El Salvador’s Bitcoin Profits Skyrocket—While IMF Still Fussing 🤨💰

Good morning, readers! Welcome to your daily dose of crypto chaos—where Bitcoin’s latest antics are more entertaining than your morning soap opera.

Pour yourself a coffee (or two, no judgment) as we dive into what Bitcoin’s wild ride means for El Salvador—famous for turning a small country’s economy into a blockchain playground. Meanwhile, the IMF is still pretending it owns the rulebook, asking El Salvador to revise its Bitcoin love affair.

Crypto News of the Day: El Salvador’s Bitcoin Wallet Just Gained $357 Million—No Big Deal, Right? 🤷♂️

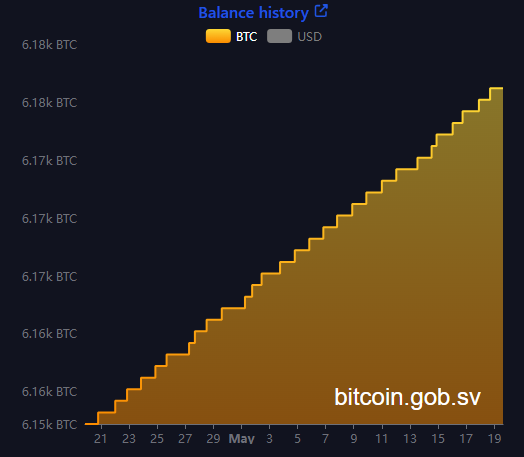

El Salvador’s charismatic leader, Nayib Bukele, announced that the nation’s Bitcoin stash has just raked in a cool $357.2 million, courtesy of a Bitcoin price peak of $107,108. Because what’s money if not an app for the government’s Bitcoin piggy bank? 🐷

— Nayib Bukele (@nayibbukele) May 19, 2025

Hour after the high-fidelity thrill, Bitcoin slipped back to $102,962. Just a gentle reminder—it’s all fun and games until the crypto rollercoaster prices make you lose your lunch.

El Salvador started its love affair with Bitcoin in 2021, borrowing Max Keiser’s street cred along the way. The government has been aggressively accumulating BTC, with recent purchases including 8 BTC on April 26 and 31 BTC over the past month—because apparently, a nation’s economy is best built on digital rocks.

Hold on, though—here comes the IMF, poking its nose in as usual, demanding reforms to El Salvador’s Bitcoin laws. And yes, they’re still having that little disagreement about whether Bitcoin should be part of national infrastructure. Because if there’s anything the IMF loves, it’s telling countries what not to do with their own money.

In December 2023, the Salvadoran government vowed to cut back on mandatory Bitcoin use, but who listens to them? Rodrigo Valdes from the IMF claimed El Salvador is “compliant,” while secretly thinking, “We still don’t trust you, but carry on, dear currency explorers.”

“In terms of El Salvador, let me say that I can confirm they continue to follow the no-Bitcoin-hoarding rule,” said Valdes, probably with a shrug.

Despite IMF’s disapproval, El Salvador keeps hoarding Bitcoin like a digital squirrel storing acorns. The US and El Salvador appear to be in a not-so-secret bromance centered around crypto, while Ireland eyes the Salvadoran playbook—Conor McGregor might even come to talk BTC over a pint! 🍺

“Conor McGregor might be coming to El Salvador,” shared the pride of El Salvador on X—because nothing says “serious economy” like UFC fights and crypto evangelism.

Meanwhile, Max Keiser confidently claimed the US shall never beat El Salvador’s Bitcoin per capita ratio, noting it’s “impossible”—which is basically the crypto version of ‘you’ll never walk alone.’ The nation’s first-mover advantage means they’ll always be ahead in the Bitcoin race—like a hare that’s just too speedy for the tortoise.

“To match El Salvador’s Bitcoin per Capita, the US would need about 2.37 million BTC,” Keiser said, giving us a good laugh and a lesson in digital country-ism.

MicroStrategy’s Bitcoin Bonanza: 7,390 BTC & a Lawsuit—Oh, the Drama! 😱⚖️

Meanwhile, Michael Saylor’s corporate circus continues. MicroStrategy, aka the Bitcoin cheerleader, just bought another 7,390 BTC for $764.85 million—because storing billions in digital gold is apparently the new business mantra.

“With 576,230 BTC worth $59.33 billion, MicroStrategy is practically printing money,” said a cheeky report, probably sipping a mojito in the Bahamas.

But wait—drama alert! The company faces a class action lawsuit accusing it of misleading investors about its Bitcoin strategy. Allegedly, Saylor & Co. hid the risks, causing a $5.9 billion loss in Q1 of 2025. Because transparency is overrated when it comes to crypto gains, right? 🤔

$MSTR – MicroStrategy Inc. just got served with a lawsuit alleging they fibbed about Bitcoin risks — SEC filing, because why not?

— *Walter Bloomberg (@DeItaone) May 19, 2025

The plaintiffs claim MicroStrategy played down Bitcoin’s wild price swings and didn’t properly reveal how recent rules could mess with their profits. The firm vows to fight back, probably with more Bitcoin and less honesty.

Recent whispers indicate that Bitcoin ETFs are putting pressure on Strategy’s premium—because what doesn’t scream ‘investor deception’ like a good ETF rip-off?

Chart of the Day: The Bitcoin Rollercoaster 🎢

Byte-Sized Alpha: Because Who Doesn’t Love Tiny Nuggets of Wisdom? 🧠

Crypto Stocks: The Pre-Market Buzz

| Strategy (MSTR) | $399.80 | $394.50 (-1.33%) |

| Coinbase (COIN) | $266.46 | $259.99 (-2.43%) |

| Galaxy Digital (GLXY.TO) | $31.49 | $32.44 (+3.01%) |

| MARA (MARA) | $16.21 | $15.81 (-2.47%) |

| Riot (RIOT) | $9.15 | $8.94 (-2.30%) |

| Core Scientific (CORZ) | $10.78 | $10.51 (-2.51%) |

In summation, crypto’s the wild cousin at family gatherings—unpredictable, flashy, and occasionally causing legal trouble. Buckle up, because tomorrow’s headlines might just be more ridiculous! 🚀🤪

Read More

- Gold Rate Forecast

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2025-05-19 18:23