- Ah, the grand spectacle of Bitcoin‘s meteoric rise! A veritable feast for the financial gluttons!

- El Salvador, the little country with a big Bitcoin heart, has become the star of this absurd play.

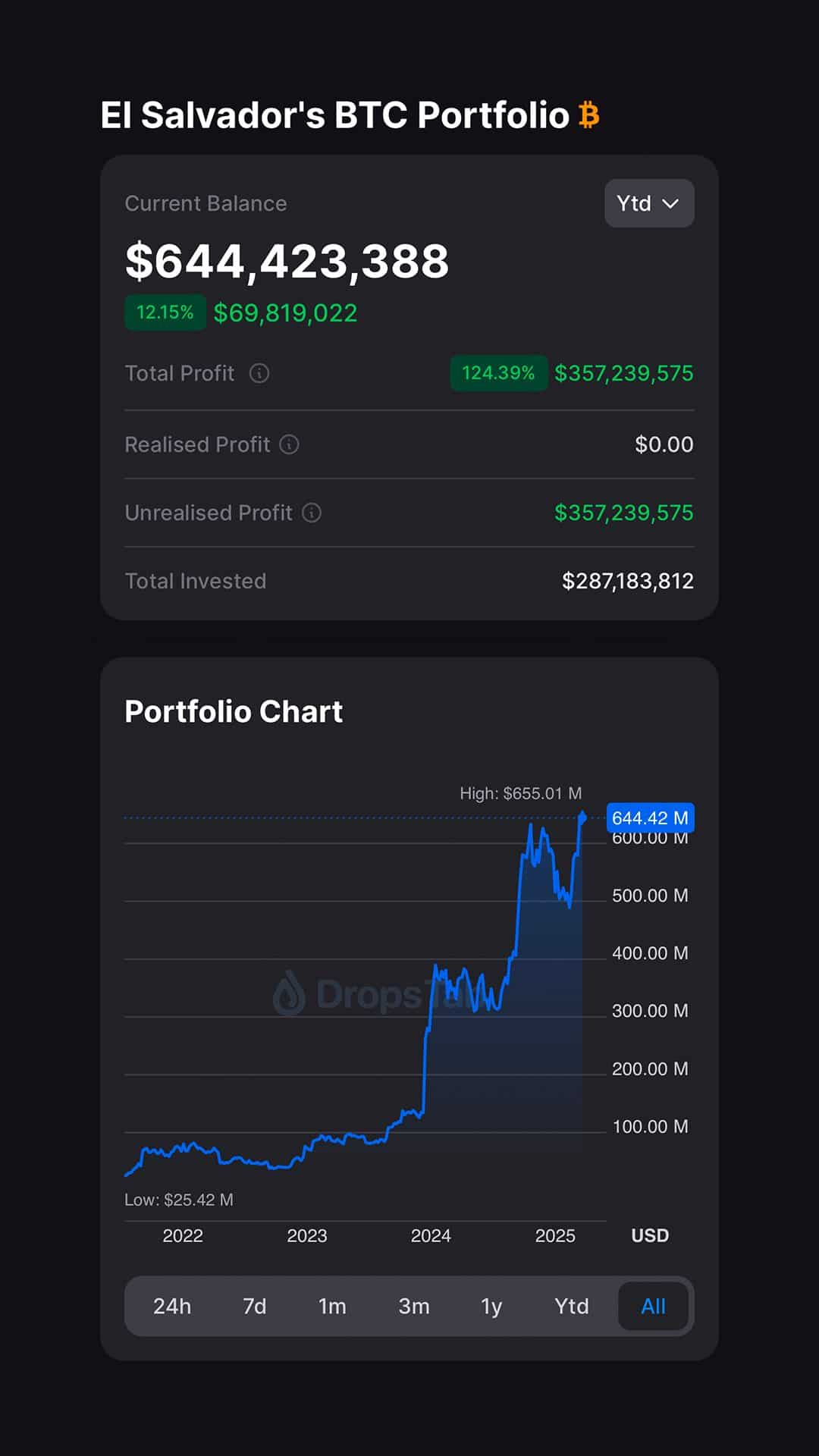

While the world was busy wringing its hands over Bitcoin’s wild swings, El Salvador was busy transforming faith into fortune. With a treasure trove of approximately 6,181 BTC, the nation now boasts a staggering $636 million in digital gold. Who knew conviction could be so lucrative? 💸

According to the oracle known as AMBCrypto, this might just be the most tantalizing hint for governments pondering their own BTC escapades. Who needs a crystal ball when you have Bitcoin?

From volatility to victory: The ROI of conviction

President Nayib Bukele, the maestro of this financial symphony, took to X (formerly Twitter) to announce that their Bitcoin bounty has ballooned by over $357 million in unrealized profits. The total value? A jaw-dropping $644 million! Talk about a plot twist! 🎭

With an initial investment of $287 million, they snagged BTC at a mere $46,433 per coin. Timing is everything, and it seems they hit the jackpot right between late 2023 and early 2024. Who needs luck when you have strategy?

Why does this matter, you ask? In less than two years, El Salvador’s Bitcoin venture has skyrocketed by 124.39%. It’s a testament to the idea that sometimes, holding onto your beliefs can lead to a windfall in the wild world of crypto.

Of course, El Salvador isn’t the only player in this game. Corporations like MicroStrategy (MSTR) are also riding the Bitcoin wave. But for a nation-state, the stakes are as high as a kite in a windstorm!

Despite the naysayers and the ever-watchful IMF, El Salvador has clung to its Bitcoin strategy like a cat to a warm windowsill. And now, with profits piling up like laundry on a Sunday, their position is a case study in how Bitcoin’s volatility is no longer a deterrent but a daring dance of opportunity.

Reframing risk: Bitcoin’s volatility as a strategic advantage

Volatility has long been the red flag waving in the face of sovereign reserves — too risky, too unstable, and far too frightening for the faint-hearted central banks. But El Salvador is flipping that narrative like a pancake on a Sunday morning! 🥞

With an average entry price of around $46,000, the country is now basking in a 124% return in under two years. A performance that makes traditional reserve assets look like a snail in a race!

Even Gold [XAU], the old reliable, has only managed a paltry 59% return in the same timeframe. Oh, how the mighty have fallen!

Clearly, Bitcoin’s volatility is no longer a weakness. It’s a strategic advantage, a golden ticket that savvy investors are starting to cash in on. As conviction grows and supply tightens, the aggressive profit-takers are fading into the background, bringing the market tantalizingly close to a new all-time high. Will they reach it? Only time will tell! ⏳

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Summer Game Fest 2025 schedule and streams: all event start times

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

2025-05-20 08:14