![]()

The market, a restless sea, has known a long, green spring. For three years, it has risen, a slow, insistent blooming. The S&P 500, a measure of this collective breath, has gained ninety-four percent since the turning of the year, a quiet accumulation of hope and calculation. And it will continue, I suspect, to climb, though not in a straight line, but in the manner of a vine seeking sunlight. Deutsche Bank speaks of eight thousand, a number that feels less like a prediction and more like a longing. Goldman Sachs, more cautious, suggests a twelve percent advance. The air is thick with expectation, and a prudent hand might find purchase now, before the ascent steepens.

To allocate a thousand dollars – a small sum, yet a seed capable of growth – requires a certain discernment. It is not merely about chasing numbers, but about understanding the currents that drive them. It is about identifying those enterprises whose fates are interwoven with the larger narrative of our time.

The Quantum Bloom: A Promise of Immeasurable Depth

Quantum computing. The very name whispers of a realm beyond our everyday comprehension. A nascent technology, yes, but one poised to erupt, to reshape the landscape of possibility. McKinsey foresees a market of seventy-two billion dollars by 2035, a figure that feels almost… polite. As if attempting to quantify the infinite. It is a technology that doesn’t simply calculate faster, but thinks differently, and that difference, that shift in perspective, is what holds the true potential.

IonQ, a small company with a grand ambition, is attempting to harness this power. They are not building better computers, but something… other. They are crafting machines that operate on the principles of superposition and entanglement, a world where bits are not merely on or off, but exist in a state of shimmering probability. Their revenue has more than doubled, a fragile shoot pushing through the hard earth of technological development. They report a 99.99% two-qubit gate performance, a near-miracle of accuracy. This is not merely a technical achievement; it is a testament to human ingenuity, a small victory against the entropy of the universe. Their cost per system is reportedly thirty times lower than competitors—a crucial advantage in a field where every electron counts.

Investing in IonQ is not without risk. The stock is expensive, volatile, prone to the whims of the market. But to deny the potential of this technology, to remain tethered to the familiar shores of classical computing, would be a profound act of shortsightedness. A small allocation, a carefully considered wager, might yield a harvest far beyond expectation.

The Infrastructure of Thought: Building the Foundations of Intelligence

The surge in artificial intelligence is not merely a technological trend; it is a cultural shift, a redefinition of what it means to be human. The demand for AI infrastructure is immense, a hunger that cannot be easily sated. Gartner anticipates a forty-one percent spike in spending, reaching a staggering $1.4 trillion. This is not simply about building faster processors; it is about creating the nervous system of a new intelligence.

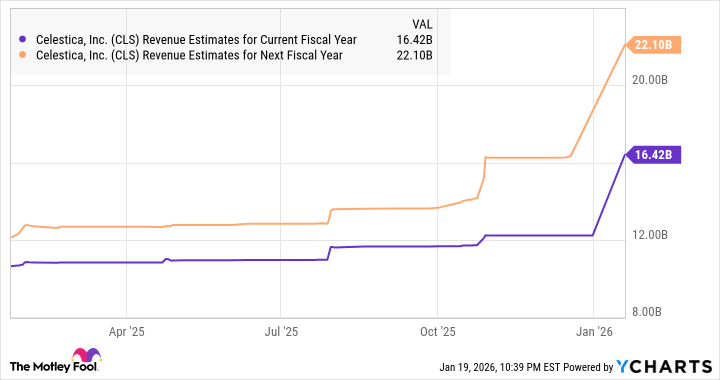

Celestica, a name perhaps unfamiliar to many, is quietly at the heart of this revolution. They are not building the AI itself, but the infrastructure that supports it. They design, manufacture, and manage the supply chains for the networking components that power the AI accelerators of Broadcom, Marvell Technology, AMD, and Intel. They are building the roads and bridges that will carry the flow of information. Their revenue jumped twenty-seven percent last year, and the forecast points toward an acceleration. This is a company that understands the importance of logistics, of ensuring that the right components reach the right place at the right time. It is a company that understands the poetry of efficiency.

At just 3.2 times sales, Celestica is a no-brainer. Its accelerating growth promises substantial gains.

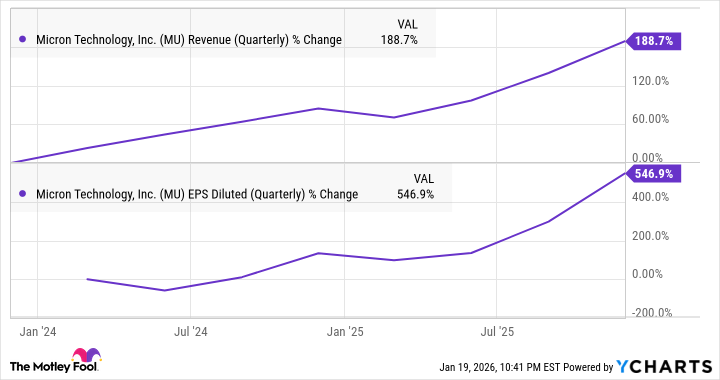

Micron Technology, too, is a compelling prospect. Despite its stunning growth, the stock remains undervalued, trading at less than ten times sales. Forward earnings multiples are equally attractive. Earnings could jump nearly fourfold this year, fueled by a hundred percent increase in sales. The key driver? A persistent shortage of memory chips, the very building blocks of digital intelligence. Demand is outpacing supply, and this trend is likely to continue through 2028. Adding capacity takes time, creating an unavoidable delay. This will likely lead to higher memory prices.

Micron’s gains—243% over the past year—are not simply the result of market speculation, but a reflection of fundamental dynamics. It is a value stock with the potential for significant appreciation. A careful allocation may yield a bountiful return.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-01-23 05:52