As a seasoned analyst with over two decades of experience in global finance and technology, I find this development by NexBridge Digital Financial Solutions and Bitfinex Securities to be not just revolutionary but also a significant stride towards democratizing financial services.

Soon, El Salvador will introduce its initial regulated offering of tokenized U.S. Treasury Bills (T-Bills), making it possible for individuals and entities that were formerly excluded to invest in this financial instrument.

In collaboration with Bitfinex Securities, the nationally-licensed digital financial solution provider, NexBridge, is launching a fresh product offering.

Bitfinex Securities Want to Raise $30 Million for the Tokenized T-Bill

Starting from next Tuesday and ending on November 29th, the subscription window for this offering will be open. Interested investors have the option to acquire tokens by utilizing Tether’s stablecoin (USDT), while it has been announced that bitcoin (BTC) will also be accepted in the future purchasing process.

Once the subscription period ends, the tokens can be traded on Bitfinex Securities’ secondary market using the ticker symbol USTBL. These tokens will have their value linked to BlackRock’s short-term Treasury bond ETF. Bitfinex Securities plans to generate a minimum of $30 million through this project by offering these tokens for trade.

In a recent press statement, Michele Crivelli, founder of NexBridge, noted that by utilizing Bitcoin’s technology and foundation, they aim to establish a universally accessible financial system. This innovative approach will make it possible for investors across the globe to invest in tokenized U.S. Treasuries.

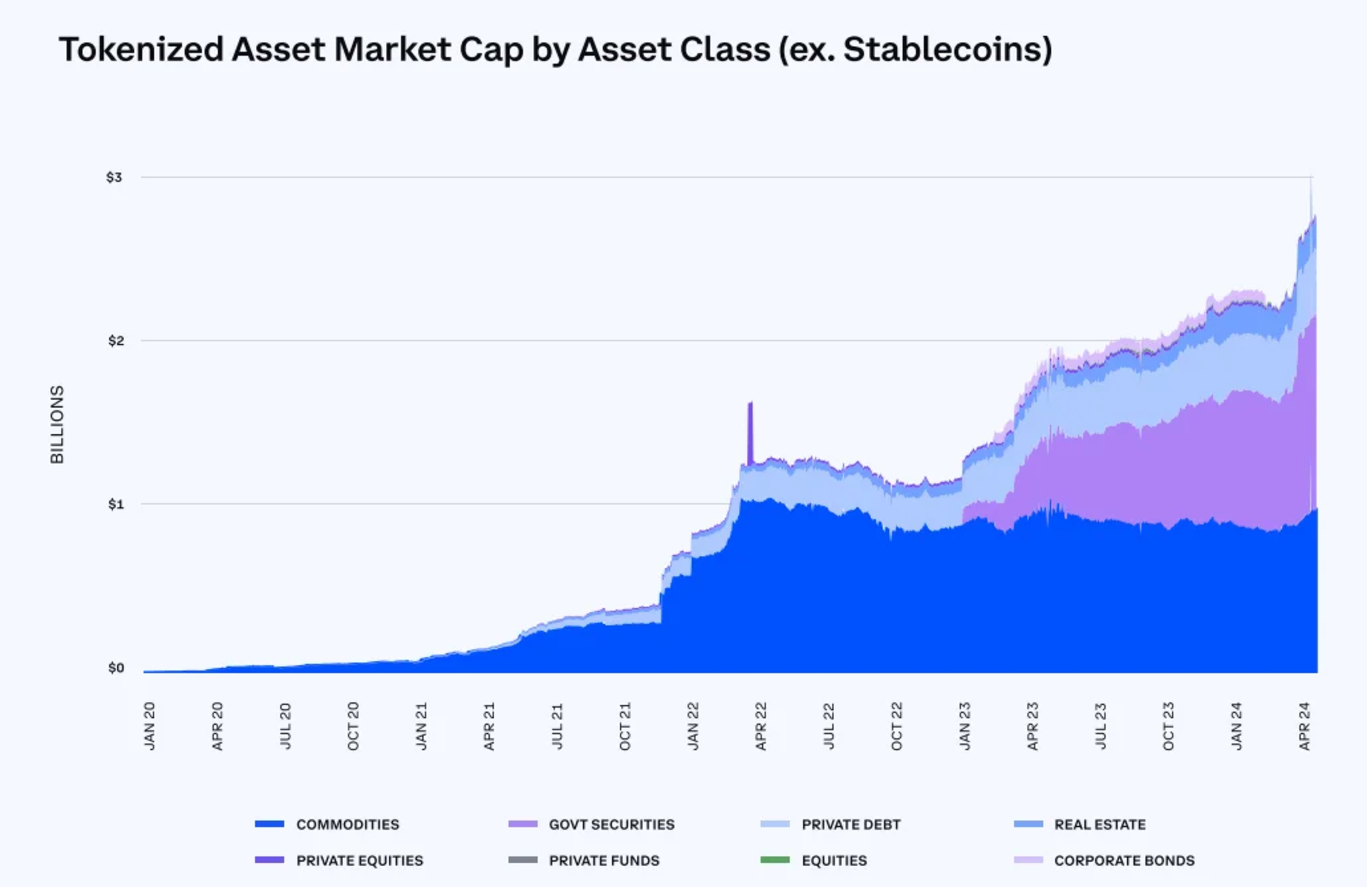

In essence, the process of converting tangible assets into digital tokens is growing at an impressive pace. Just recently, BNB Chain introduced a tokenization platform, specifically designed to make it easier for both real-world asset owners and private corporations to onboard new users from the Web3 community.

In a similar fashion, Mantra launched its main network, facilitating on-chain RWA integration. This development significantly increased the usefulness of its OM token, causing it to soar more than 200% in November, hitting a fresh record peak.

El Salvador Continues to Benefit from Its Bitcoin Holdings

In a notable move, El Salvador is persistently advancing with substantial financial endeavors. Lately, the government initiated the third repurchase of dollar bonds. This initiative aims to redeem over $2.5 billion in bonds, subject to obtaining fresh funding. The decision was made following Bitcoin’s record high after the election.

Moreover, referring to former U.S. President Donald Trump by another name might prove advantageous for President Nayib Bukele’s government. This could enhance El Salvador’s prospects of securing financial aid from the International Monetary Fund (IMF).

In the year 2021, El Salvador earned global acclaim by being the first country to make Bitcoin a legitimate form of currency. Now, its Bitcoin assets amount to approximately $515 million in value.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-11-19 23:13