The market’s recent embrace of Dutch Bros (BROS) stock has transformed what was once a niche player into a valuation curiosity. A price-to-earnings ratio of 193 suggests investors are paying handsomely for the privilege of participating in its growth narrative. Yet, as with all high-flying stories, the question remains: is this a parable of potential or a fable of folly?

Valuation at a Glance: The Price of Optimism

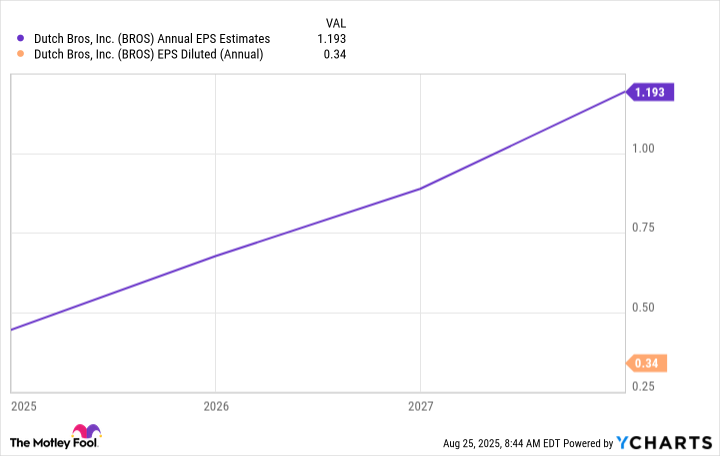

Dutch Bros’ stock has appreciated by over 100% in the past year, buoyed by a revenue surge of 28% in Q2 2025 and a net-income leap from $22.2 million to $38.4 million year-over-year. Earnings per share (EPS) have followed a similar trajectory, rising from $0.03 to $0.34 in 2024 and $0.12 to $0.20 in Q2 2025. Analysts project a 350% EPS increase over the next three years-numbers that demand scrutiny as much as celebration.

Operational Metrics: Beyond the Surface Numbers

The company’s financials are a study in contrasts. While same-store sales growth rebounded to 6.1% in Q2 2025 (with 3.7% transaction growth), its path to profitability was anything but smooth. Dutch Bros did not report an annual profit until 2023, and earlier growth relied heavily on price increases amid flat same-store sales. The current valuation assumes these trends are relics of a bygone era.

- Growth Drivers: Store expansion remains the primary catalyst. With a price-to-sales ratio of 5, the market is betting on the company’s ability to scale efficiently.

- Risk Factors: High valuation multiples, reliance on discretionary consumer spending, and competitive pressures in the coffee sector.

- Forward-Looking Metrics: A forward P/E of 74 suggests optimism, but this metric hinges on the accuracy of earnings forecasts-a bet with no guarantee.

Strategic Implications: A Thesis Under Scrutiny

Dutch Bros’ premium valuation is contingent upon three critical assumptions:

- Continued store-level profitability amid rising operational costs;

- Sustainable same-store sales growth without price erosion;

- Execution of capital-allocation strategies that prioritize long-term value over short-term monetization.

The company’s ability to meet these benchmarks will determine whether the current valuation is a prudent investment or a speculative gamble.

In the lexicon of finance, “high-growth” often doubles as a euphemism for “high-risk.” Dutch Bros’ story is no exception. The charts and numbers tell a compelling tale, but the unwritten sequel-whether this momentum can outpace the gravitational pull of reality-remains to be seen. For now, the market dances on the edge of a knife. 😐

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- USD PHP PREDICTION

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-08-25 23:07