The indices, bless their optimistic hearts, continue to dance near record highs. A delightful façade, wouldn’t you agree? But beneath the surface, a distinctly less cheerful tune is being played. One might even say a mournful ditty. It’s as if the market is determined to remain cheerful while simultaneously sending out smoke signals of impending… well, let’s call it ‘adjustment.’

We’ve observed, not for the first time, that the labor market appears to have developed a rather stubborn case of inertia. Job openings, it seems, are experiencing a post-COVID slump, a phenomenon one might compare to a deflating balloon. A most disheartening sight, really. Sentiment, meanwhile, is currently residing somewhere south of dismal. A truly impressive feat, considering the usual levels of optimistic delusion.

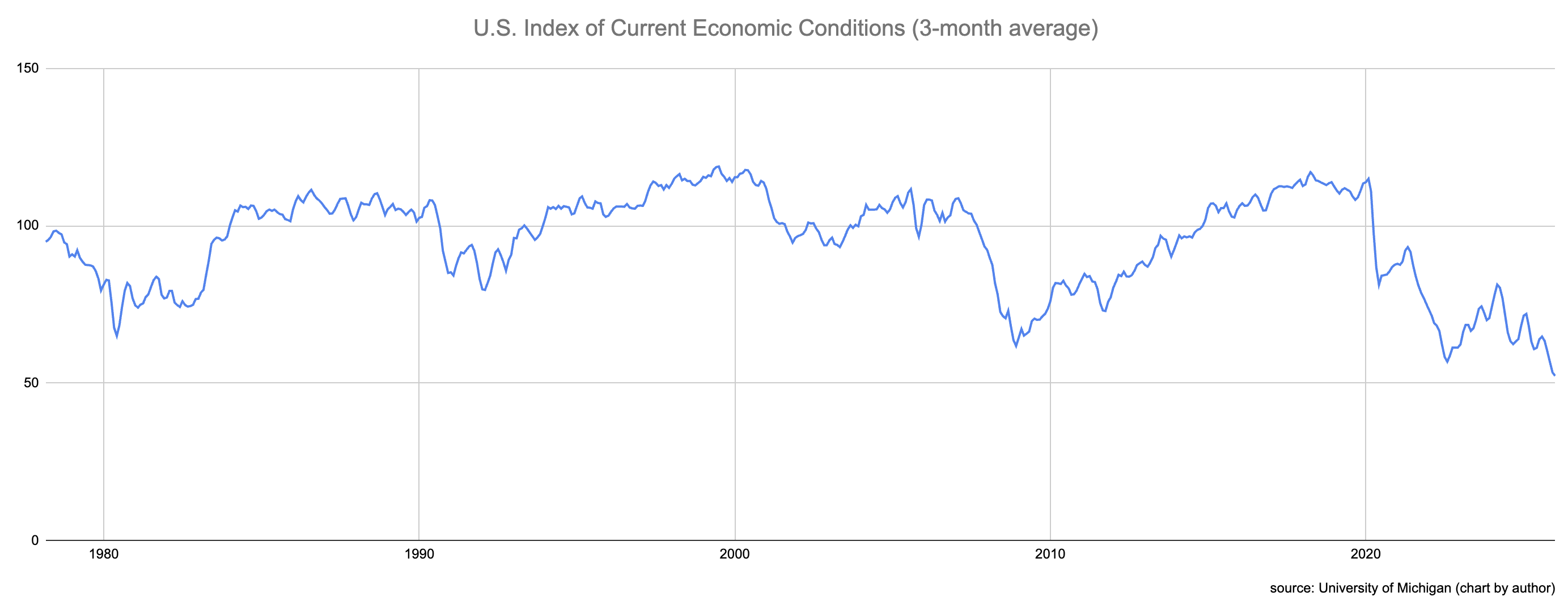

The University of Michigan’s Current Economic Conditions Index has recently plumbed depths previously uncharted. A new low, they declare with a flourish. One wonders if they’ve considered the psychological implications of such pronouncements. It’s enough to make a perfectly rational investor consider a career in goat farming.

December’s reading clocked in at a mere 50.4, and the three-month average in January? A paltry 52.3. These figures, my friends, are not merely low; they represent a historical nadir, stretching back to the late 1970s, a time when polyester reigned supreme and economic forecasts were frequently… optimistic. A curious coincidence, wouldn’t you say?

A Contrarian’s Delight?

Naturally, such gloomy pronouncements are rarely met with enthusiasm. But what if, just what if, this pervasive pessimism is… a signal? A subtle wink from the market gods? A “buy low” invitation disguised as a lament? It’s a long shot, admittedly, but one must always be on the lookout for opportunities amidst the prevailing gloom. After all, a clever speculator knows that fortunes are often built on the misfortunes of others.

Let’s delve into the data, shall we? I’ve assembled, with considerable effort, every monthly Current Economic Conditions Index reading since 1978. A monumental task, I assure you, involving countless cups of strong tea and a surprisingly large quantity of paperclips. Alongside this, I’ve gathered the corresponding month-end S&P 500 values. A comprehensive dataset, wouldn’t you agree?

My intention? To assess the S&P 500’s performance over the subsequent twelve months, depending on the initial Current Economic Conditions Index reading. A simple enough concept, though the execution proved… demanding. The twelve-month period begins with the month following the report’s release. For instance, a January 1991 report would be followed by an analysis of returns from February 1, 1991, to January 31, 1992. Precision, you see, is paramount.

I’ve also categorized the monthly readings into five-point “buckets.” A reading of 84.4, for example, would fall into the “80-84.9” group. A rather elegant solution, if I may say so myself. And now, the results of my painstaking research:

| Current Conditions Range | Number of Instances | Average Forward-12-Month S&P 500 Return |

|---|---|---|

| 55-59.9 | 3 | 14.89% |

| 60-64.9 | 12 | 18.38% |

| 65-69.9 | 19 | 19.05% |

| 70-74.9 | 33 | 12.15% |

| 75-79.9 | 34 | 8.16% |

| 80-84.9 | 45 | 9.79% |

| 85-89.9 | 37 | 13.92% |

| 90-94.9 | 37 | 7.80% |

| 95-99.9 | 57 | 3.17% |

| 100-104.9 | 75 | 8.26% |

| 105-109.9 | 123 | 13.89% |

| 110-114.9 | 65 | 12.30% |

| 115+ | 23 | 3.20% |

While there’s a degree of variability, a pattern emerges. The highest returns consistently occur when the Current Economic Conditions Index is at its nadir. A rather curious phenomenon, wouldn’t you agree? Returns become more average in the middle range, and then fluctuate wildly when readings climb into the triple digits.

There’s enough uncertainty to prevent definitive predictions. But one cannot ignore the fact that the three buckets with the highest returns correspond to periods of extreme economic pessimism. A coincidence? Perhaps. But a clever speculator never dismisses a pattern, however faint.

Right now, we find ourselves in that very territory. A prime buying opportunity, wouldn’t you say? A chance to acquire assets at a discount, while others are busy lamenting the state of the world. A truly delightful prospect.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-02-16 17:02