They speak of keeping powder dry, of waiting for the opportune moment. A sensible enough notion, if one has the luxury of time. I, however, find myself less interested in abstract waiting and more in observing where the dust settles. For a while, the market offered little more than inflated promises. Now, a few cracks appear, and with them, a few opportunities. I’ve been accumulating a small position in e.l.f. Beauty (ELF +9.53%). It’s not a grand pronouncement, but a quiet acknowledgement of a changing tide.

The market, of late, has been generous to many. This largesse, naturally, cannot last. I’ve watched as valuations climbed to heights divorced from reality, and held back. Now, a modest correction begins, and a company like e.l.f. Beauty – not a titan, but a survivor – presents itself. It’s not about chasing brilliance, but identifying resilience.

A Touch of Rouge on the Ledger

I confess, my interest isn’t purely analytical. My household, like many, is subject to the whims of fashion, and e.l.f. Beauty’s products find their way into daily rituals. It’s a small thing, perhaps, but I prefer to invest in businesses I understand, used by people I know. It’s a grounding principle in a world of abstractions. Beyond this, the company displays a growth rate that cannot be ignored. They anticipate a 22% increase in net sales for fiscal 2026 – a substantial figure, particularly in these uncertain times.

They’ve raised prices, a bold move, but a necessary one. To remain a low-cost provider in a world of rising expenses requires a delicate balance. They’ve managed it, at least for now, maintaining a price advantage while boosting margins. It’s a testament to efficient operation, or perhaps, a shrewd understanding of the consumer’s limitations. The working woman, after all, demands value, not merely vanity.

Let us not mistake growth for invulnerability. Tariffs, the inevitable consequence of trade disputes, have chipped away at their margins. The acquisition of rhode, while ambitious, has added complexity. These are headwinds, and they must be acknowledged. But a company that can navigate such challenges, while still delivering a profit according to generally accepted accounting principles, deserves a closer look. It suggests a degree of competence, a refusal to succumb to the prevailing chaos.

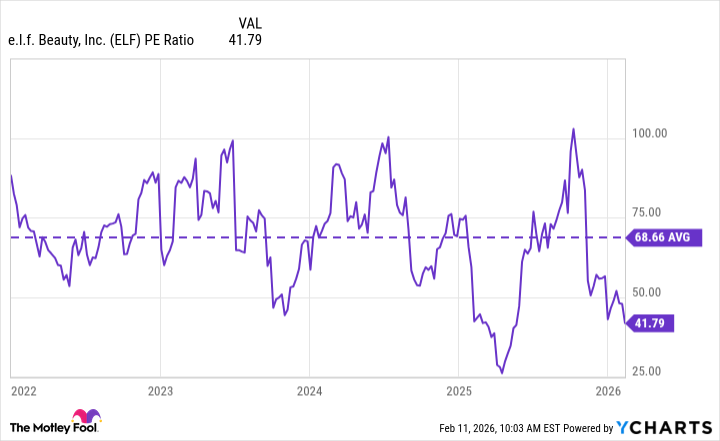

The stock has fallen from its peak, as most have. The price-to-earnings ratio of 42 is not insignificant, but it’s below the average since 2022. Valuation, however, is a fickle mistress. It’s a snapshot in time, a reflection of hope and fear. The true measure lies in the underlying business, its ability to adapt and endure.

Profits are down, yes. But the potential for recovery exists. If they can navigate these temporary obstacles, profits should rise, further lowering the valuation. It’s a simple equation, but one often obscured by the noise of the market.

In conclusion, e.l.f. Beauty offers what I seek: a growing business, generating profits, trading at a reasonable valuation. It’s not a revolutionary investment, but a pragmatic one. And, frankly, I find a certain satisfaction in supporting a company whose products are used by those I care for. It’s a small connection, a reminder that even in the vast, impersonal world of finance, human needs still matter.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- NEAR PREDICTION. NEAR cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- Wuthering Waves – Galbrena build and materials guide

- USD COP PREDICTION

- Silver Rate Forecast

- EUR UAH PREDICTION

- USD KRW PREDICTION

- Games That Faced Bans in Countries Over Political Themes

2026-02-14 18:12