My Aunt Millie, God love her, once tried to explain compound interest to me using a collection of porcelain thimbles. It didn’t take. I was more interested in the tiny, chipped roses painted on them. But lately, I’ve been thinking about thimbles, and about Enbridge (ENB 0.81%), and the unsettling realization that maybe, just maybe, I’ve been approaching wealth-building all wrong. I always pictured it involving yachts and a complete disregard for price tags. Turns out, it might just be about consistently buying more…stuff. Like, consistently buying more Enbridge.

They’re a Canadian midstream energy company, which sounds…robust. And boring. Like a sensible pair of orthopedic shoes. But they move oil and gas, and natural gas, and they’re also dipping a toe into renewable power. All this translates to something called “reliable cash flow,” which, to a person like me, sounds suspiciously like actual money. They’ve been increasing their dividend for thirty years, which is a streak even my grandmother’s bridge club hasn’t managed. It’s…consistent. Like a metronome, but for your bank account.

The current yield is around 5.7%, which, frankly, feels almost indecently high. I keep expecting someone to tell me there’s a catch. Like they’re secretly powered by unicorn tears or something. They’re aiming for about 3-5% dividend growth in the coming years. So, if you do the math—and I generally avoid math like a tax audit—you’re looking at a potential total return of around 10%. Which, as far as I can tell, is what people generally expect from the S&P 500 (^GSPC 0.43%).

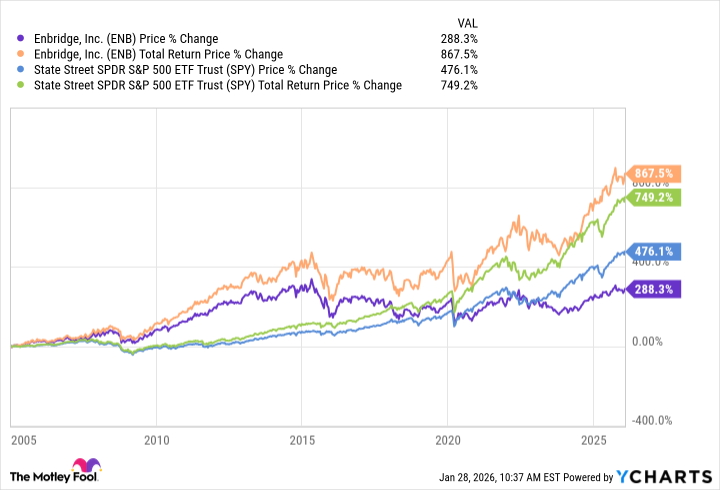

Here’s the thing. I looked at a chart. Charts intimidate me. They look like someone tried to predict the future with a Spirograph. But this chart showed Enbridge versus an S&P 500 ETF over the last twenty years. The ETF did better if you just looked at stock price. But! If you factored in dividend reinvestment—that is, taking the money they give you and buying more Enbridge—suddenly, it looked like Enbridge was the one having the last laugh. It’s a slow burn, a methodical accumulation. It’s…unsettlingly effective.

I’ve always been a “growth investor,” which is a fancy way of saying I chase shiny objects. I want the stock to go up, dramatically, immediately. But this dividend reinvestment thing…it’s like building a little army of shares. It’s less glamorous, certainly. No overnight riches. But it’s strangely comforting. Especially during a bear market, when everyone else is panicking and selling. You’re just quietly buying more, like a squirrel preparing for a particularly harsh winter.

I imagine my Aunt Millie would approve. She always said the best way to build wealth was to be frugal and consistent. She also collected porcelain thimbles, so maybe her judgment was questionable. But still. Enbridge isn’t exciting. It’s not going to make headlines. But it might just be the thing that allows me to finally afford a slightly less chipped set of teacups. And that, frankly, feels like a win.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 9 Video Games That Reshaped Our Moral Lens

2026-01-31 11:52