoino, head of Tether, consistently brushes off speculation as a coordinated attempt by rivals and critics, labeling it as unsubstantial. The firm maintains that its reserves are safe and that they are working diligently to meet regulatory requirements on a global scale. However, unlike its competitor Circle, which became compliant with MiCA regulations in mid-2024, Tether has not yet secured the necessary license required by MiCA for stablecoin issuers.

Past Scrutiny and the ‘Too Big to Fail’ Debate

For quite some time, Tether has been under scrutiny due to concerns about the clarity of its reserve disclosures, with certain parties doubting the thoroughness of its audits. The firm has encountered legal disputes and penalties from multiple regulatory bodies over the years, but it has persisted in growing its global footprint. Given its reported market capitalization surpassing $138 billion at one point, some financial experts suggest that Tether has attained a “too large to collapse” position within the broader cryptocurrency industry.

Critics argue that no stablecoin can avoid future regulations if it doesn’t comply with evolving standards, using the EU’s strong legal system as proof that stricter supervision is imminent. Some believe Tether’s past durability may help it navigate its current challenges, especially since it’s putting money into European businesses like Quantoz and StablR to boost its presence in Europe.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2024-12-28 14:38